By Caleb Sevian

Thought to ponder…

“The time we spend worrying is actually time we’re spending trying to control something that is out of our control. Time invested in something that is within our control is called work. That’s where our most productive focus lies. Worrying isn’t productive because it doesn’t produce confidence, and even if it did, the confidence wouldn’t last.”

Seth Godin, The Practice

The View from 30,000 feet

The markets should have been delighted with last week’s data. On balance, the disinflationary trends continued, with earnings season all but over, the trend was upside surprises and broader participation, and the economy is on track to grow significantly above potential. Yet with all the seeming good news guiding us to a magical soft-landing in the U.S., the market feels stuck in the doldrums. The question on investors’ minds is, why? Perhaps the answer lies the answers to the questions surrounding, who is going to buy all the U.S. Treasuries being issued the remainder of the year, or how consumers and businesses are going to cope with increasing interest payments combined with the prospects of a more subdued labor market, or what will happen if the Fed is forced to confront higher inflation or a surprising deceleration to growth expectations that have become embedded in asset values? And what about geopolitical risks, which seem to be erupting again between Russia and Ukraine as well as between the United States and China? Bottom line, there is a lot of uncertainty, and how the market shakes out any given week has to do with what traders choose to focus on.

- Two camps, locked horns in battle: the disinflation junkies vs. the inflation revivalists

- What ratings agencies think doesn’t matter until it does

- Everyone is crowding to one side of the boat, the soft-landing side

- The most Frequently Asked Question from clients this week: China, deflationary bust or reflationary comet in the making?

Two camps, locked horns in battle: the disinflation junkies vs. the inflation revivalists

- There are two main camps forming around the inflation situation. Each has a cast of characters signing a tune like an 80’s rock band. In that spirit, I went ahead and came up with band names for each.

The Deflation Junkies

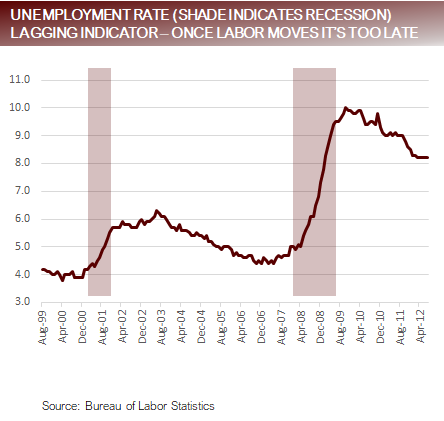

- Believe deflationary trends will enviably lead to deflationary spiral, tightening lending conditions will cripple the economy and history will likely show that we may already be in a recession. Key arguments to their thesis:

- According to the Senior Loan Officer Opinion Survey lending supply and demand are already at recessionary levels.

- The yield curve has begun a bear steepening cycle, indicating that the recession will commence faster than expected by the consensus.

- Unemployment and inflation are classic lagging indicators, by the time they show the progress the Fed would like to see, they will be collapsing with momentum behind the fall.

The Inflation Revivalists

- Believe that disinflationary forces are transitory, and inflation will be a persistent problem that forces the Fed to continue its hiking campaign, or at a minimum, maintain a restrictive policy stance for much longer than expected. Key arguments to their thesis:

- Much of the recent bout of success in the fight against inflation can be attributed to a steep decline in gasoline and food prices over the last year, as well as normalization in demand for goods, trends in respect to each of these have changed in the last two months.

- Wages are the most important part of the picture, and they remain pegged at annualized rate above 4%.

- As we approach Q4 base effects will make less of an impact on the disinflationary picture, making it mathematically more difficult to extend the current trend.

- Market measures of inflation such as the 5y5y Forward and Breakevens are showing renewed signs of inflationary expectations in market pricing.

Disinflation Junkies and Inflation Revivalists both have compelling cases (and great lead singers)

![]()

What ratings agencies think doesn’t matter until it does

- In the last two weeks the ratings agencies Fitch and Moody’s have both made significant downgrades with commentaries about the unsustainability of current operating models that have spooked the markets.

Fitch U.S. Debt Downgrade (8/1/23):

- “The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.” – Fitch

Moody’s Bank Downgrade (8/7/23):

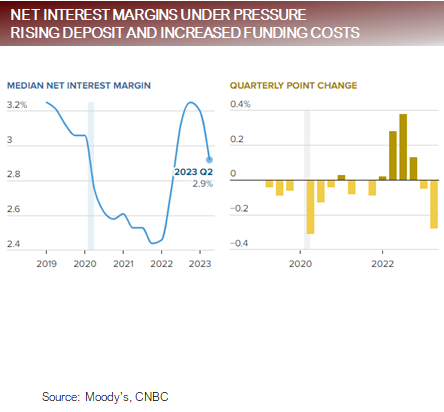

- Downgrade of 10 banks ($10b of debt downgraded), with 6 banks ratings under review and 11 banks outlooks moved from stable to negative (collectively $100b of debt impacted by Moody’s).

- Increased funding cost, higher regulatory costs, potential losses on loans and lower loan growth creating an industry headwind.

