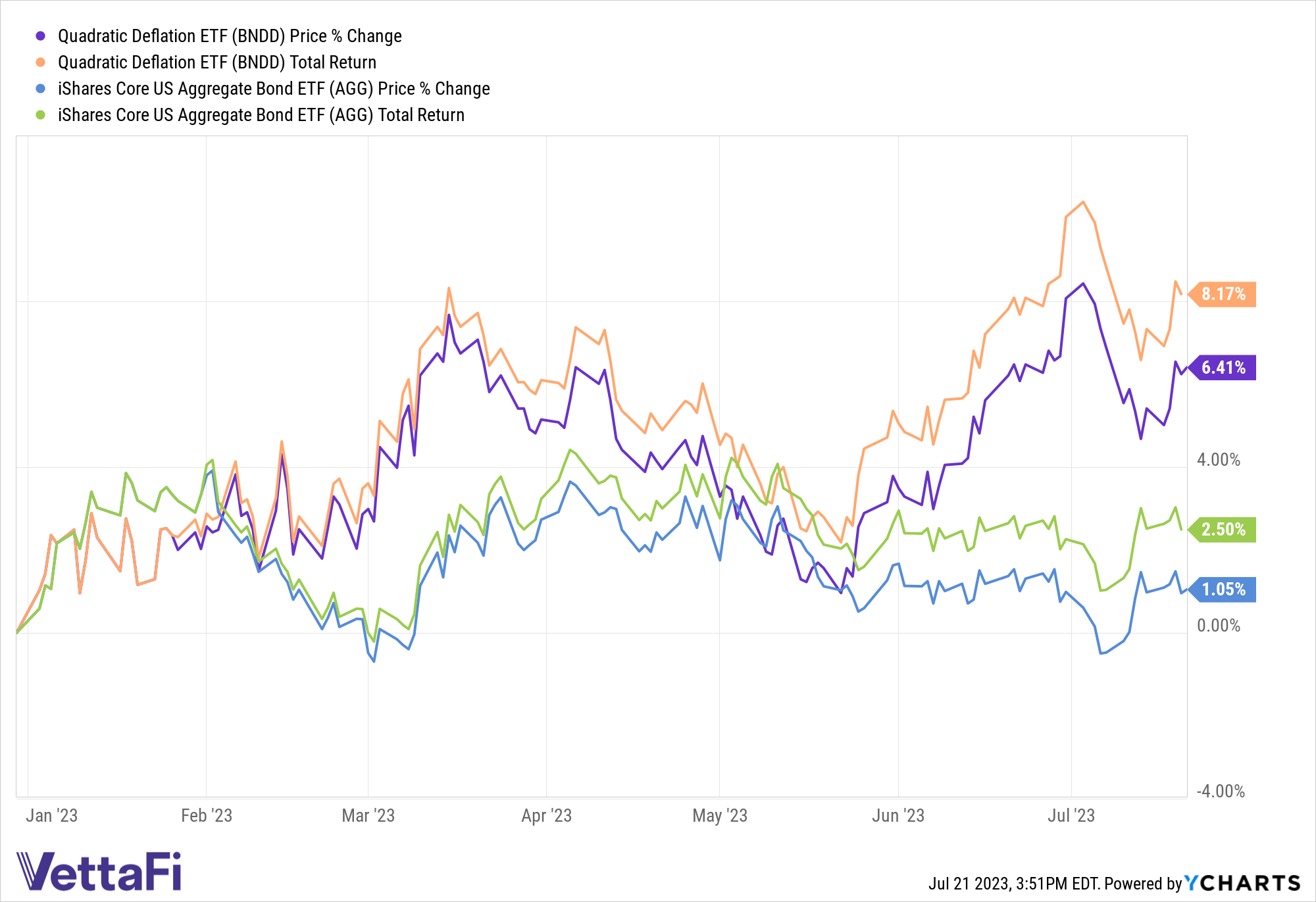

While there are strong yield opportunities back in bonds, some bond ETFs stand out this year for their performance. In particular, the Quadratic Deflation ETF (BNDD) is noteworthy, outperforming the broad U.S. fixed income market year-to-date.

The Fed meeting next week to set interest rates and discuss the path ahead remains a highly anticipated event. Though markets remain fairly certain of another quarter-point interest rate hike, investors will watch for any potential change in guidance. It’s guidance that could carry large implications for the U.S. bond market in the coming months.

Bond prices continue to take hits this year as interest rates rise at historic rates. Prolonged market and investor uncertainty regarding inflation and the path of the Fed led to continued volatility and increasing yields in bonds (bond prices and yields move inversely to each other).

BNDD is a fixed income, ESG-focused, actively managed ETF. KFA Funds, a KraneShares company, subadvises the fund. It remains a top-performing bond ETF this year.

In the last week, BNDD was the third highest fixed income ETF on a total return basis, up 1.49%, according to FactSet data. It is also the seventh-highest U.S. bonds ETF YTD with returns of 8.16%. The fund crossed above its 50-day Simple Moving Average on June 7 and has held above it ever since. The ETF remains below its 200-day SMA but continues to trend upwards.

The fund seeks to benefit from lower growth and a reduced spread between short- and long-term interest rates. It also benefits from deflation and lower or negative long-term interest rates. According to KFA, the fund’s strategy profits when yields decline on the 30-year Treasury or when short-term rates rise.

BNDD seeks to hedge against deflation risk while creating positive returns at times when the U.S. interest rate curve flattens or inverts. It invests in long-duration Treasuries with different maturities either directly or via ETFs that invest in Treasuries.

It also uses options tied to the U.S. interest rate curve and traded on the OTC market. These include long options, long spreads, and butterflies (an options strategy that uses both bear and bull spreads). All options utilized attempt to limit loss by the fund and enhance returns.

BNDD carries an expense ratio of 0.96% with fee waivers that expire on August 1, 2023.

For more news, information, and analysis, visit the China Insights Channel.