Companies globally are focused on sustainability and ESG, with the amount of sustainable debt set to pass $1 trillion this year, primarily in green bonds, reported Forbes. In the midst of regulation, China’s push towards lowering emissions has held mostly steady, with a growing green bond market in Hong Kong.

Green bonds were valued at over $2 billion last year in Hong Kong; 15 of those and a green loan were internationally linked, the greatest number of green-related bonds from Hong Kong thus far. The Hong Kong and Shanghai Banking Corporation Ltd (HSBC) has indicated that these green bonds are vital for funding green projects and companies that are working to help meet China’s goal of net-zero emissions by 2060.

ESG and sustainable practices are increasing concerns for major businesses in China. “How we do business is as important as what we do,” management from HSBC Group said recently. “Reporting on our ESG performance transparently is essential to building stakeholder confidence and creating value for all our stakeholders.”

The Hong Kong Financial Services Development Council (FSDC) believes that Hong Kong is rapidly becoming an ESG investment hub, with regulators supporting efforts towards sustainability and ESG practices. There is a call for greater regulation on ESG products and greater scrutiny on investment managers by the Hong Kong Monetary Authority when it pertains to ESG funds, reflecting healthy growth within the sector.

“The financial services industry is, by and large, expecting the opening up of more business opportunities in relation to ESG for the city, and in the region,” the FSDC said in a report. “In short, the ESG momentum is piling up in Hong Kong; and the next to expect is how firms will expand the scope of their ESG journey, which means increasing the need for related talents.”

Investing in Clean Technology in China

China is currently the world leader in total renewable energy capacity, holding 31% of the world’s capacity. In the midst of the regulatory crackdown in China, this industry has continued to perform.

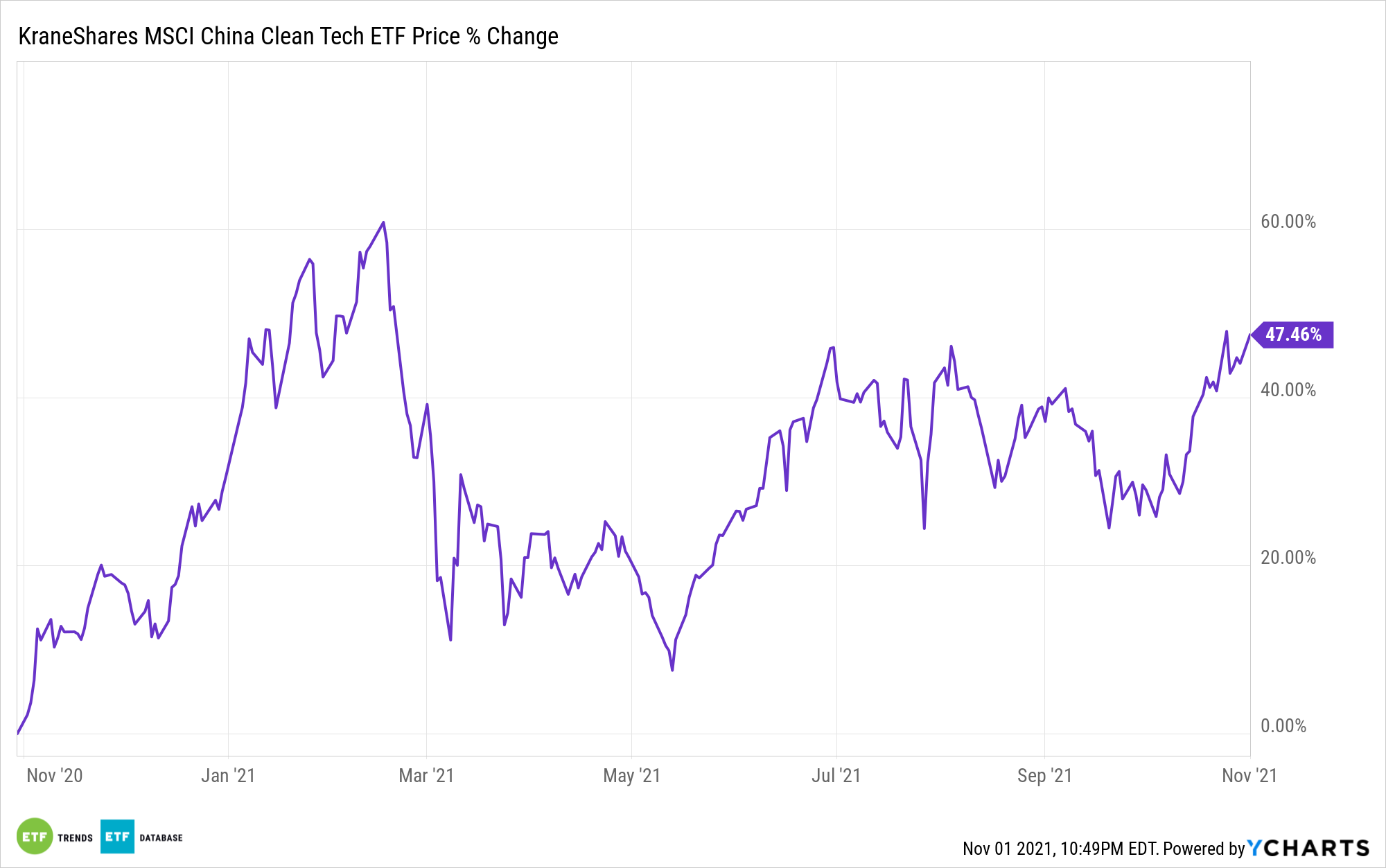

The KraneShares MSCI China Clean Technology Index ETF (KGRN) capitalizes on investing in clean technology in China’s growing economy.

KGRN tracks the MSCI China IMI Environment 10/40 Index and is based on five clean technology themes: alternative energy, energy efficiency, green building, sustainable water, and pollution prevention.

It allows investors direct exposure to ESG market movers in China by investing in companies such as Chinese electric vehicle manufacturer Li Auto Inc at 9.20%; China Longyuan Power Group Ltd, the largest wind power producer in China, at 5.18%; and LONGi Green Energy Technology Co. at 4.94%.

The ETF has an expense ratio of 0.78%.

For more news, information, and strategy, visit the China Insights Channel.