Advisors and investors looking to dividends for income opportunities in challenging months ahead shouldn’t overlook potential in Pan-Asia.

The KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) offers noteworthy returns, yields, and more this year. It’s a fund to consider for inclusion within portfolios looking ahead to second-half challenges, as detailed in a recent paper from KraneShares.

Noteworthy Performance and Yields

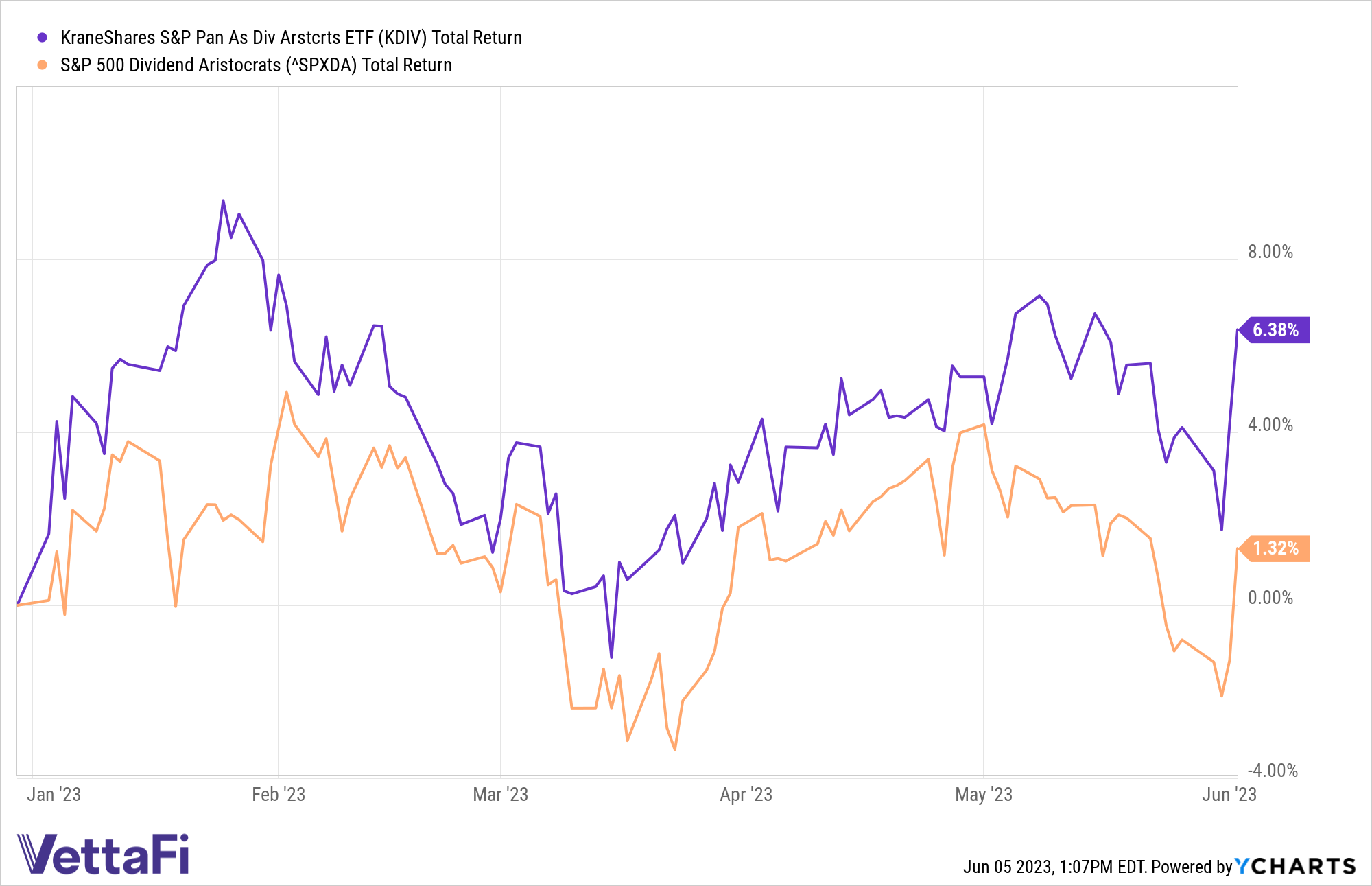

KDIV is currently up 6.38% year-to-date as of June 5, 2023. The fund consistently outperformed the S&P 500 Dividend Aristocrats Index this year. The index is up just 1.32% YTD and will likely face continued challenges in the second half.

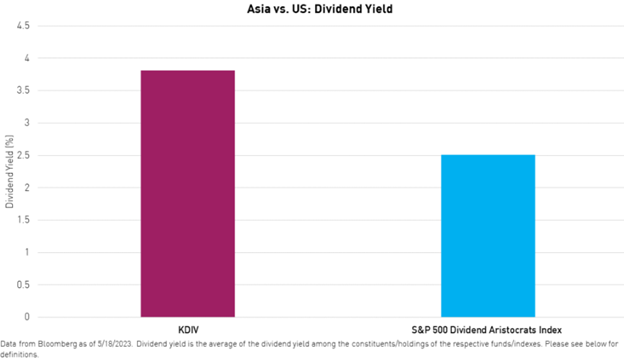

What’s more, KDIV’s dividend yields remain substantially higher than the S&P 500 Dividend Aristocrats Index.

Valuation and Correlation Opportunities Within Dividends

For advisors and investors looking for valuation opportunities in equities, KDIV is a fund to consider. Many companies in the Pan-Asian region are trading at deep discounts unrelated to their underlying fundamentals.

The fund also provides strong diversification opportunity for an income sleeve within a portfolio. The S&P 500 Dividend Aristocrats Index has a 10-year weekly correlation of 1.0 to the S&P 500. Meanwhile, the S&P Pan Asia Dividend Aristocrats Index has a correlation of 0.67 to the S&P 500.

See also: “Top 3 KraneShares ETFs by Returns: Diversification and Defense”

The KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) tracks companies that have grown their dividends sustainably over an extended time horizon in the Pan-Asia region. The fund offers exposure to China, Australia, Japan, and more. On average, “Pan Asia Dividend Aristocrats are currently trading at nearly one half of the multiple of their US counterparts,” KraneShares wrote.

KDIV provides advisors with the opportunity to diversify their portfolios globally. It also enables a more defensive stance against market volatility through dividend aristocrat companies.

KDIV seeks to provide investment results that correspond to the performance of the S&P Pan Asia Dividend Aristocrats Index. It is the first U.S.-listed ETF to apply the S&P Dividend Aristocrats strategy to the Pan-Asian area.

The fund is diversified across a number of sectors. Current allocations include real estate at 15.97%, utilities at 14.77%, and information technology at 14.09%, as of May 31, 2023. It also includes financials at 14.08%, healthcare at 12.71%, and several smaller allocations.

KDIV has an expense ratio of 0.69%.

For more news, information, and analysis, visit the China Insights Channel.