Chinese stocks once more gained mainstream media attention this week as investor confidence wanes. The impending deletion of 66 Chinese companies from MSCI Indexes spurned a flurry of coverage belaboring the volatility and challenges China contends with this year. However, the realized impact of these deletions could be much smaller than mainstream coverage indicates.

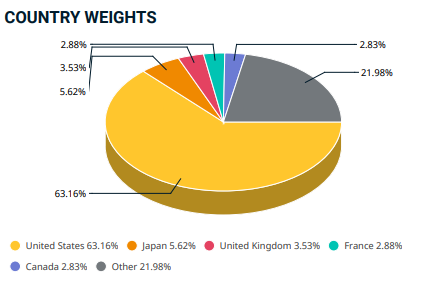

The MSCI All Country World Index (ACWI) invests in large- and midcap companies across developed and emerging market countries. The index represents approximately 85% of all investable equity globally. The U.S. currently comprises 63.68% of the index as of 02/13/24, while China weighs in at 2.52%.

Image source: MSCI

The MSCI Emerging Markets Index currently makes up just 10.9% of the ACWI Index as of the end of January. Within the MSCI EM Index, China weighs in at 25.01%, followed by India at 17.69% as of 02/13/24.

The Impact of MSCI Net Reductions of China Securities

MSCI ACWI will add 24 securities and remove 101 securities at the end of February. Of the securities being removed from MSCI indexes, 66 are Chinese companies, a fact that garnered attention this week. The majority of the companies removed will come from the MSCI China Index. Removed companies include China Southern Airlines, Weibo, and Chinasoft International.

However, the Chinese companies being removed will have little to no impact on the broader indexes, as Brendan Ahern, CIO of KraneShares, pointed out in the China Last Night blog.

“Virtually all companies being removed are less than 0.00% of the MSCI EM Index!” Ahern explained. The largest security to go, Chinasoft International, currently weighs in at just 0.03% within the MSCI EM Index. “That’s the LARGEST being removed, with the majority of the eliminated stocks having weight less than 0.00%.”

The removal of these securities will drop China’s overall weight in the MSCI EM Index from 25.7% to 25.4%. “Is that world ending? Hardly,” Ahern commented. Five new companies will be added to the MSCI China Index, including Midea Group and Giant Biogene.

Meanwhile, the addition of 136 securities from India will bump the country’s weight in the index from 17.9% to 18.2%.

Though the broad net loss is a changing tide from the net additions of Chinese securities in recent years, the actual impact, at least by weights, is minimal at best. While the net deletions echo the macro investing sentiment regarding China currently, understanding actual index impacts allows for informed decision-making.

For more news, information, and analysis, visit the China Insights Channel.