China is looking to revive economic growth, but in the meantime, exchange-traded fund (ETF) investors can obtain monthly income while awaiting future upside in the country’s tech sector with the KraneShares China Internet and Covered Call Strategy ETF (KLIP).

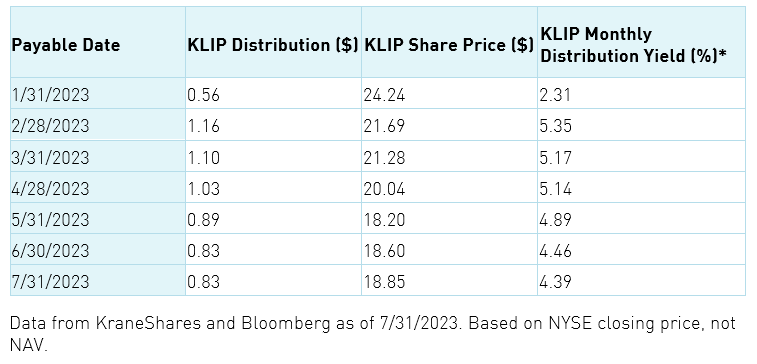

ETF provider KraneShares announced that since the beginning of the year through the month of July, KLIP has been returning an average return of 4.9% per month. As central banks continue to keep monetary policy tight, and inflation proves to be more stubborn than originally anticipated. This results in higher yield that’s available with a covered call strategy that’s inherent in KLIP.

“KLIP distributed $0.83 for July. That represents a distribution yield of 4.39%* for the month and an annualized current yield of 51.98%,” Kraneshares noted. As mentioned, the chart below shows the fund’s monthly distribution yield for six full months. This includes a partial distribution during the month of January.

In addition to monthly income, KLIP investors also get exposure to China’s tech sector as the fund sells covered call options on the KraneShares CSI China Internet ETF (KWEB). China’s tech sector can be more volatile than the U.S. tech sector. However, in the world of covered call options, volatility could open opportunities for more yield and potential price appreciation when KWEB rallies.

Of course, China will need to work out its current economic doldrums. But, if the second largest economy can right the ship, this could translate to gains for KWEB and, subsequently, KLIP. In the meantime, KLIP investors can still harness the fund’s income potential.

“KLIP’s sixth full-month distribution in July builds on its growing track record of providing meaningful current income distributed monthly,” said Jonathan Shelon, KraneShares Chief Operating Officer. “As momentum returns to the China internet sector, investors can combine allocations to both KLIP and KWEB to produce a targeted strategy. That would provide both growth and income.”

Leverage Future Upside in China’s Tech Sector

The Chinese government is already working to resuscitate its economy with a bevy of stimulus measures. In particular, this props up its ailing real estate sector. If the stimulus measures prove to be effective, KWEB could reclaim its strong performance. This would resemble the beginning of the year.

“Policymakers have announced a batch of policies in recent months to revive the property sector, which include easing home buying restrictions in the nation’s biggest cities, extending loan relief for developers, and considering reducing down payments in some non-core neighborhoods of major cities,” MSN reported.

For more news, information, and strategy, visit the China Insights Channel.