Covered call strategies continue to gain traction this year as advisors and investors look to diversify their income streams. A noteworthy covered call fund that offers strong diversification potential is the KraneShares China Internet and Covered Call Strategy ETF (KLIP).

“We wanted to deliver something that gave more certainty and outcomes,” Jonathan Shelon, COO of KraneShares, said in a webinar earlier this year regarding the launch of KLIP in January.

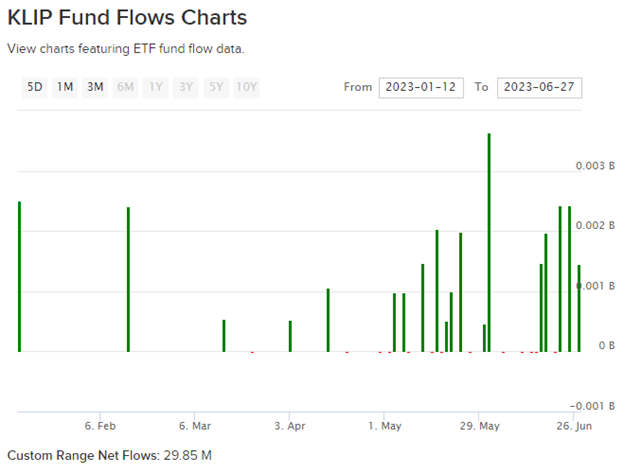

Covered call funds remain popular going into the second half of the year. KLIP continues to garner new flows. In the last two weeks alone, the fund brought in nearly $10 million in new flows. Since inception (January 12, 2023) the fund is up almost $30 million in net flows.

A Covered Call ETF to Capitalize on China’s Growth Volatility

KLIP is a fund that seeks to provide income through written covered calls on the KraneShares CSI China Internet ETF (KWEB). Because of the increased volatility, it has the potential to offer higher yield than investing in tech in the U.S. or other technology sectors globally.

A covered call entails holding the underlying security while writing calls on that security. This earns a premium from selling the covered call that can then be utilized to generate income for the fund.

“When we have higher volatility, that leads to higher option premiums,” explained James Maund, head of capital markets at KraneShares in the webcast. “KWEB has a history of heightened volatility which leads directly to higher options premiums.”

KLIP offers a current yield of 53.79% as of June 27, 2023. Current yield is a measure of the most recent distribution, annualized, and then divided by the most recent NAV.

The ETF is benchmarked to the CSI Overseas China Internet Index. The index tracks publicly traded Chinese-based internet companies. KLIP can be used alongside KWEB in a portfolio to capture China’s growth in the internet sector while also benefiting from any volatility in the sector through income generation.

KLIP has an expense ratio of 0.95%.

For more news, information, and analysis, visit the China Insights Channel.