Tensions between China and the U.S. continue to take the media mainstage this year in an environment of continued geopolitical risk. Despite muted flows into China-focused funds this year, the country maintains its position as the most researched within EM countries by advisors on the VettaFi platform.

Because of fears of enhanced geopolitical risk, investors largely remain on the sidelines when it comes to China investing. Though the flows may be tepid this year, China remains closely watched by advisors.

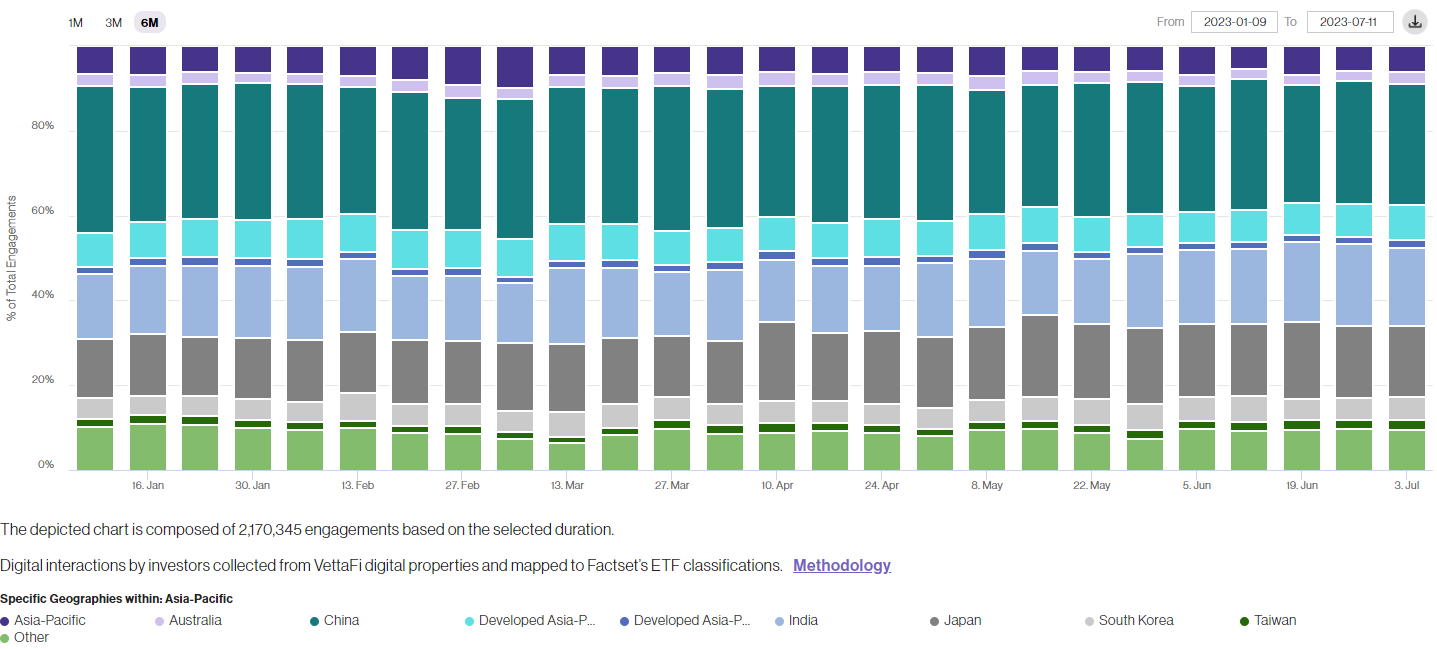

When it comes to advisor research on emerging markets on the VettaFi platform, the Asia-Pacific region is the highest researched this year. For the week ending July 9, 48% of advisors searching within emerging markets did so specifically in the Asia-Pacific region. The next closest was broad EM at 31%.

Within the Asia-Pacific region, China maintains its dominance as the most researched single country in 2023.

Image source: VettaFi

For the week ending July 9, 28% of advisors searched for China-specific funds and related strategies. It’s a small drop-off from the beginning of the year when 34% of advisors searched for China, but the country remains the most researched on a consecutive basis within the Asia-Pacific. India, for all its rising popularity, continues to trail in research frequency, at 16% for the week ending July 9.

Moving Beyond Research to Investing in EM and China

There are several ways to approach investing in China while keeping an eye on risk and volatility. The KraneShares MSCI Emerging Markets ex-China Index ETF (KEMX) offers emerging market exposure but excludes China. This allows investors to intentionally allocate how they want into China through complementary, targeted funds. Options include plays on consumer recovery through the KraneShares CICC China Consumer Leaders Index ETF (KBUY) or on China’s green transition through the KraneShares MSCI China Clean Technology Index ETF (KGRN).

The KraneShares S&P Pan Asia Dividend Aristocrats ETF (KDIV) provides global portfolio diversification with a defensive stance against market volatility through dividend aristocrat companies. The fund offers exposure to China, Australia, Japan, and more.

For more news, information, and analysis, visit the China Insights Channel.