While developed U.S. and non-U.S. markets indexes were up year to date through October 20, emerging markets benchmarks were treading water. The two largest emerging markets ETFs are the Vanguard FTSE Emerging Markets (VWO) and the iShares Core MSCI Emerging Markets (IEMG). Despite lagging the performance of the SPDR S&P 500 ETF (SPY) this year, the pair has combined net inflows of $6.5 billion. However, advisors have concerns.

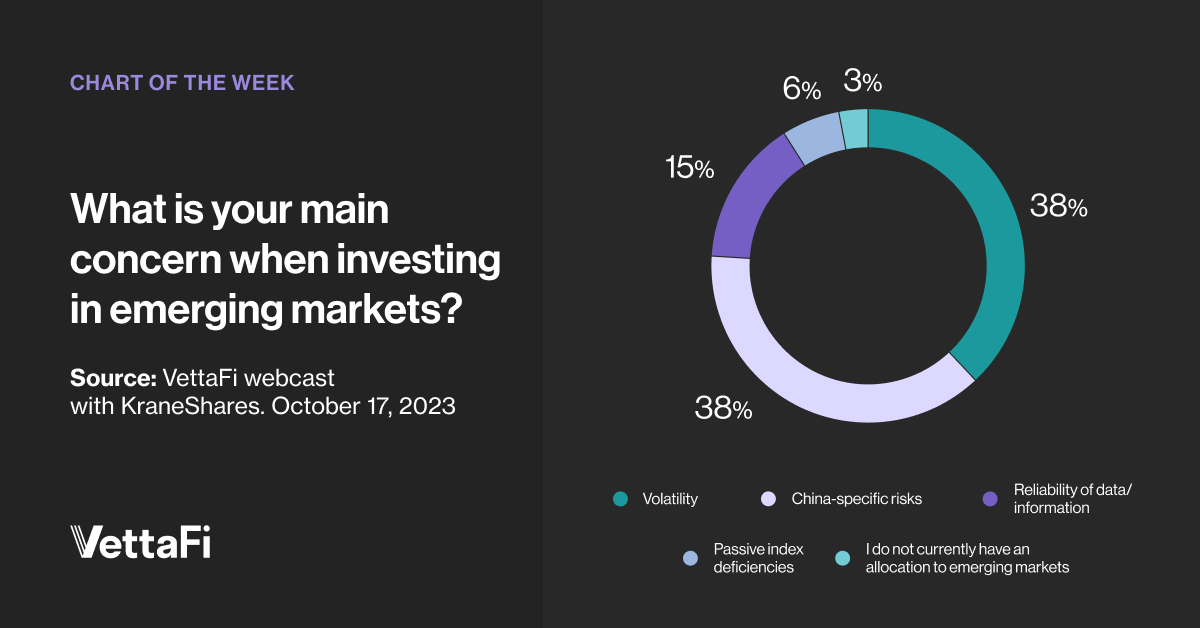

VettaFi held a webcast with KraneShares in mid-October. During the virtual event, we asked advisors, “What is your main concern when investing in emerging markets?” There was a tie for the top answer. The top responses were “China specific risks” and “volatility.” These responses each pulled in 38% of the poll results, ahead of reliability of data/information and passive index deficiencies. We think some advisors are avoiding emerging markets due to these concerns.

Avoiding China-Specific Risks With ETFs

China is the largest of the emerging markets, representing 31% and 26% of VWO and IEMG recent assets, respectively. However, some investors have concerns about Chinese geopolitics, while others see more fundamentally focused risks. There are ETFs gaining traction that provide emerging market exposure without Chinese stocks inside.

The iShares MSCI Emerging Markets ex China ETF (EMXC) has $6.4 billion in assets, aided by $950 million of net inflows in the past month. India (23% of assets), Taiwan (22%), and South Korea (17%) are the three largest markets in this ETF. Relative to IEMG, EMXC has more financials exposure and less information technology.

The Columbia EM Core Ex China ETF (XCEM) has $310 million, aided by $45 million of net inflows in the past month. While the fund excludes companies domiciled in China like EMXC, it has distinct exposure. Recently, Taiwan was its largest market (24% of assets), followed by South Korea (12%), and India (12%). Saudi Arabia was close behind, at 9.4% of assets, a weighting double that of EMXC. XCEM was highlighted during the VettaFi Equity Symposium last month.

China’s Lack of Freedom Impacting Its Weight Too

The Freedom 100 Emerging Markets ETF (FRDM) has $660 million in assets, with $25 million added in the past month. The fund’s largest markets are Taiwan (22% of assets), South Korea (19%), Poland (17%), and Chile (16%). The absence of China and Saudi Arabia, as well as a few other markets, is the result of the freedom weighting. According to Perth Tolle, founder of Life + Liberty Indexes, China could be included in the index behind the ETF if the country’s relative standing changed.

However, the country’s assessed personal and economic freedom, from the Cato Institute and the Fraser Institute, would need to improve significantly. Freer countries like Chile and Poland have enjoyed more sustainable growth, faster recovery, and more efficient use of capital, explained Tolle. FRDM is built through country-level, not security-level, decisions, unlike some lower-risk peers.

Emerging Markets Exposure With Less Volatility

Investors seeking to still own Chinese stocks, but in a lower-risk manner, have a range of ETFs to consider. For example, the iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV) has a 23% stake in China but owns the less volatile stocks from this and other emerging market countries. The $4.2 billion EEMV has constraints to keep its country and sector exposure looking more like a broad market ETF like IEMG.

Meanwhile, the Invesco S&P Emerging Markets Low Volatility Portfolio (EELV) has just a 4% stake in China. Taiwan and Thailand are EELV’s largest markets, while financials (38% of assets), not information technology, was its largest sector. The $710 million EELV does not have constraints like EEMV does and owns shares of the the least risky companies regardless of their domicile or sector classification.

Indeed, EEMV and EELV are the emerging market ETF versions of the iShares MSCI USA Min Volatility ETF (USMV) and the Invesco S&P 500 Low Volatility ETF (SPLV).

See More: NYSE’s ETF Leaders: Invesco’s John Feyerer

Emerging Markets With an Income Boost

The KraneShares China Internet & Covered Call Strategy ETF (KLIP) provides exposure to Chinese Internet companies in a lower-risk manner. The fund owns shares of Alibaba, Baidu, Tencent, and peers through the KraneShares CSI China Internet ETF (KWEB). In addition, KLIP sells call options on KWEB. This provides additional income and some downside protection. In the three-month period ended October 20, KLIP was up 0.3%, while KWEB was down 9.4%. KLIP launched in early 2023 and has approximately $110 million in assets.

VettaFi and KraneShares will be talking about KLIP and other covered call ETFs during the Income Strategy Symposium on October 27. Register to join us.

For more news, information, and analysis, visit the China Insights Channel.