The beginning of March brought the weeklong meeting of China’s National People’s Congress to discuss monetary policy and economic goals for the year. From that meeting came a goal of 5.5% GDP growth which will see China creating stimulus when a large percentage of the world’s countries grapple with inflation and fiscal tightening, a policy that is anticipated to potentially be reflected in equity performance soon.

Anthony Sassine, CFA and senior investment strategist at KraneShares, discusses the correlation between China’s fiscal policy and its equity markets in a recent white paper on the KraneShares website. Sassine explains that at the onset of the pandemic in 2020, China partook of a loose monetary policy but one that was still tighter than the U.S. and EU.

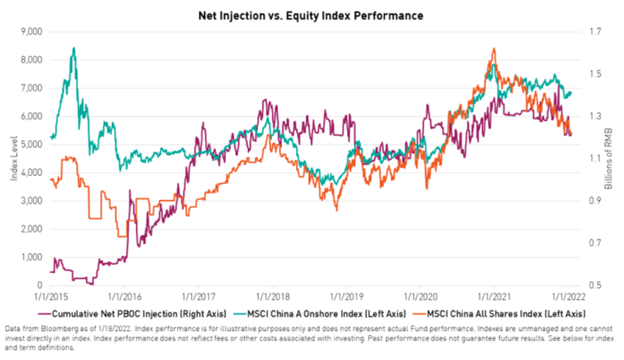

Monetary policy shifted to one of tightening in 2021, pulling liquidity from markets before downgrading to easing once more in December 2021. Central banks announced tax cuts for loans for small and medium-sized businesses as well as greater fiscal stimulus.

“The aggressive and broad stimulus measures flowing to many sectors of the economy, including real estate, are starting to show in the data and may trickle down to capital markets in short order,” Sassine writes.

Image source: KraneShares

The correlation between stimulus and positive equity performance is “relatively high” Sassine explains, but there is generally a minimum of a three-month gap between when the policy is enacted and when equity performance reflects a stimulus in a “significant run-up”.

“The third and fourth quarters of 2020 represented the height of the COVID 19 recovery, providing a tough benchmark to beat on a year-over-year growth basis. However, the high base effect is now behind us, and we believe growth will normalize going forward,” Sassine writes. “In addition, the Chinese government seems to be adamant about supporting growth, especially considering the political importance of 2022 as the National Party Congress (NPC) will convene to elect a president in the fall.”

Investing in the Growth Potential in China

For investors looking for exposure to China’s economy and the A-shares market, the KraneShares Bosera MSCI China A-Share ETF (KBA) invests in Chinese A-shares — specifically, the MSCI China A-Share Index.

The ETF captures mid-cap and large-cap representation of Chinese equities listed on the Shenzhen and Shanghai Stock Exchanges, which have been historically closed to U.S. investors.

Holdings in KBA include Contemporary Amperex Technology, a Chinese battery manufacturer, at 8.73%; Kweichow Moutai, a major alcohol producer in China, at 7.36%; and Longi Green Energy Technology Co, a solar energy technology company, at 6.05%.

KBA carries an expense ratio of 0.56% with fee waivers that expire on August 1, 2022.

For more news, information, and strategy, visit the China Insights Channel.