The International Energy Agency (IEA) recently reported that nearly 3 million new electric cars were registered in 2020–a record high. That number was up 41% compared to 2019, according to the IEA website.

It should be noted that this growth happened at a time when driving had actually fallen, as lockdowns forced individuals to stay home. The global automotive industry struggled.

When looking to the future, the IEA anticipates that the number of electric vehicles on the road will increase to 145 million by 2030.

If governments more heavily promote the shift to help meet global climate and energy goals, then that number could grow to 230 million in the same period of time.

In China, electric vehicle registration increased 9% to 1.2 million last year, while in Europe the vehicles more than doubled to 1.4 million.

Consumers Spending More on EVs

Last year, consumers spent $150 billion USD on electric cars, more than double the previous year, while governmental support measures continued to fall for the fifth year in a row. This indicates a growing consumer demand for electric vehicles, one that does not rely on government subsidies for growth. “While they can’t do the job alone, electric vehicles have an indispensable role to play in reaching net-zero emissions worldwide,” said Fatih Birol, executive director of the IEA in a press release.

He went on to say that “current sales trends are very encouraging, but our shared climate and energy goals call for even faster market uptake.”

Investing with KARS

According to the KraneShares website, “55% of new car sales and 33% of the global car fleet are projected to be electric by 2040.” The global electric vehicle market is estimated to grow to $2.7 trillion by 2040.

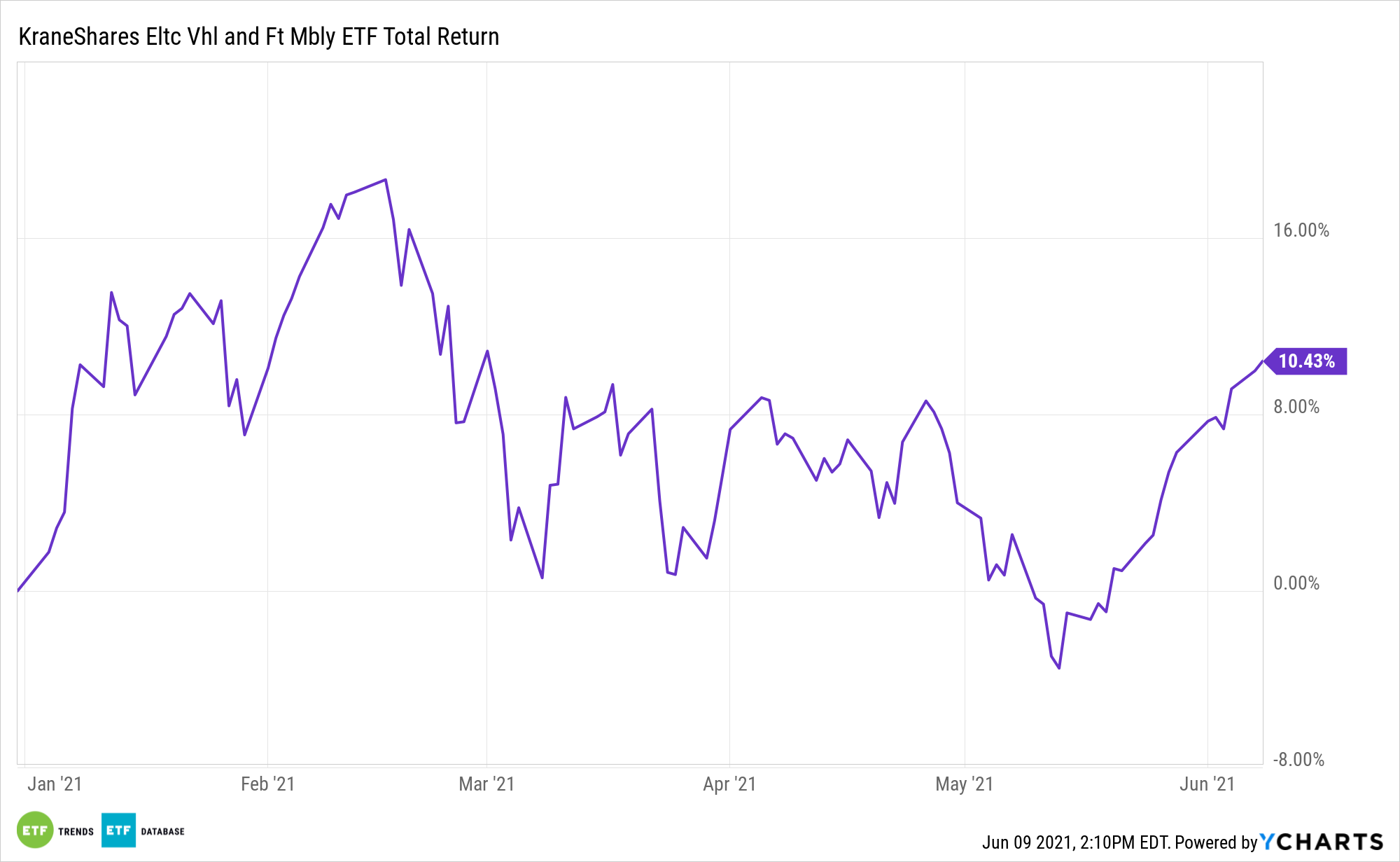

The KraneShares Electric Vehicles and Future Mobility ETF (NYSE: KARS) measures the performance of the Solactive Electric Vehicles and Future Mobility Index, an index that tracks companies that manufacture electric vehicles or parts as well as companies that are pushing to change the future of travel.

KARS has a allocates 39% of its portfolio to consumer discretionary stocks, nearly 34% to information technology stocks, with another 11% in industrials, 8% in materials, and 6% in communication services.

KARS, which has net assets under management of $206 million, has seen $108 million in net inflows year-to-date.

For more news, information, and strategy, visit the China Insights Channel.