Recently in the news for the boardroom loss to activist hedge fund Engine No. 1, Exxon, with its three newly elected board members, is purportedly mulling over a pledge to reduce carbon emissions by 2050. This is according to two individuals familiar with the matter, reports Reuters.

Shareholders recently pushed back on the oil giant’s leadership and lack of environmental policy, with major institutional investors backing the activist hedge fund in its successful bid to replace three Exxon directors on the board. As part of its message, Engine No. 1 focused on the preparation for a low-carbon future, as well as boosting returns.

Exxon hasn’t made any formal declarations of the private talks but has said that it plans to release its plan for strategic moves in regard to its environmental policy and other issues by the end of the year. While Exxon declined commenting for the story, it did make clear of its commitment to reduce and eliminate carbon emissions from high-emitting sectors, as well as plans to invest in technologies that will help society reach the net-zero future it is aiming for.

“Throughout our engagement process with shareholders, we have heard clearly their interest in our work in this area and affirm our commitment,” Exxon said in a written response.

Current plans by the oil company are a 30% reduction in greenhouse gas emissions within the oil and gas production side by 2025. Exxon trails its European counterparts; companies such as BP Plc. (BP) and Royal Dutch Shell Plc (RDS.A) have pledged to cut emissions from products sold in their plans, as well as emissions from operations and the power used for those operations; Exxon has only pledged to the latter thus far.

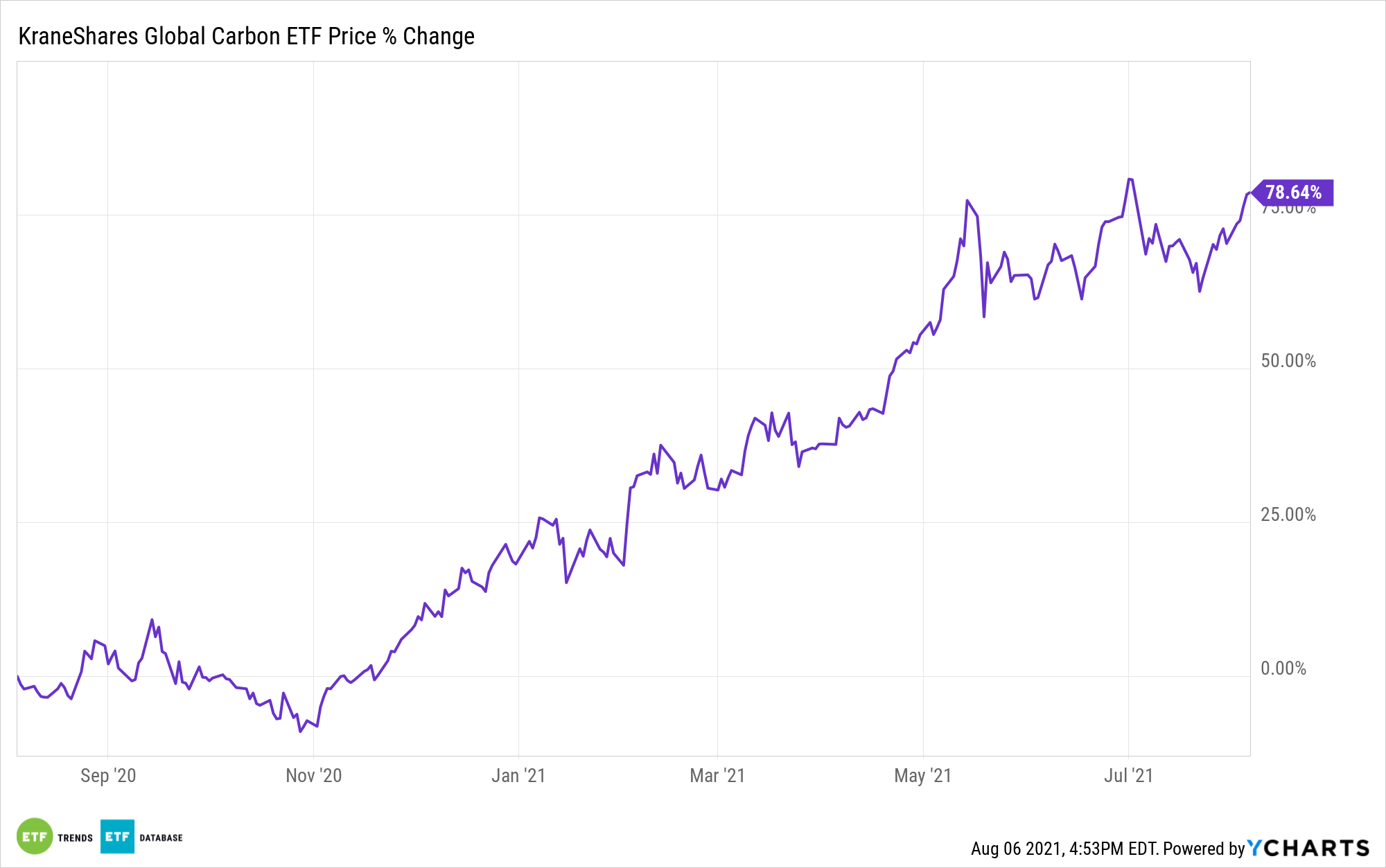

‘KRBN’ Invests in Carbon Emission Reduction Globally

Investors looking to support responsible investing and encourage pollution and emissions reduction, can consider the KraneShares Global Carbon ETF (NYSE: KRBN), which offers a first-of-its-kind take on carbon credits trading.

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), and Regional Greenhouse Gas Initiative (RGGI) markets. North American pricing data is supplied by IHS Markit’s OPIS service, while European prices are supplied by ICE Futures Pricing.

As of December 31, 2020, those three carbon futures markets had a market size of $260.79 billion.

KRBN invests in its futures contracts via a Cayman Islands subsidiary, meaning it can avoid distributing the dreaded K-1 tax form to its shareholders.

According to IHS Markit, the global price of carbon was $24.05/ton CO2 as of December 31, 2020.

However, it’s estimated that carbon allowance prices will need to reach a range of $50 – $100 per ton of CO2 to achieve the emissions reductions goals of the Paris Agreement.

KRBN carries an expense ratio of 0.79%.

For more news, information, and strategy, visit the China Insights Channel.