- “Elevated CRE exposures are a key risk given sustained high interest rates, structural declines in office demand due to remote work, and a reduction in the availability of CRE credit.“ – Moody’s

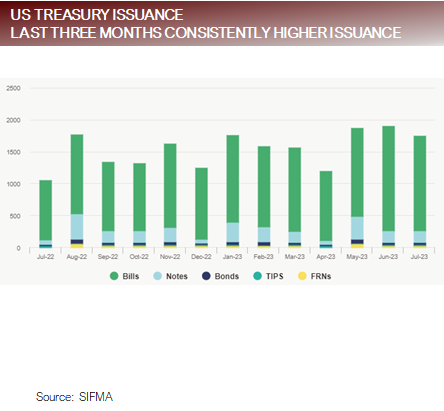

On 8/10/23, the market struggled to absorb the $23b 30-year U.S. Treasury auction, eventually clearing at 4.189%, the highest yield on the 30 year since 2011, principally sold to primary dealers, which is seen as a sign of poor demand.

- Last week was a particularly heavy week of issuance with the Treasury issuing a combined total of $103b of 3, 10 and 30 year of paper. This made last week unusual, but highlighted that larger issuances don’t have unlimited demand, especially at the long end, where there are structurally less buyers.

Markets struggling to absorb debt issuance and banks cost structures under pressure

Everyone is crowding to one side of the boat, the soft-landing side

“If everybody is thinking alike, then somebody isn’t thinking.” – General George S. Patton

- At end of December 2022, 78% of strategists in the Bloomberg Institutional Survey expected the S&P500 to increase less than 10%, with the average forecast in the group projecting that S&P500 would increase by barely 2%.

- Everyone was on one side of the boat.

- By July, 60% of Strategist had increased their year end forecast.

- Everyone was shifting to the other side of the boat.

- Already during August several prominent strategist, including possibly the most well cited bear, Mike Wilson of Morgan Stanley, have thrown in the towel on a lower market in the near-term.

The soft-landing scenario has three important assumptions:

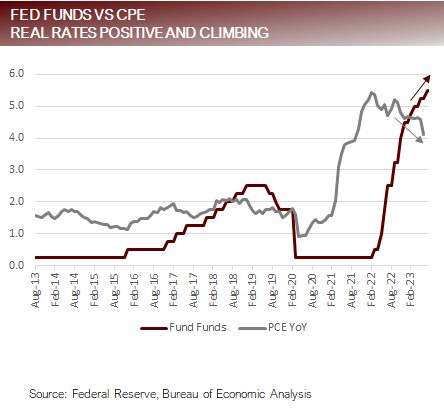

- Disinflationary forces will persist driving CPI and CPE steadily lower.

- Growth will continue come in at or above trend supporting consumer spending and allowing the labor market to cool at a measured pace.

- Falling inflation pegged against the current Fed Funds Rate will create increasingly positive real rates, providing the Fed room to ease.

This is a tall order, and it’s beginning to feel a lot like it did at the end of December when everyone was thinking the same thing about a recession in the first half of 2023.

Soft-landing scenario is predicated on continuation of current trends for growth and disinflation

FAQ: China, deflationary bust or reflationary comet in the making?

Asset crisis:

- There was estimated to be over 65m empty homes in China at the end of 2020.

- According to China Real Estate Monitor, the excess housing supply in China’s 50 largest cities would take over 20 months to clear. This compares to the US, where the excess housing supply is estimated to be 2.9 months, according the National Association of Realtors.

- Last week, China’s largest developer, Country Garden, defaulted on debt with a face value of over $1b. This adds to the list of nearly 70 high profile developers who have defaulted in the past year and half.

Employment & Population Crisis:

- The youth unemployment rate (16-24 year olds) in was recently reported as 21.3%, but external whisper numbers suggest that the actual number could be in excess of 40%.

- Last week the Wall Street Journal reported that Asian factories are having an increasingly hard time finding workers to fill relatively unappealing factory jobs.

- China’s population is currently 1.4b and is expected to drop to 1b by 2080 and 800b by 2100.

- The working age population of China peaked in 2011 at about 900m and is expected to drop to 700m by 2050.

Economic Slowdown:

- China inflation statistics showed the country has now slipped into deflation.

- Mortgage and corporate loan demand has collapsed by almost 50% as compared to a year ago.

Trade Crisis:

- US imports of Chinese goods are trending at dollar volumes below 2011, dropping almost a third from peak levels in 2021.

Bottom Line:

- China’s government has thus far been unwilling to create sufficiently large enough stimulus to resuscitate their economy. Many of their previously policies to drive economic growth have proved unproductive and unsustainable. Their shrinking market share of US production and internal asset, employment and population crisis is beginning to show up in economic data, and smacks of Japan in the 1980s. Much of the answer to the question likely lies in the effectiveness of future policy responses, but they are fighting an uphill battle.

Chinese government is fighting to avoid a deflationary bust but unwilling, or unable, to respond

Putting it all together

- The markets are priced for a soft-landing scenario, so moving forward data will need to support that scenario or data will be seen as a disappointment to the markets.

- Last week’s market action was interesting from the respect that data supporting better than expected growth, strong earnings and continued disinflation was reported, but that markets did not react with a rally. Which begs the question of how good the data will have to be to generate additional upside if a week of good data doesn’t generate positive price action.

- It’s natural for the markets to consolidate or even pullback after a sizable run. In fact, since 1980 the S&P500 has averaged 4.5 pullbacks of 5% or more a year, with 10% pullbacks occurring every 1.2 years. So, the fact that the equity markets can’t rally on good news could reflect a normal consolidation and pullback or could also be a signal of exhausted buyers.

- However, with so many people sharing the same market view (soft-landing), it creates a large risk because when all players are positioned for the same outcome, if the outcome is different, it can create exaggerated moves.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected]

Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied. FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.

For more news, information, and strategy, visit the China Insights Channel.