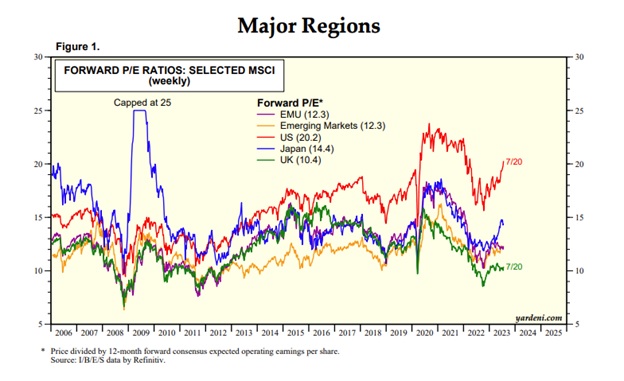

Many investors have been dumping China equities over the last couple of years, often in favor of other markets like India. In fact, based on MSCI data, China is trading at a forward price-to-earnings multiple of about 10.1 — exactly half that of the U.S., at 20.2. That’s the highest the valuation gap between the two countries has been in 20 years.

Given that China and the U.S. are the two biggest economies in the world, it’s worth questioning why the valuation gap between the two nations is so massive. Of course, just like any other investment, there will always be bulls and bears on the subject, but we can get some ideas about what’s driving this huge valuation gap between China and the U.S. if we dig deep into what’s happening globally.

De-risking From China

Earlier this year at the Hiroshima summit, the Group of Seven, better known as the G7, called for a “de-risking” of ties with China, citing the nation’s “non-market policies and practices.” However, amid the G7’s call in May, the Atlantic Council, reported that foreign fund managers had already been de-risking from China for some time, dumping large amounts of Chinese securities dating back at least two years.

The firm noted that international institutional investors had been net sellers of approximately 1 trillion yuan (US$148 billion) worth of Chinese bonds since early 2022. Additionally, they’ve been unloading large numbers of shares of Chinese companies, sending their stock prices plummeting, especially those listed in New York and Hong Kong.

Of course, such widespread selling of Chinese equities can’t go unnoticed, although it hasn’t received much attention until recently.

Why Investors Are Dumping Chinese Equities

In a statement, the G7 leaders advised de-risking from China due to its policies and practices that “distort the global economy.” Among the concerns highlighted was China’s history of “economic coercion” of countries that take actions it isn’t happy with.

Aside from the geopolitical concerns that have stemmed from such policies, the Chinese economy still hasn’t recovered from the COVID-19 pandemic the way most had expected it would. Many place the lion’s share of the blame on the nation’s zero-COVID policies.

China’s latest GDP reading showed that its economy slowed significantly in the spring from where it stood earlier this year. According to the second-quarter GDP numbers reported by Beijing in July, the Chinese economy expanded by 6.3% year over year.

While that might not seem terrible, it’s measuring off a steep slowdown in last year’s second quarter, when Shanghai, the largest city in China, was in the midst of a two-month lockdown. Under the surface, we see more troubling signs. Exports have plummeted, especially in June, and weak spending is dragging China down almost to deflation levels.

Meanwhile, the crippling property crisis in China continues, and some local governments there can’t pay their bills, leading to some services being shut down. For example, Baoding, which has a population of 12 million, was forced to suspend most of its bus services due to a lack of funds.

Aside from the economic and geopolitical concerns, some of China’s business practices may be keeping foreign investors out. In particular, Beijing’s regulatory crackdown on China’s tech sector may be weighing on foreign investor sentiment toward the country.

Does the Valuation Picture for China Make Sense?

Amid all these concerns, it’s natural for investors to wonder whether China deserves to be valued at half of what the U.S. is valued at or whether this valuation gap suggests that a plethora of deals may be available. In fact, Chinese equities have traded at a discount to their global peers for more than a decade, although they have rarely been cheaper than they are currently.

Additionally, the valuation gap between U.S. and Chinese equities is the widest it has been since March 2022 and at one of the widest points it has been at any point over the last 20 years using estimates of future earnings. As mentioned earlier, Chinese equities are trading at about 10x PE (forward 12-months earnings), versus around 20 for the U.S. market.

The only time Chinese equities became more expensive than U.S. stocks was during the Great Financial Crisis between 2007 and 2009. During the crisis, stocks around the world suffered, but the U.S. market dropped less in comparison to its global peers due to the perceived safety of U.S. stocks.

Although China and the U.S. are the two largest global economies, some might argue that the comparison isn’t fair. However, looking at some of the markets investors are pouring into instead of China can be very revealing

For example, MSCI data shows that India is trading at a forward P/E of 21.2 — more in line with where the U.S. is trading despite the disparities between the two countries. Meanwhile, Japan is trading at a forward P/E of 14.4, and emerging markets as a whole are trading at a forward P/E of 12.3.

Charts with permission from Yardeni

In other words, China is trading at a lower valuation than the world’s emerging markets — despite being the second-largest economy in the world.

Some Leading China Equity ETFs

With such massive valuation gaps between China and other major equity markets, it’s no wonder that investing opinions on China are tending to run at one extreme or the other. It all depends on whether the large number of risks more than offsets the potential reward of investing in China.

However, the long-term bearish tilt is easily evident in the fact that names like Alibaba and Tencent are way off their peaks, with Alibaba trading at around $300 at one point, and Tencent at around $100, versus their current prices below $100 and $45, respectively.

If you are in the bull camp, there are dozens of exchange-traded funds that provide unleveraged exposure to China from a variety of angles. The largest fund covering the space is the $8.1 billion iShares MSCI China ETF (MCHI), which is down 0.55% this year. It offers broad coverage, investing in shares of China companies that are available to foreign investors.

Meanwhile, the Invesco Golden Dragon China ETF (PGJ), with more than $200 million in assets under management, is one of the best performing China funds and invests mainly in ADRs representing Chinese companies. The fund is up more than 12% year-to-date.

And the KraneShares CICC China Leaders 100 Index ETF (KFYP), which applies a smart-beta strategy to China’s A-Shares market, is up 5.7%, year to date. That’s more than any other fund that focuses on that share class.

If you’re looking to get granular, the Global X MSCI China Communication Services ETF (CHIC) is up more than any other China ETF, with a return of nearly 13% year-to-date, while the KraneShares MSCI China Clean Technology Index ETF (KGRN) notched a return of 11.5%.

For more news, information, and strategy, visit the China Insights Channel.