Rockefeller Asset Management, a branch of Rockefeller Capital Management, recently announced a new partnership with KraneShares. The two firms aim to launch a suite of innovative ETFs to meet the changing needs of investors, according to the press release.

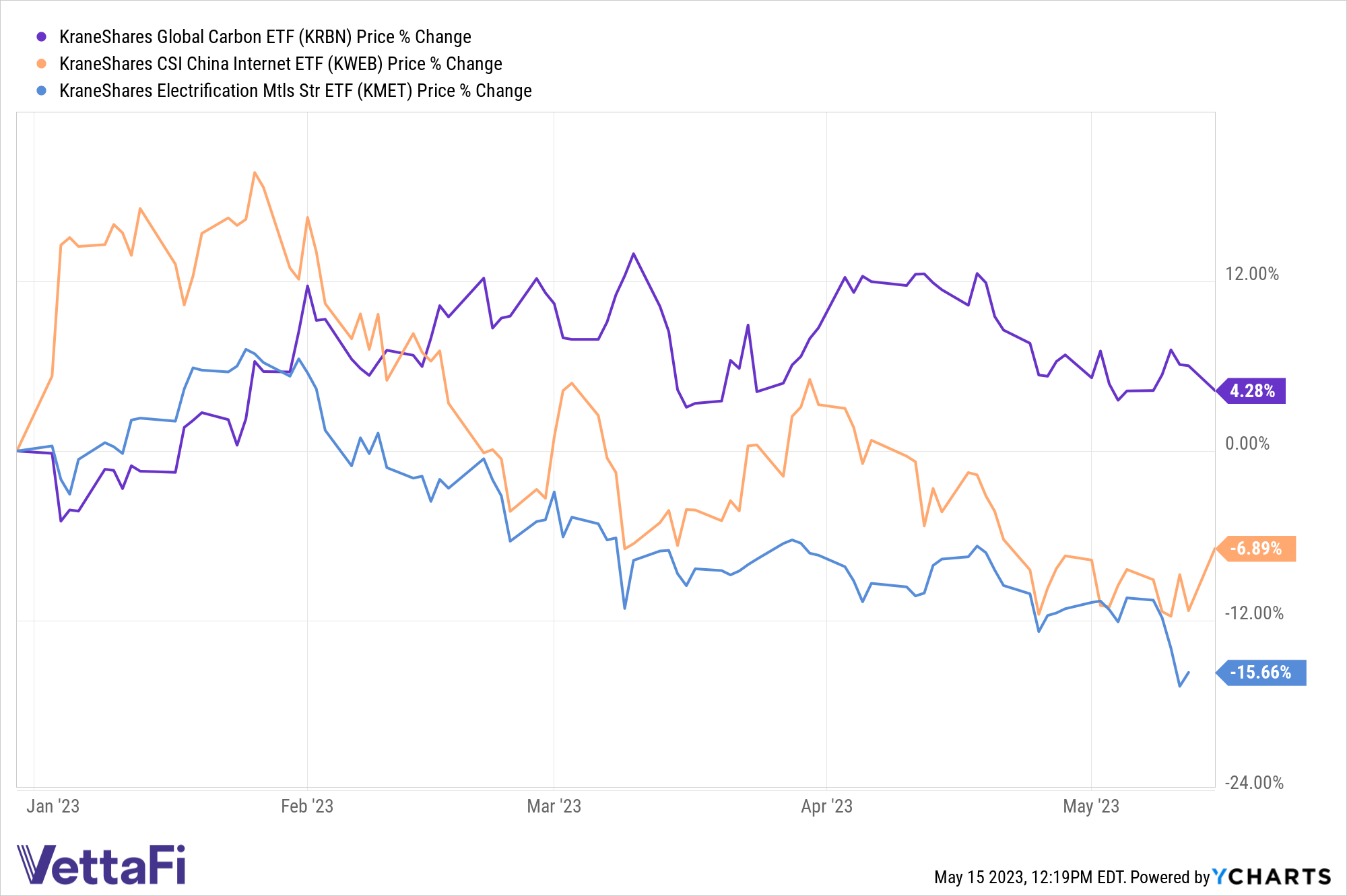

KraneShares offers a variety of China-centric ETFs, including the popular KraneShares CSI China Internet ETF (KWEB). Other ETFs from the issuer include targeted and broad investment strategies in both Mainland and Hong Kong markets.

See also: “China Pops and KraneShares ETFs Benefit“

The firm also offers several first-of-its-kind ETF exposures for climate solutions, such as the KraneShares Global Carbon Strategy ETF (KRBN). KRBN is the first carbon allowances ETF launched on the NYSE and offers exposure to the world’s leading carbon markets.

Other innovative funds include the KraneShares Electrification Metals Strategy ETF (KMET). KMET provides exposure to the six metals necessary for carbon transition and electrification. Forecasts call for strong demand in the coming decades for these metals, and KMET remains well-positioned.

“This partnership between Rockefeller Asset Management and KraneShares will allow us to provide innovative investment solutions,” Jonathan Krane, CEO of KraneShares, said in the press release.

See more: “Luke Oliver Talks Carbon Allowances and Innovation“

KraneShares and Rockefeller Look Towards Innovation

Rockefeller Asset Management offers a range of investment strategies, including thematic, systematic, and fundamental within equities, fixed income, and alternatives.

“The Rockefeller heritage in sustainable and impact investing dates back to the 1970s,” Krane said. “We are delighted to collaborate with a pioneer in this space to deliver compelling strategies that incorporate a mission-aligned approach with a focus on outperformance.”

The partnership is the latest in a string of Rockefeller partnerships seeking to offer investors innovative solutions and products. Other partnerships include Nordea Asset Management, Credit Suisse, and Touchstone Investments.

Casey C. Clark, President and CIO of Rockefeller believes it’s a partnership that will greatly benefit investors for the capabilities both firms provide. Rockefeller brings to the table “broad access to our institutional portfolio managers, distinctive intellectual capital, and award-winning research.”

Alongside “KraneShares’ proven track record of identifying and developing new asset categories for investors worldwide,” it’s a strong partnership, according to Clark.

“We share KraneShares’ focus on delivering strong investment outcomes and creating long-term value for clients in a dynamic, competitive marketplace.”

For more news, information, and analysis, visit the China Insights Channel.