This year continues to follow in the footsteps of 2023, marked by increased investor optimism but ongoing uncertainty. For now, much remains unknown, and a higher January inflation print only proves the challenges that still lie ahead. Managed futures strategies are worth consideration in such an environment for their strong diversification potential and ability to capitalize on asset class gains and losses.

Managed futures take long or short positions on a range of asset classes via the futures market. As 2024 continues to unfold in unpredictable ways, these strategies are uniquely qualified to adapt and take advantage of potential dislocations, outperformance, and underperformance of asset classes.

“Markets tend to move aggressively when things don’t turn out as expected and Managed Futures can be framed as exposure to this uncertainty,” the authors of the KFA Funds 2024 Managed Futures Outlook wrote.

Equity Outlook and Managed Futures

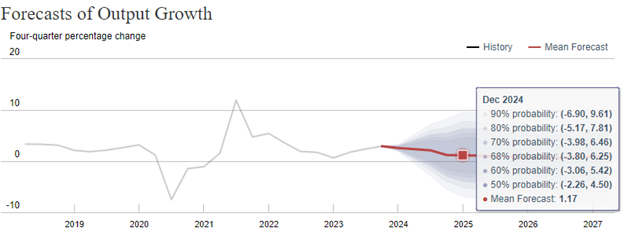

Equities entered 2024 trading at sizable multiples. The S&P 500 ended 2023 with an estimated 22 price-to-earnings ratio. Forecasts for 2024 put the S&P 500 forward PE around 20 with markets priced for ambitious rate cuts.

“Stocks are not cheap right now and priced for a smooth, soft landing,” the authors wrote.

Image source: The New York Fed

A higher-than-expected January CPI print sent equities plummeting Tuesday. The inflation narrative remains complex, nuanced, and most importantly, impossible to predict. When market predictions go awry, volatility follows. It’s the kind of environment that managed futures, with their low correlation strategies to stocks and bonds, can potentially thrive in. At minimum, they provide much diversification potential in a sea of uncertainty.

Uncertainty Abounds in Bonds and Currency

Similar to equities, bond markets entered 2024 priced for perfection with early and frequent interest rate cuts predicted. January’s CPI challenged that narrative, sending yields on the 10-year Treasury climbing once more. As yields rise, prices fall once more within fixed income. It’s an environment that managed futures funds can capitalize on due to their ability to take short positions in the asset classes believed to underperform.

Meanwhile, a strong dollar continues to impact currencies around the world, but easing would shift the scales. “The U.S. dollar implications of a shifting monetary policy landscape are also large,” the authors wrote. “The past few years have seen a strong dollar against major currencies driven in part by rate differentials.”

You need look no further than the Japanese Yen to see the impact of the dollar. Should the U.S. begin cutting rates at a time when Japan finally decides to begin raising rates, the resultant rate differential would be both significant and significantly different than the current rate reality.

“Foreign exchange market moves are often driven by diverging monetary and fiscal policy stances,” wrote the authors. “The last mile in of inflation may well be bump and experienced differently in different countries.”

Add into the mix the impact of the upcoming election on foreign policies, and it makes for an uncertain year for bonds and currencies. rapidly. These strategies base positions on how asset classes currently trade amidst changing narratives.

Tipping the Scales in Commodities

Commodities are perhaps the most precarious of asset classes when it comes to predictions this year. Much hinges on the supply and demand scales and how a confluence of factors weigh in this year. Ongoing geopolitical risk and impacts make predictions particularly fraught this year, but the base case itself still underscores the inherent uncertainty within commodities.

Oil prices are the easiest place to see this. The U.S. continues to grow its supply, positioning it directly opposite OPEC reductions. Ongoing Russian sanctions also add a layer of ongoing tensions with OPEC countries.

“It only takes a couple of million barrels a day either way on supply and demand to move markets in a big way,” the authors explained.

Copper and grains are two commodities set for rebound, though along differing timelines. Grain supply is likely to increase this year, curtailing record prices of the last few years. Meanwhile, copper prices continue to plummet. However, with forecasted global deficits alongside skyrocketing demand likely to begin playing out in the next several years, the fundamentals for copper prices appear promising.

“That this worsening deficit picture is happening amidst the downturn in Chinese property values makes us wonder what happens if stimulus measures are enacted there,” the authors mused.

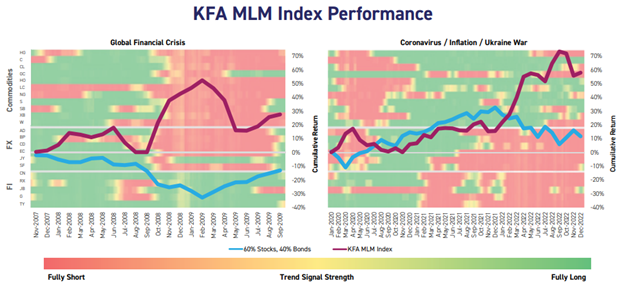

Gain Exposure to Managed Futures via KMLM

The KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, invests in futures contracts in commodities, currencies, and global bond markets. KMLM’s benchmark is the KFA MLM Index. The index uses a trend-following methodology and is a modified version of the MLM Index. The index demonstrated strong performance at peaks of maximum uncertainty. Detailed below are the index’s performance during the Great Financial Crisis and the years of the onset of the pandemic, inflation, and the beginning of the Ukraine War.

Image source: KFA Funds

The index weighs the three different futures contract types by their relative historical volatility. Within each type of futures contract, the underlying markets are equal dollar-weighted. The index also evaluates the trading signals of markets every day and rebalances on the first day of each month. It invests in securities with maturities of up to 12 months and expects to invest in ETFs to gain exposure to debt instruments.

KMLM hit the three-year mark in December 2023. Over that period, KMLM generated a 41.48% return compared to the 31.25% return of equities over the same period. Performance was even better compared to the -11.88% return of bonds over the same time.

KMLM carries an expense ratio of 0.92%.

For more news, information, and analysis, visit the China Insights Channel.