This year has been a difficult one for advisors as market volatility, soaring inflation, rising interest rates, global supply chain issues, and the ongoing pandemic have all taken their toll on portfolios. In a market where bonds and equities have both plummeted, finding U.S. equity allocations that work when the Nasdaq Composite remains in a bear market and the S&P 500 nearly joined it last week has become a difficult prospect, with many advisors and investors pivoting to dividend strategies.

The KFA Value Line Dynamic Core Equity Index ETF (KVLE) follows a strategy of investing in higher-yielding companies while diversifying in a way that a “theme” portfolio does not. The fund is a core equity portfolio of securities that are tilted to favor dividend yield, and it seeks to increase yield while avoiding investing solely in high-yield sectors and stocks.

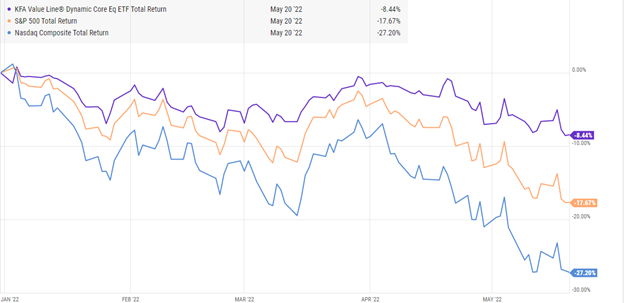

Image source: YCharts

Year-to-date the fund is down significantly less than the broader indexes, only dropping 8.44% as of May 19, compared to the S&P 500’s 17.67% drop and the Nasdaq Composite’s 27.20% drop. Through the use of quantitative modeling in addition to unique risk management tools, the portfolio’s beta is positioned at monthly rebalances to respond to the current market environment.

By investing in KVLE, advisors can maintain positions in some of the major U.S. large cap companies such as Apple, Microsoft, JPMorgan, and more, while diversifying across sectors and screening for risk potentials.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index and utilizes optimization technology to emphasize securities with solid dividend yields that have the highest rankings in both Value Line Safety and Timeliness. KVLE’s beta target is between 0.8–1 compared to the S&P 500 based on forecasting models.

The fund uses a smart beta strategy in seeking more cost-efficient alpha as well as a risk-management strategy that seeks to limit the effects of major market declines while also being positioned to capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and strategy, visit the China Insights Channel.