High yield bond investing in Asia carried elevated risk in the last two years and many foreign investors chose to remain on the sidelines. There are a number of potential tailwinds that make the space increasingly attractive, alongside the substantial yields.

The KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB) carries a 30-day SEC yield of 10.48% as of 06/14/23. The fund’s portfolio manager, Wai Hoo Leong of Nikko Asset Management, discussed recent performance and why Asia high yield bonds are worth consideration in current markets in an interview with KraneShares recently.

Deleveraging Risk Within Asia High Yield Bonds

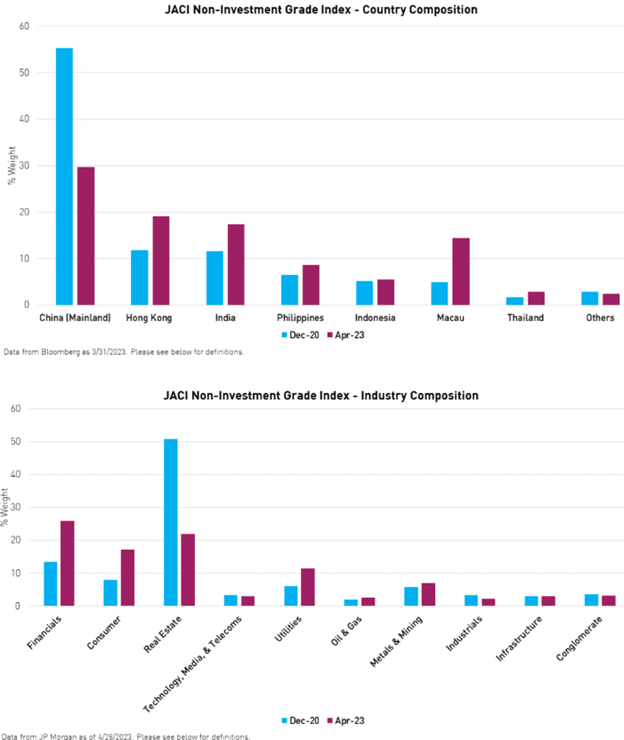

It’s no secret that China’s real estate sector created significant drag on Asian bonds in the last 18 months. Changes to the positioning of KHBY’s underlying index, the JP Morgan Asia Credit Index (JACI) Non-Investment Grade, reflect the risk in China’s real estate sector.

“Historically, the Asia high yield bond market was driven by China’s real estate sector,” explained Wai Hoong. It’s a reality “that is no longer the case.”

Image source: KraneShares

The index reduced both its overall weight to China (50% in 2020 to under 30% in 2023) as well as its exposure to real estate over the same period. Real estate issuers comprised 50% of the index’s weight in 2020 whereas now they make up less than 30%.

Reductions in China exposure resulted in increased exposure to India, Thailand, and the Philippines. India and the Philippines particularly benefit from younger populations and “large and growing economies”. Rising wages also lend support to gains in domestic consumption. All three countries continue to benefit from “fiscally responsible” governments and a rise in foreign direct investment.

Shrinking real estate sector exposures proved both beneficial and timely for increased weights to the consumer sector and financial services sector.

“This is primarily due to the significant increase in domestic consumption and demand for domestic financial services that many Asian economies have experienced in recent years,” Wai Hoong said.

