Dividend strategies have become popular in 2022 as advisors and investors seek income and performance in a challenging market environment. One dividend yield-focused equity ETF, the KFA Value Line Dynamic Core Equity Index ETF (KVLE), has outperformed the S&P 500 every market day this year except one (January 3) and offers the appeal of a dividend and value focus while providing diversification potential.

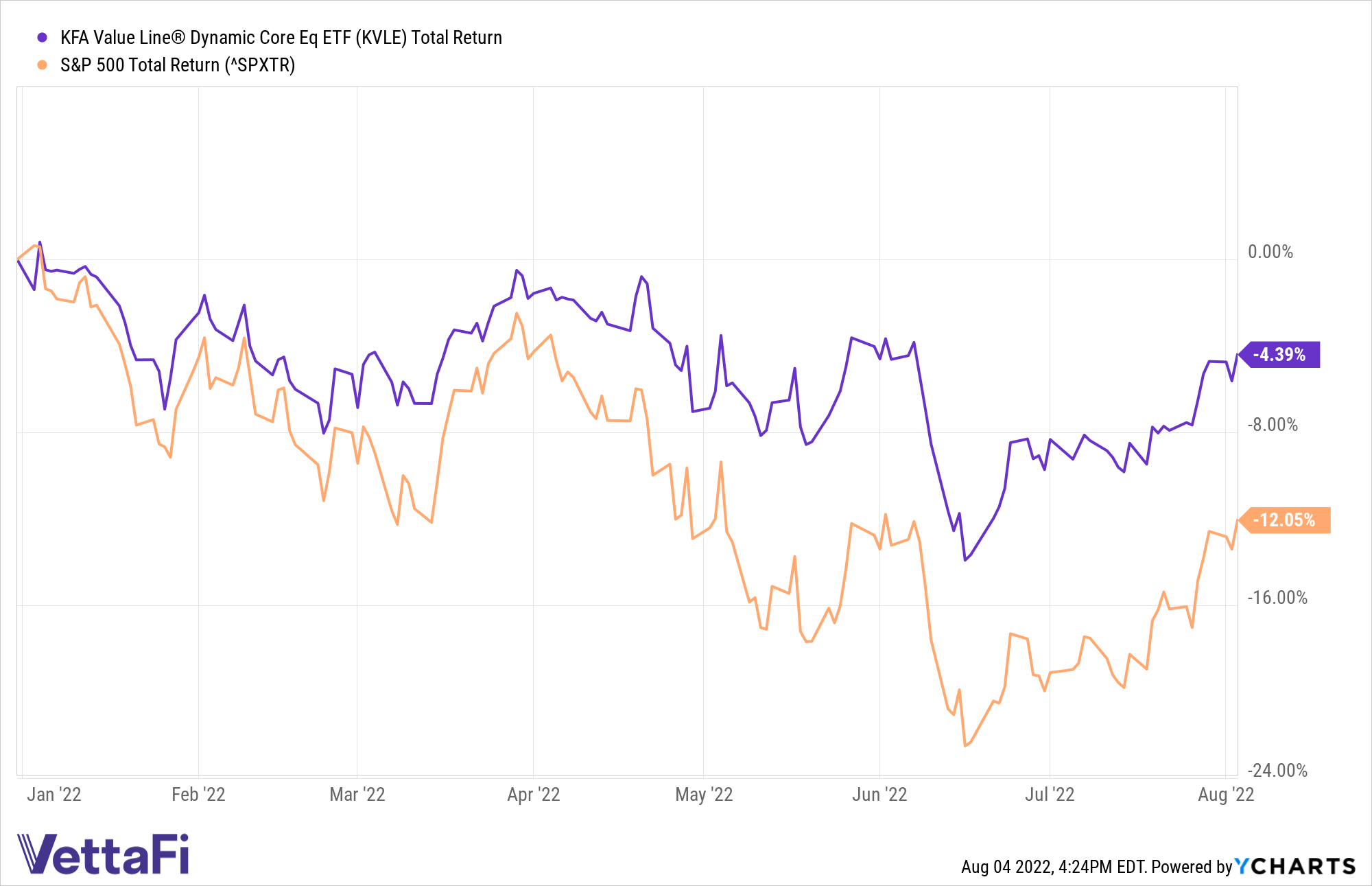

Year-to-date KVLE is currently down just 4.39% while the S&P 500 is down 12.05% as of August 3. KVLE has been significantly outperforming while also offering exposure to a portfolio of equity companies that provide higher dividend yields while also diversifying across sectors.

In a challenging environment with advisor and investor concerns of a recession, grappling with aggressively rising interest rates for modern times alongside persistent inflation, markets remain volatile as uncertainty rules. There has been a retreat from some of the high valuation growth stocks within U.S. equities and instead a pivot to value plays that can provide the potential for less volatility and steadier return, and KVLE offers both a value screen as well as a dividend yield tilt.

The KFA Value Line Dynamic Core Equity Index ETF (KVLE) follows a strategy of investing in higher-yield companies while diversifying in a way that a “theme” portfolio does not. The fund is a core equity portfolio of securities that are tilted to favor dividend yield, and it seeks to increase yield while avoiding investing solely in high-yield sectors and stocks.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index and utilizes optimization technology to emphasize securities with solid dividend yields that have the highest rankings in both Value Line Safety and Timeliness. The fund uses a smart beta strategy in seeking more cost-efficient alpha as well as a risk-management strategy that seeks to limit the effects of major market declines while also being positioned to capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and strategy, visit the China Insights Channel.