Dividends remain a compelling buy for a turbulent second-half fraught with U.S. recession risk and continued global slowing. The dividend aristocrats strategy is appealing in economic downturns for the reliable income potential for portfolios as well as stability of the underlying securities.

Dividend aristocrats are companies that both pay reliable dividends and grow those dividends consistently. These are companies that demonstrated strong, reliable dividend growth over the last 25 years. They are typically attractive for their stability and proven track record across a variety of economic and market conditions.

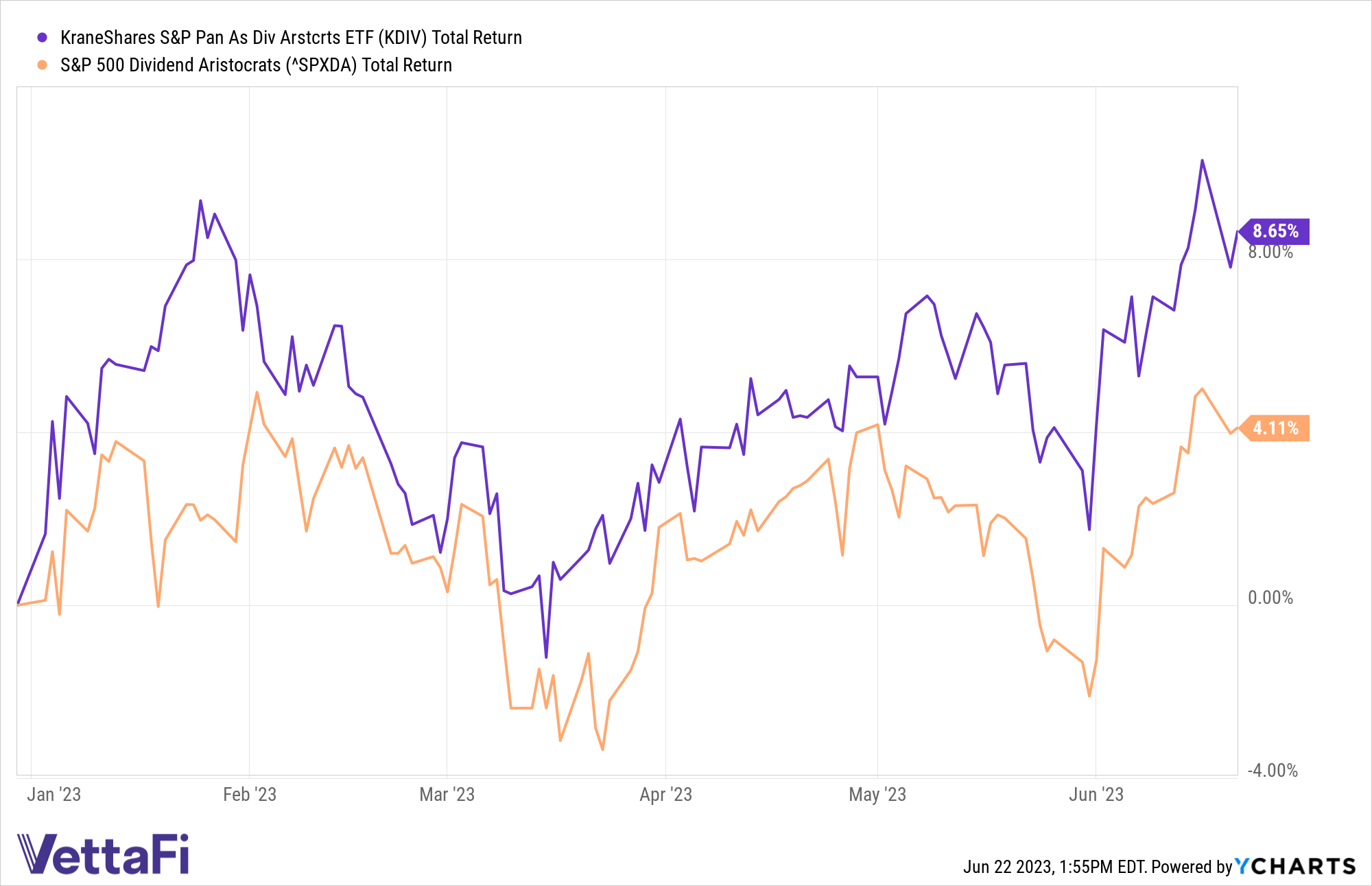

The KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) is up 8.65% YTD as of 06/21/22. KDIV tracks companies that have grown their dividends sustainably over an extended time horizon in the Pan-Asia region. The fund offers exposure to China, Australia, Japan, and more.

It’s a relative newcomer ETF but is worth consideration, given its outperformance over U.S. dividend aristocrats. The S&P 500 Dividend Aristocrats Index is up just 4.11% YTD.

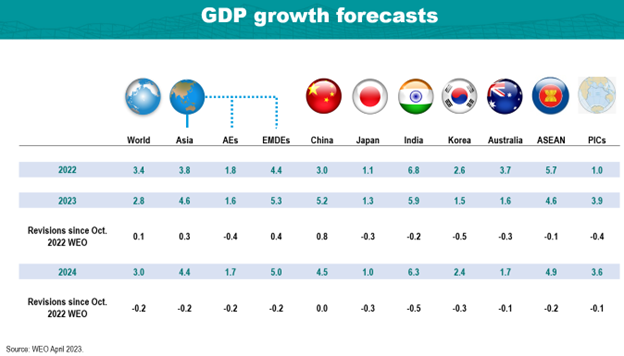

While much of the world’s developed economies continue to slow this year, counties in the Pan-Asian region are forecast for growth. The International Monetary Fund’s latest estimates put growth for the Asian Pacific region at an estimated 4.6% GDP in 2023. It’s a stark comparison to world GDP estimates of 2.8%.

Image source: IMF

KDIV provides advisors with the opportunity to diversify their portfolios globally. It also enables more defensive stance against market volatility through dividend aristocrat companies.

See also: “KDIV to Benefit From Electronic Market 4.27% CAGR Growth”

KDIV seeks to provide investment results that correspond to the performance of the S&P Pan Asia Dividend Aristocrats Index. It is the first U.S.-listed ETF to apply the S&P Dividend Aristocrats strategy to the Pan-Asian area.

The fund is diversified across a number of sectors. Current allocations include real estate at 15.97%, utilities at 14.77%, and information technology at 14.09% as of 05/31/23. It also includes financials at 14.08%, health care at 12.71%, and several smaller allocations.

KDIV has an expense ratio of 0.69%.

For more news, information, and analysis, visit the China Insights Channel.