KHYB Performance YTD

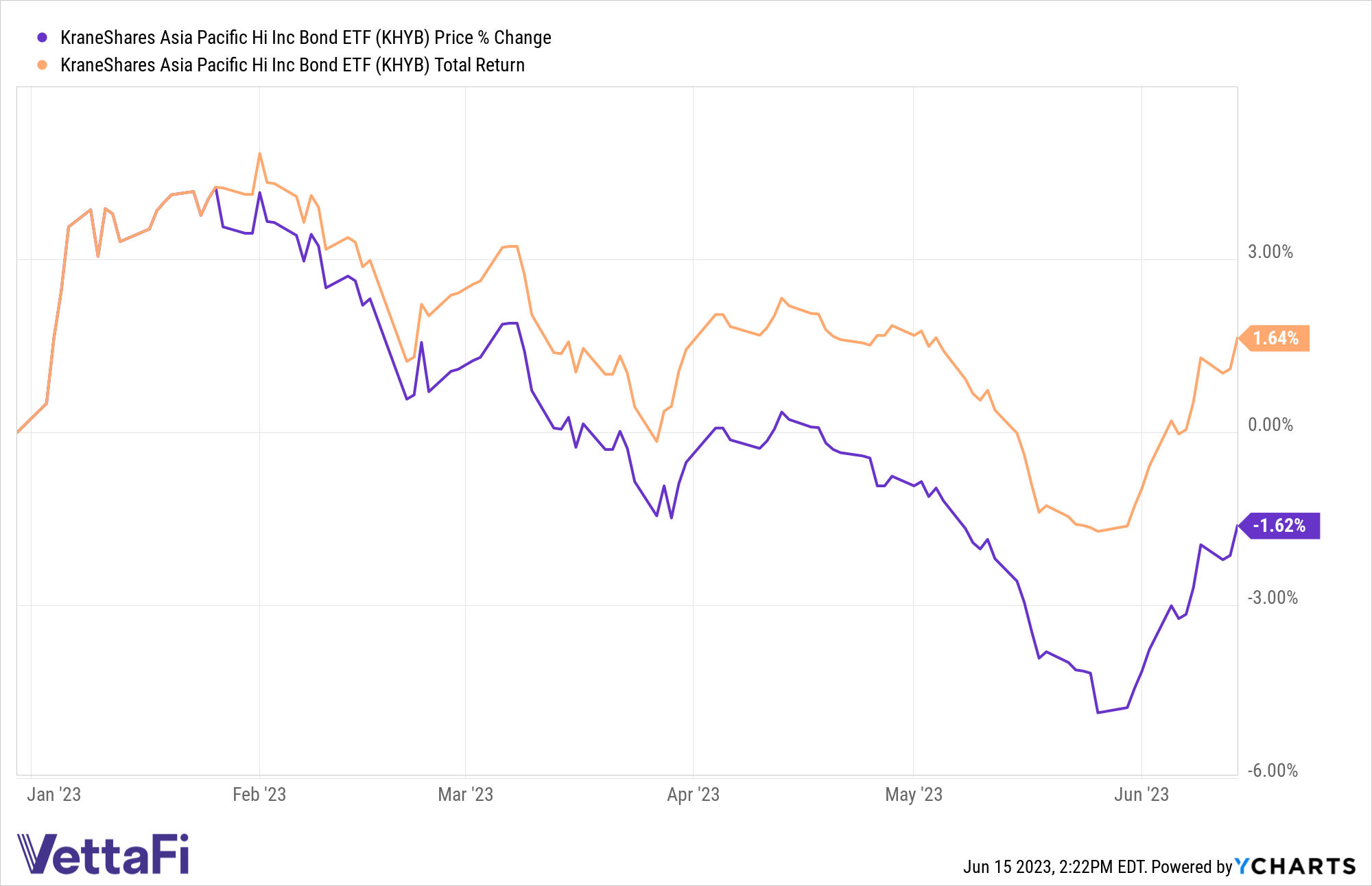

Global outperformance in the first quarter of 2023 carried over into Asia high yield bonds as well. Q1 gains have largely corrected in the second quarter, but KHYB benefited from overweighting Chinese real estate early in the year.

“At the beginning of the year, we went overweight China’s real estate sector,” explained Wai Hoong. The fund primarily targeted “issuers that we thought would see the most improvement in the first quarter based on our bottom-up credit research.”

Those positions resulted in Q2 profits and contributed to the high cash position the fund currently carries. Wai Hoong hopes to funnel the cash into Macau and Thailand this year, focusing on consumer-facing businesses that benefit from Chinese tourists.

KHYB remains tilted in favor of higher rated credit exposures than the underlying index. At the end of Q1 the fund carried an overall average credit rating of BB while the underlying index’s credit average was BB-.

Invest in Asia High Yield Bonds With KHYB

KHYB is an actively managed fund that invests in USD-denominated high yield debt securities from companies in Asia, excluding Japan. The fund is benchmarked to the JPMorgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index. The index invests in high yield fixed income securities, or “junk bonds,”. These junk bonds are rated below the four highest categories (Ba1/BB+ or lower) by at least one credit rating agency, or, if unrated, are determined by the sub-advisor to be of similar quality.

Nikko, the sub-advisor, uses top-down macro research and bottom-up credit research to create the portfolio. They also employ a proprietary process that combines qualitative and quantitative factors used to value an issuer’s credit profile.

By moving the credit curve up, KHYB will be more defensive against the benchmark. This means the fund will also have shorter-duration bonds than the index. When the bonds mature, Nikko can decide how and when it wants to redeploy and invest in new bonds.

KHYB carries an expense ratio of 0.68%.

For more news, information, and analysis, visit the China Insights Channel.