After China’s late-night Sunday announcement that it will be partially banning the use of microchips from U.S.-based Micron Technology, boosting the stock of that country’s semiconductor companies, a funny thing happened. Despite no significant semiconductor exposure, the $5.1 billion KraneShares CSI China Internet ETF (KWEB) saw its share price jump as much as 2.5% during the day.

With the fund down in the double digits during 2023, Monday’s bump is a significant increase. It’s also not that surprising. Many investors see KWEB as a proxy for China’s technology sector, even though it focuses mainly on internet stocks like Alibaba and Tencent.

The announcement regarding Micron’s products occurred around the same time that U.S. President Joe Biden predicted a “thawing” in the chilly relations between China and the U.S. at the G-7 summit. Those relations have worsened this year, not helped by the discovery (and subsequent destruction) of several surveillance balloons from China within U.S. borders and tensions over China’s friendly relationship with Russia. However, China indicated in a strongly worded statement that it did not agree with Biden’s assertion.

The Micron news isn’t as drastic as many have made it out to be. It is likely a negotiating tactic ahead of a meeting between China’s Minister of Commerce Wang Wentao and U.S. Commerce Secretary Gina Raimondo this week in Washington DC, according to a blog by KraneShares CIO Brendan Ahern. China is only barring the use of Micron’s chips in “critical information infrastructure.” Consumer products that use Micron components can continue to do so.

Understanding the KWEB Peak

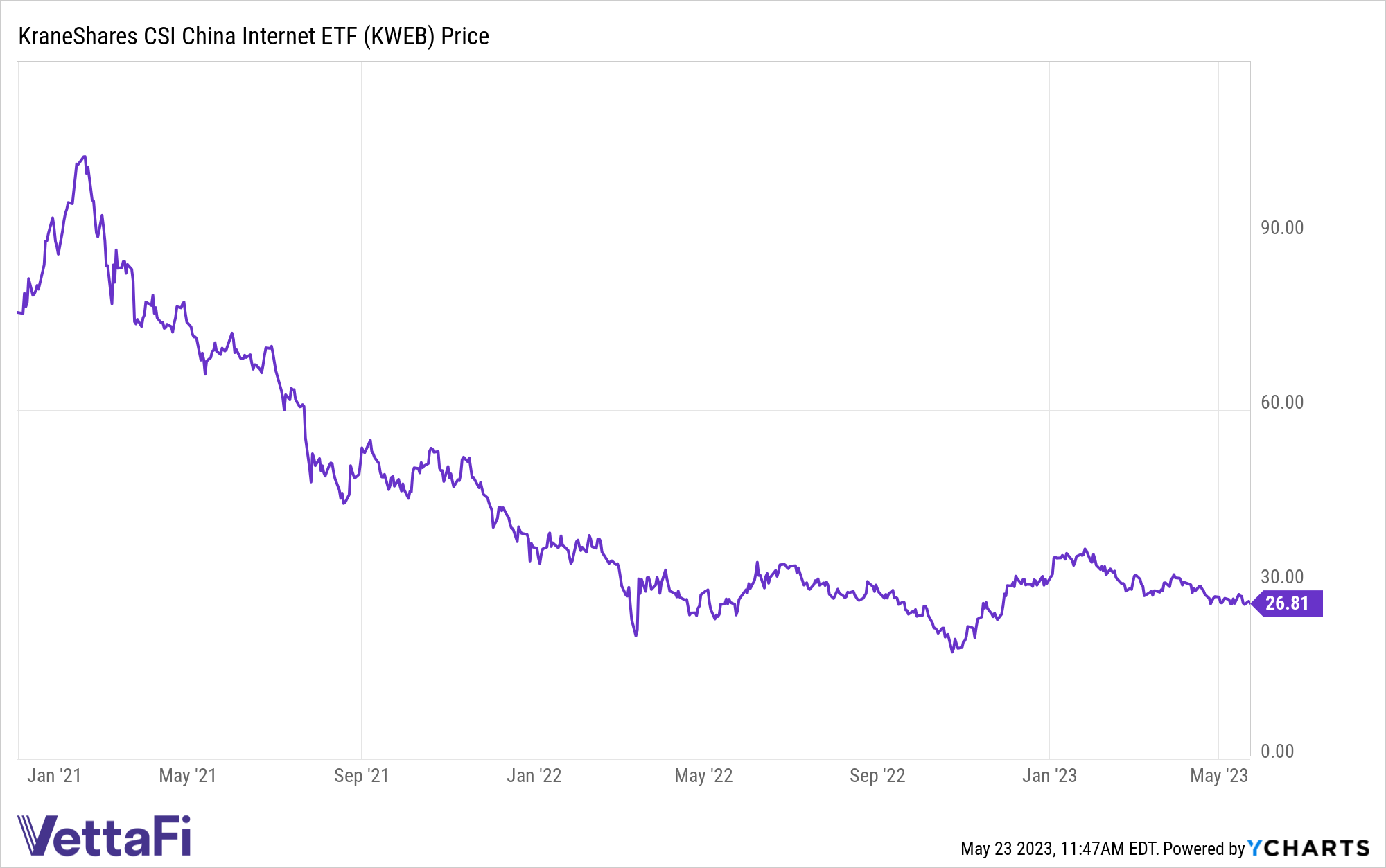

KWEB peaked in February 2021 and has been on a downward trajectory ever since. But recently, when it comes to China’s internet industry specifically, there’s been more good news about the space than bad. While some news sources such as the Financial Times warned about the hidden pitfalls in China’s broader economy, ChinaDaily.com reported on recent data cited by PwC that takes a very different angle. The analysis projects compound annual growth for the country’s internet advertising revenues of more than 10% through 2025, with mobile internet advertising set to see particularly strong growth.

That bodes well for KWEB and the potential for a reversal of its long-running slump. Read more about the fund’s prospects of a turnaround here.

For more news, information, and analysis, visit the China Insights Channel.