Flagging economic recovery in China spurred the People’s Bank of China into action this week, cutting lending rates. The cuts are likely to be followed by a stimulus package to stave off further weakening. Equities in China and the Asia region rose in response, benefiting broad China funds like the KraneShares MSCI All China Index ETF (KALL).

The lending rate cut on the 1-year loan Thursday by the PBOC was the first in 10 months. The move followed on the heels of short-term rate cuts earlier in the week. The PBOC also cut deposit rates last week.

The WSJ reported that Beijing could introduce a new special treasury bond in the coming weeks. These bonds aim to increase infrastructure spending and are worth one trillion yuan ($140 billion USD). The bonds could serve multiple purposes, aiding local governments indirectly with debt as well as boosting confidence of businesses. Alongside the bonds are rumors of an initiative to allow residents in certain areas to purchase a secondary residence in hopes of lifting property markets.

Global economic slowing continues to weigh heavily on China. Production in China’s industrial sector rose just 0.6% month-over-month in May. It’s a gain of 3.5% year-over-year and a drop from April’s 5.6% production rate. A 7.5% pullback in exports year-over-year reflects the impacts of the global macro environment.

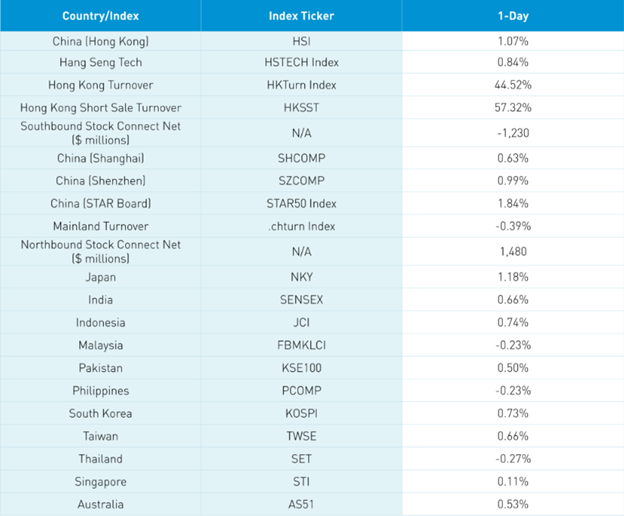

Rate cuts this week and suspected loan prime rate cuts next week alongside stimulus hopes lifted Asian markets and Chinese equities this week. Of note, volumes spiked at the end of the week on quad witching in the U.S. as futures and options on stocks and indexes expired.

Image source: KraneShares’ China Last Night blog

Capture Potential Growth in Broad China Equities

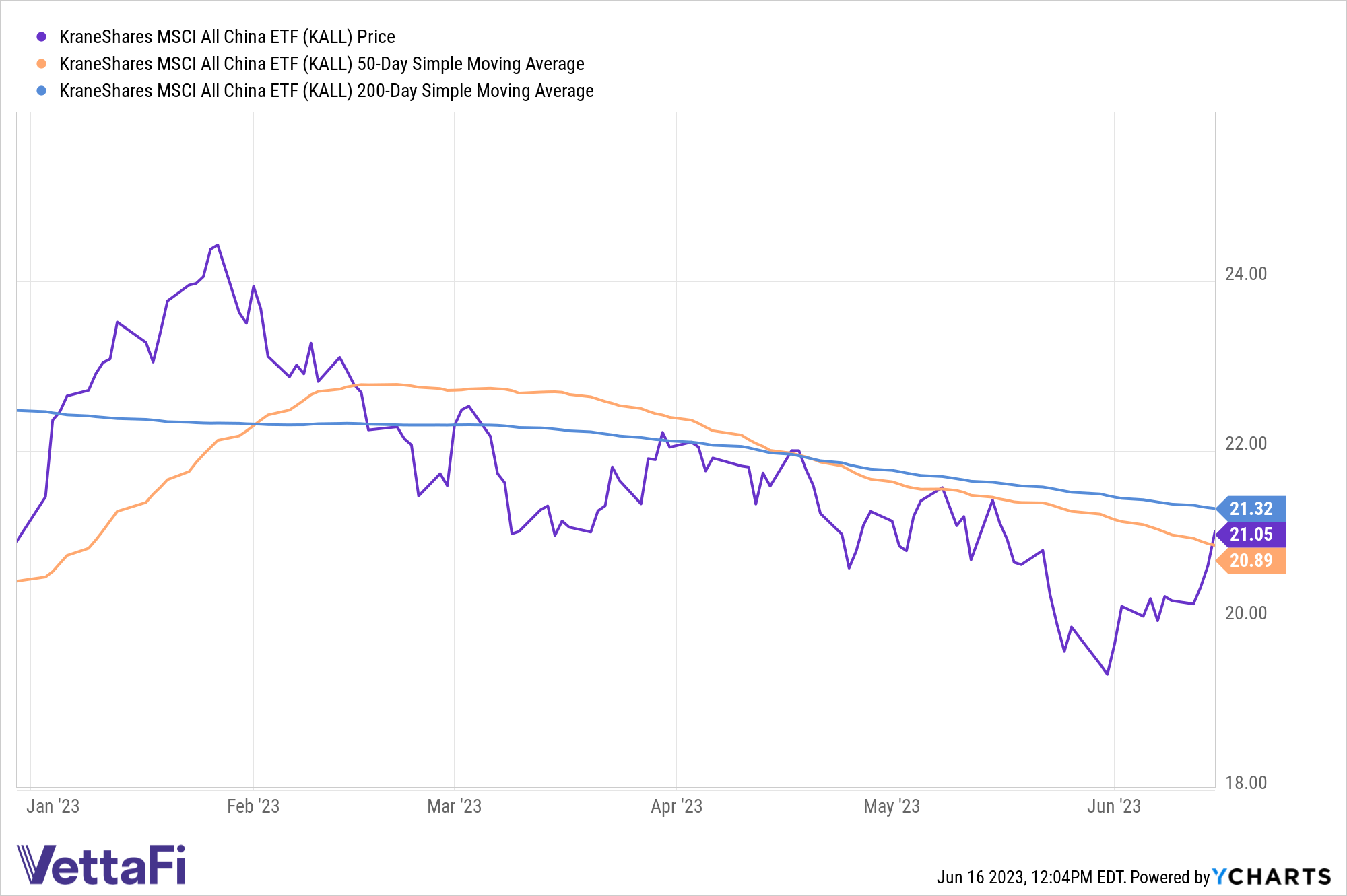

The KraneShares MSCI All China Index ETF (KALL) tracks the MSCI China All Shares Index. It’s a benchmark of companies that are based and headquartered in China as well as listed in the Mainland China, Hong Kong, and the U.S. KALL is broadly diversified across the Chinese equity market.

KALL is up 0.54% YTD and crossed above its 50-day Simple Moving Average in trading Thursday and is rapidly closing in on its 200-day SMA. Funds that cross above their SMAs are considered in buy territory for investors and trend followers.

As of the end of May, top sectors in KALL included: consumer discretionary (22.71%), financials (20.26%), communication services (13.56%), and consumer staples (11.13%).

Top holdings include Tencent (8.30%), Alibaba (5.57%), and Kweichow Moutai (2.93%) as of 06/15/23.

The fund has an expense ratio of 0.48% with a fee waiver that expires on August 1, 2023.

For more news, information, and analysis, visit the China Insights Channel.