Near-term predictions for the U.S., Europe, and much of the world continue to be one of monetary tightening as economies continue to grapple with inflation and growth slows. China remains one of the handfuls of countries, and the largest economically, to be easing as its central banks add stimulus to try to bolster growth as it fights through COVID-19 lockdown impacts and a looming presidential election in the fall.

KraneShares believes that the disparity between rising rates and high valuations in both Europe and the U.S. compared to lower valuation opportunities in emerging markets and China could lead to an influx of investors to emerging markets in the mid to long-term.

“We believe emerging markets and China should benefit from such changes due to higher growth expectations, lower valuations, and highly bearish positioning. We believe this should help attract long-term investors looking to meet their investment objectives over the next five years,” wrote Anthony Sassine, CFA and senior investment strategist at KraneShares, along with Henry Greene, investment strategist, and Robin Zheng, quantitative research analyst at KraneShares in a recent paper.

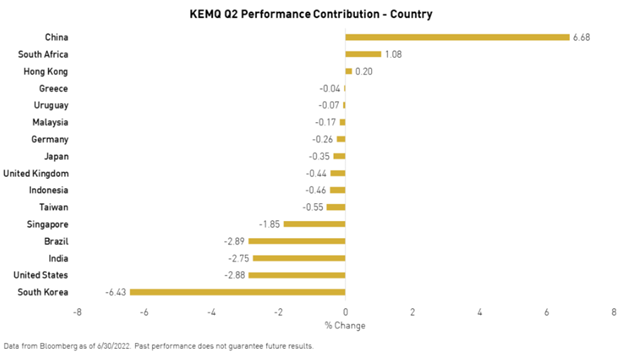

Image source: KraneShares’ Emerging Markets paper

Emerging markets were challenged in the second quarter of 2022, dragged down significantly by South Korea which had a sharp drawdown in June driven by an Omicron wave, high inflation, China’s lockdowns, and a trucker’s strike, with Taiwan similarly affected. Commodity-centric countries such as Indonesia, Saudi Arabia, and Brazil were all impacted by the decrease in commodity prices, and while India performed stronger than many other EM countries, the cost of high oil prices had a heavy toll on the country’s balance sheets.

The authors believe that negative sentiment could be bottoming in Taiwan and Korea, but they still anticipate tightening in the two countries in the near term. Commodity price reductions should help ease inflationary pressures across all economies. India is showing signs that the outperformance of its export and manufacturing sectors could be slowing, but falling oil prices and inflation should boost consumer growth, the main driver of growth for the country.

“We believe China’s growth should recover in the second half of the year from the impact of the lockdowns. While revenue growth for Chinese companies may come below the long-term trend, we believe earnings growth will remain robust as companies continue to cut costs and bad investments. We believe low valuations, low positioning, and the end of the regulatory cycle in China will continue to attract investors as growth recovers,” the authors wrote but cautioned that COVID-19 impacts remain a risk factor.

Two Strategies to Access Emerging Markets

There are a variety of ways to access emerging markets and China through KraneShares, both as a broad emerging market strategy that includes China as well as an emerging market ETF that excludes China alongside a China-specific, broadly diversified fund to offer targeted China exposure.

The KraneShares Emerging Markets Consumer Technology Index ETF (KEMQ) is a fund that targets consumer technology within emerging markets. KEMQ is structured to ensure diversification because of its limitation on country inclusion (one country can only account for 40% of the fund), with a maximum holding weight of 3.5%. The fund focuses on internet retail and e-commerce growth in 26 emerging market countries, including China, and has an expense ratio of 0.59% with a fee waiver that expires on August 1, 2023.

The KraneShares MSCI Emerging Markets ex-China Index ETF (KEMX) offers emerging market exposure but excludes China, allowing investors to intentionally allocate how they want into China through a complimentary fund. KEMX seeks to track the MSCI Emerging Markets ex-China Index, a free float-adjusted, market-cap-weighted index that includes large- and mid-cap companies from emerging markets, excluding Chinese issuers. Securities contained are in the top 85% of their emerging market and the fund has an expense ratio of 0.23%, with fee waivers that expire on August 1, 2023.

The KraneShares MSCI All China Index ETF (KALL) is a fund that offers targeted exposure to China and can be used as a compliment to KEMX. KALL tracks the MSCI China All Shares Index, a benchmark of companies that are based in and headquartered in China, as well as listed in Mainland China, Hong Kong, and the U.S., and is broadly diversified across the Chinese economy. KALL has an expense ratio of 0.48% with a fee waiver that expires on August 1, 2023.

For more news, information, and strategy, visit the China Insights Channel.