In a subdued year for developed market equities, investors increasingly look to emerging markets for more substantial growth in the second half. First half volatility risk still looms for EM however, and finding strategies that capture growth and hedge defensively for volatility will prove advantageous.

The lure of potential EM outperformance this year compared to developed markets will result in substantial EM inflows this year. That’s according to Fitch Ratings, who put EM capital flows estimates at $200 billion in 2024. If flows manifest according to predictions, it will be the highest influx of capital into emerging markets this decade.

Notoriously volatile in recent years, EM investing still carries the potential for elevated risk in the first half. U.S. rates and dollar strength continue to dominate the global stage and carry an often-outsized impact on emerging and frontier markets.

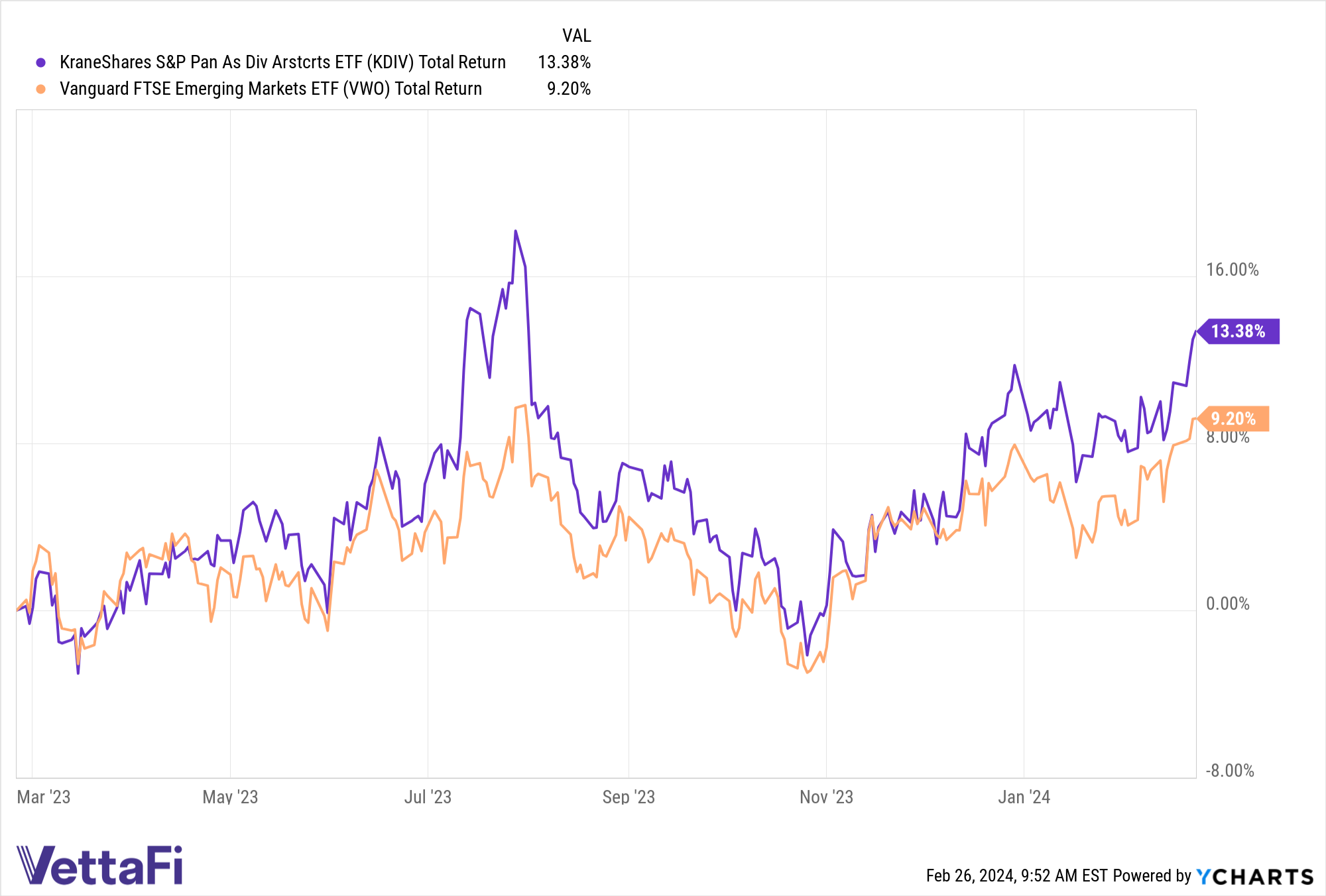

KDIV Harnesses EM Growth, Positions Defensively for Volatility

The KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) provides advisors with the opportunity to diversify their portfolios globally. It also enables more defensive stance against market volatility through dividend aristocrat companies. KDIV tracks companies that have grown their dividends sustainably over an extended time horizon in the Pan-Asia region. The fund offers exposure to China, Australia, Japan, and more.