China’s push to continue building out its domestic semiconductor industry is yielding attractive fruit for investors. In an environment of regulatory support, China’s semiconductors manufacturers are flourishing and the KraneShares CICC China 5G and Semiconductor ETF (KFVG) offers exposure to the continued growth and growing on-shore demand.

President Xi continues to demonstrate the favorable stance that the government is taking towards technology companies and the role they play in the growth and recovery of China, as demonstrated by his recent visit to Beijing Hyper Strong Technology Co, reported Brendan Ahern, CIO of KraneShares, on the China Last Night blog.

The pro-technology stance includes foundational support for building out China’s domestic semiconductor industry which dominates globally in lower-grade semiconductor chips but lags much of the world in high-end chip production. In such a supportive environment, semiconductor companies continue to shine.

Semiconductor Manufacturing International Corp was up 7.17% on the Hong Kong market and 7.34% in Mainland markets in trading overnight and was the most heavily traded by value in Mainland markets. The semiconductor sub-sector was the second highest performing sub-sector in both Hong Kong Markets and Mainland markets and remains a consistent performer this year.

Invest in China’s Semiconductors With KFVG

China continues to work rapidly to become self-sufficient in semiconductor production, with goals of 70% domestic use by 2025. The KraneShares CICC China 5G and Semiconductor ETF (KFVG) offers exposure to this rapidly expanding industry within China as well as its continued 5G technology dominance which is up 19.66% YTD.

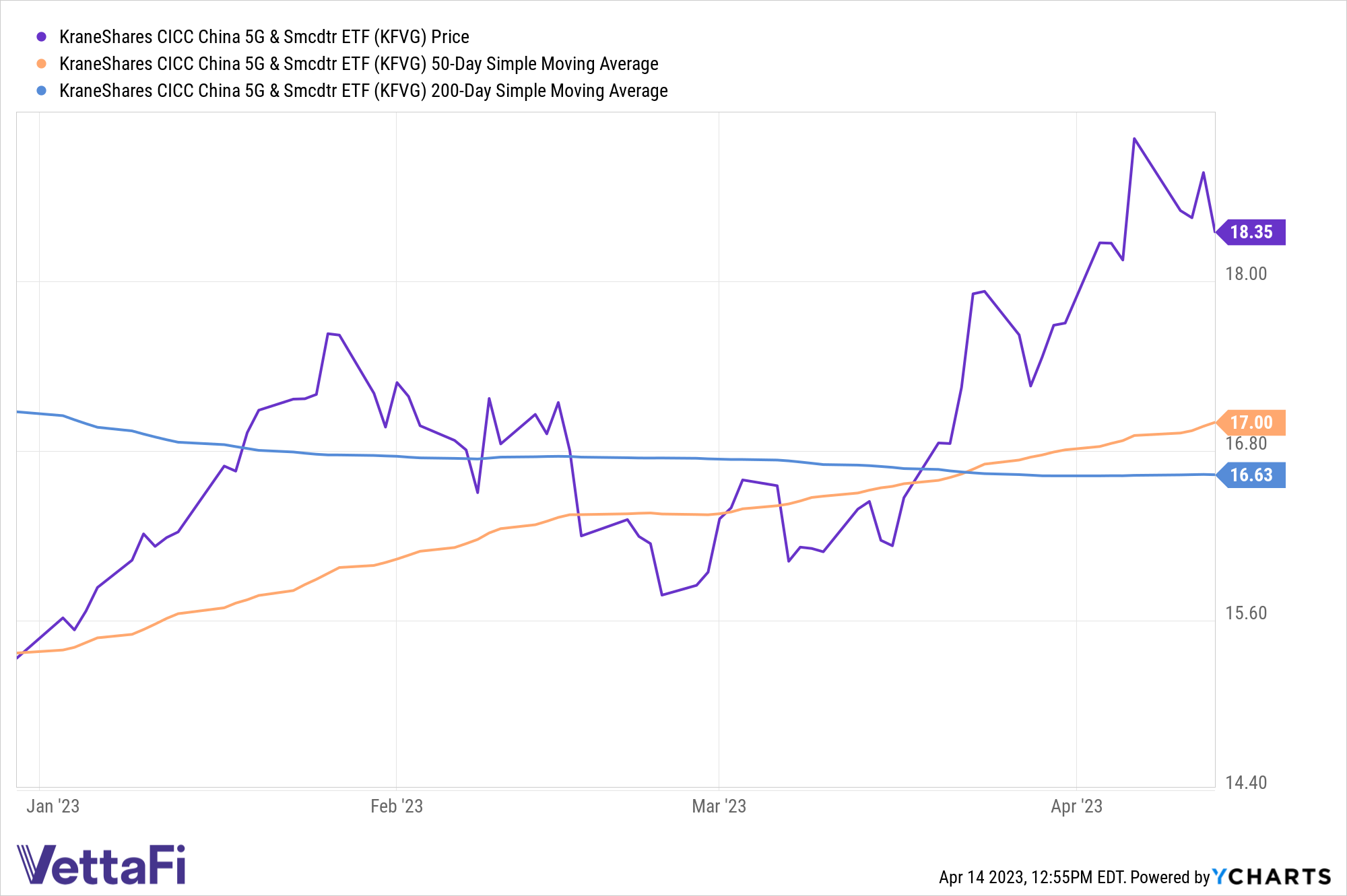

KFVG tracks the performance of the CICC China 5G and Semiconductor Leaders Index and is currently trending well above both its 50-day Simple Moving Average as well as its 200-day SMA, strong buy signals for trend followers.

The index contains the top 30 Chinese companies by free-float market cap that are within the following industries: semiconductor manufacturing, manufacturing equipment and services, internet and data services, electronic equipment manufacturing, electronic components, consumer electronics, computer hardware and storage, communications equipment, and commercial electronics.

KFVG has an expense ratio of 0.65% with fee waivers that end on August 1, 2023.

For more news, information, and analysis, visit the China Insights Channel.