Last year brought about a rise in covered call strategies as investors sought to maximize income potential in uncertain times. An area of opportunity often overlooked is covered call strategies on Chinese stocks. The increased volatility of China’s tech sector stocks creates the potential for higher yield and income opportunities for investors.

Foreign investors have largely divested from China exposures due to ongoing trade tensions between the U.S. and China. Additionally, a muted economic forecast for China this year following last year’s 5.2% GDP growth finds many investors now looking elsewhere in emerging market countries.

Internally, ongoing regulatory support from the People’s Bank of China continues with significant interest rate cuts. In addition, the new China Securities Regulatory Commission Chairman signaled a significant focus on boosting investor confidence. Both could be catalysts for market growth this year, but much remains to be seen.

See also: “PBOC Rate Cuts May Boost China Outlook”

Capitalize on Volatility for Diversified Income

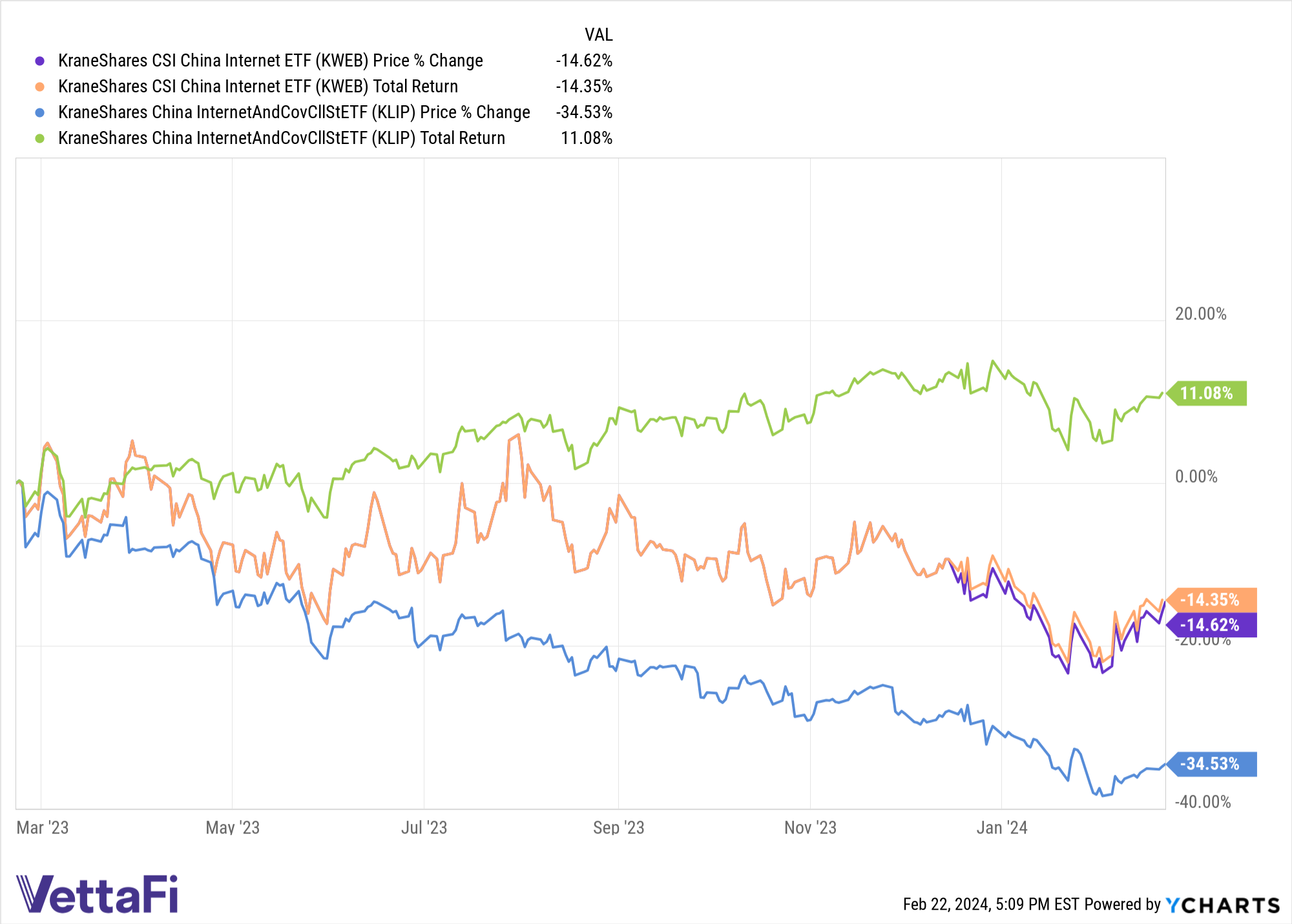

For investors that don’t wish to take on the risk of a China exposure but still seek to benefit from market movements, the KraneShares China Internet and Covered Call Strategy ETF (KLIP) is worth consideration. The fund offers a play on volatility while offering a diversified income stream for portfolios. Currently, KLIP offers a distribution rate of 47.76% as of 02/21/2024. Distribution rate takes the most recent distribution and annualizes it before dividing it by the fund’s recent NAV.

KLIP seeks to provide monthly income through its strategy that writes options on the KraneShares CSI China Internet ETF (KWEB). KWEB invests in China’s largest growth companies within its technology sector, historically a more volatile sector than the U.S. tech sector counterpart.

KLIP writes covered calls on KWEB and because of the increased volatility, has the potential to offer a higher yield than investing in tech in the U.S. or other technology sectors globally. A covered call entails holding the underlying security while writing calls on that security. This earns a premium from selling the covered call that can be utilized to generate income for the fund.

The ETF is benchmarked to the CSI Overseas China Internet Index which tracks publicly traded Chinese-based internet companies. KLIP can be used alongside KWEB in a portfolio or as a standalone play for diversified income.

KLIP has an expense ratio of 0.95%.

For more news, information, and analysis, visit the China Insights Channel.