Markets gained hope this month for the potential of a “soft landing” amidst a historic rate-hiking regime. While it’s a shift from the heightened uncertainty that covered markets in the first half, much remains unknown. In such uncertainty, dividend strategies continue to prove popular, and a fund to consider is the KFA Value Line Dynamic Core Equity Index ETF (KVLE), given its outperformance since its inception.

Falling inflationary numbers alongside a weakening labor market in June sent markets climbing in July. Strong initial bank earnings continue to drive market rebound this week. Much still remains unknown regarding future rate hikes from the Fed beyond this month, however. FOMC meeting outcomes remain a consistent source of strong market volatility this year.

While major banks recently passed the Fed’s stress tests, regional banks still hold the vast majority of commercial real estate loans. Torsten Slok, chief economist at Apollo, noted in a recent interview with Bloomberg that 15% of U.S. banks are currently over the FDIC’s recommended limits on concentration within real estate loans.

The temptation for small banks now is to turn to higher-risk loans in pursuit of greater yields. It’s a practice that proved disastrous in the 1980s according to Richard Portes, professor of economics at London Business School.

“That’s the way to sudden disaster as opposed to the slow leak in the tire,” Portes told Bloomberg.

Maximize Income Potential Within Equities With This Dividend ETF

Given the elevated risk that still exists in the financial sector as well as equity outperformance this year, it’s no wonder dividend strategies continue to prove attractive.

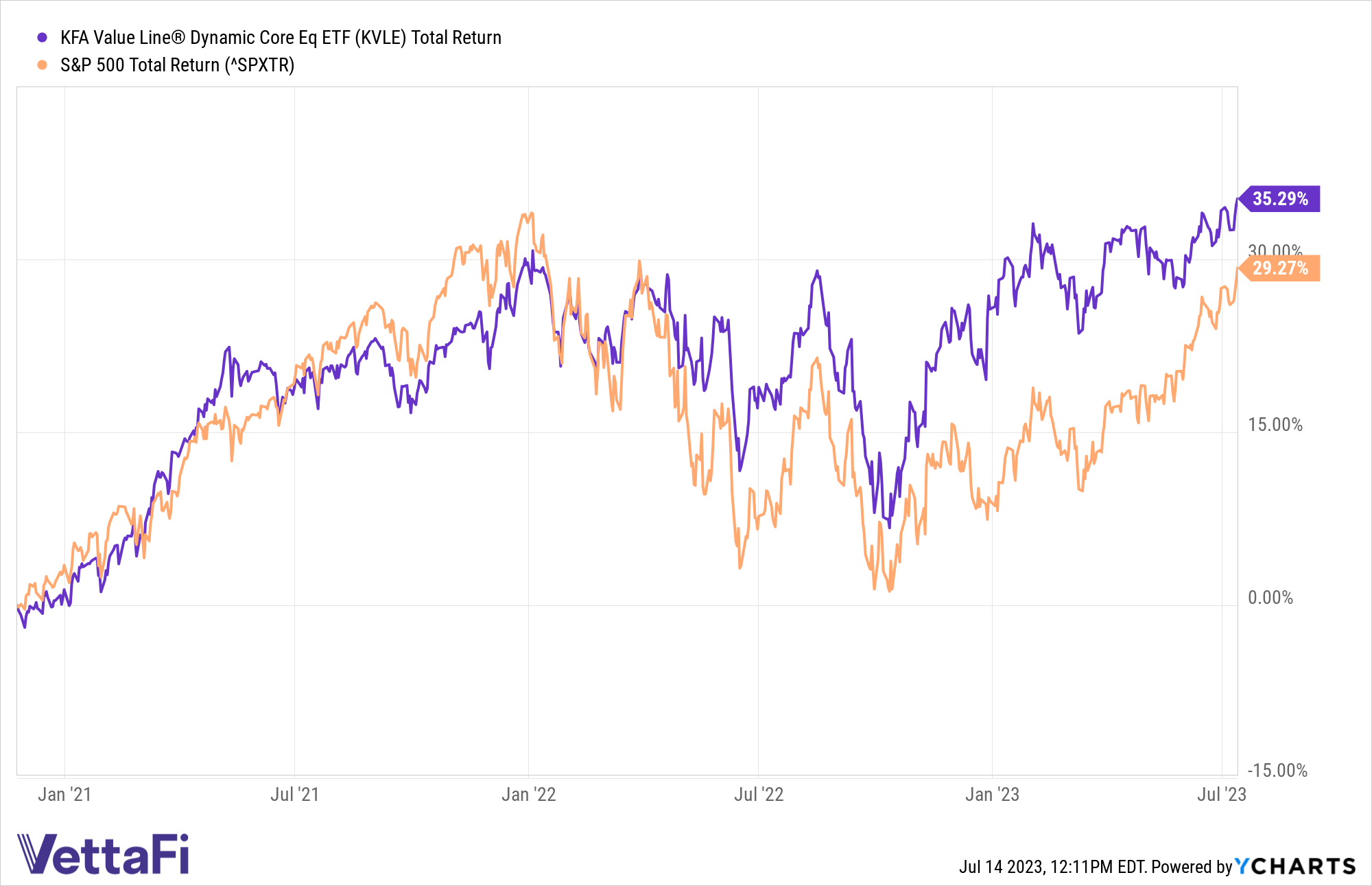

Advisors looking to increase dividend strategy allocations should consider the tactical KFA Value Line Dynamic Core Equity Index ETF (KVLE). On a total return basis, KVLE outperformed the broader S&P 500 the vast majority of the time since its inception in November 2020.

KVLE is up 35.29% on a total returns basis since inception compared to the S&P 500’s 29.27% gains as measured by the SPDR S&P 500ETF Trust (SPY).

The fund is a core equity portfolio of securities that are tilted to favor dividend yield. It seeks to increase yield while avoiding investing solely in high-yield sectors and stocks.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index. The fund utilizes optimization technology to emphasize securities with solid dividend yields. These securities demonstrate the highest rankings in Value Line Safety and Timeliness.

The fund uses a smart beta strategy in seeking more cost-efficient alpha. It also employs a risk management strategy that seeks to limit the effects of major market declines and capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and analysis, visit the China Insights Channel.