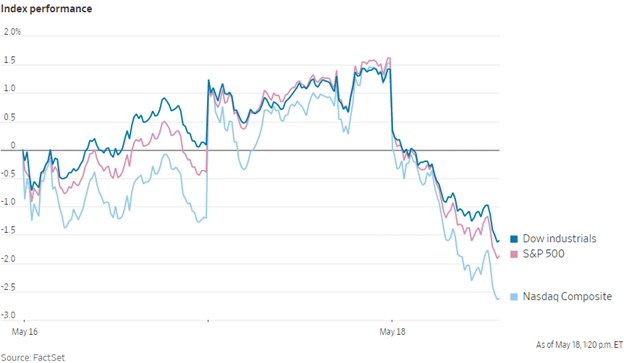

The major exchanges take another nosedive after the news that retail giants Target and Walmart missed earnings as they broadly felt the impacts of increasing food prices and costs.

Image source: Wall Street Journal

Technology stocks had led a brief rebound for markets on Tuesday. Exchanges were all down Wednesday when Target reported its earnings that missed expectations due to inflation-driven rising costs and supply-chain driven cost increases, reported Wall Street Journal. Target’s stocks were down 26% and it was on trend for the worst singular day’s performance since the market crash of October 1987.

Walmart reported earnings on Tuesday that showed an increase in sales, but a heavy impact on profits due to factors that included ballooning inventory and impacts from rising food prices and costs in general. Shares of the company were down 11% on Tuesday and another 6.2% in trading so far on Wednesday.

It all reflects the growing impact and burden that consumers are feeling from inflation as some of the largest retail giants showcase the changing environment in their first-quarter earnings. As market volatility continues, investors continue to seek havens and income where they can.

“There were a lot of conversations among investors that maybe inflation for the consumer has peaked, but these companies are giving us very different signals that we are still seeing costs rise more than prices,” said Steph Wissink, an analyst for Jefferies, in an interview with Yahoo Finance.

Hedging Your Portfolio During Volatility with Managed Futures

For advisors and investors seeking non-correlated hedging opportunities, the KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, offers investment with managed futures.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency and global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index and KMLM offer possible hedges for equity, bond, and commodity risk and have demonstrated a negative correlation to both equities and bonds in bull and bear markets. Investing in managed futures offers diversification for portfolios, and carrying them within a portfolio can potentially help mitigate losses during market volatility and sinking prices.

The index weights the three different futures contract types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

Futures contracts in the index include 11 commodities, six currencies, and five global bond markets.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.90%.

For more news, information, and strategy, visit the China Insights Channel.