Growing awareness and recent warming trends have seen companies shifting their environmental efficiency standards, as well as investing in new carbon credit trading, according to the Wall Street Journal.

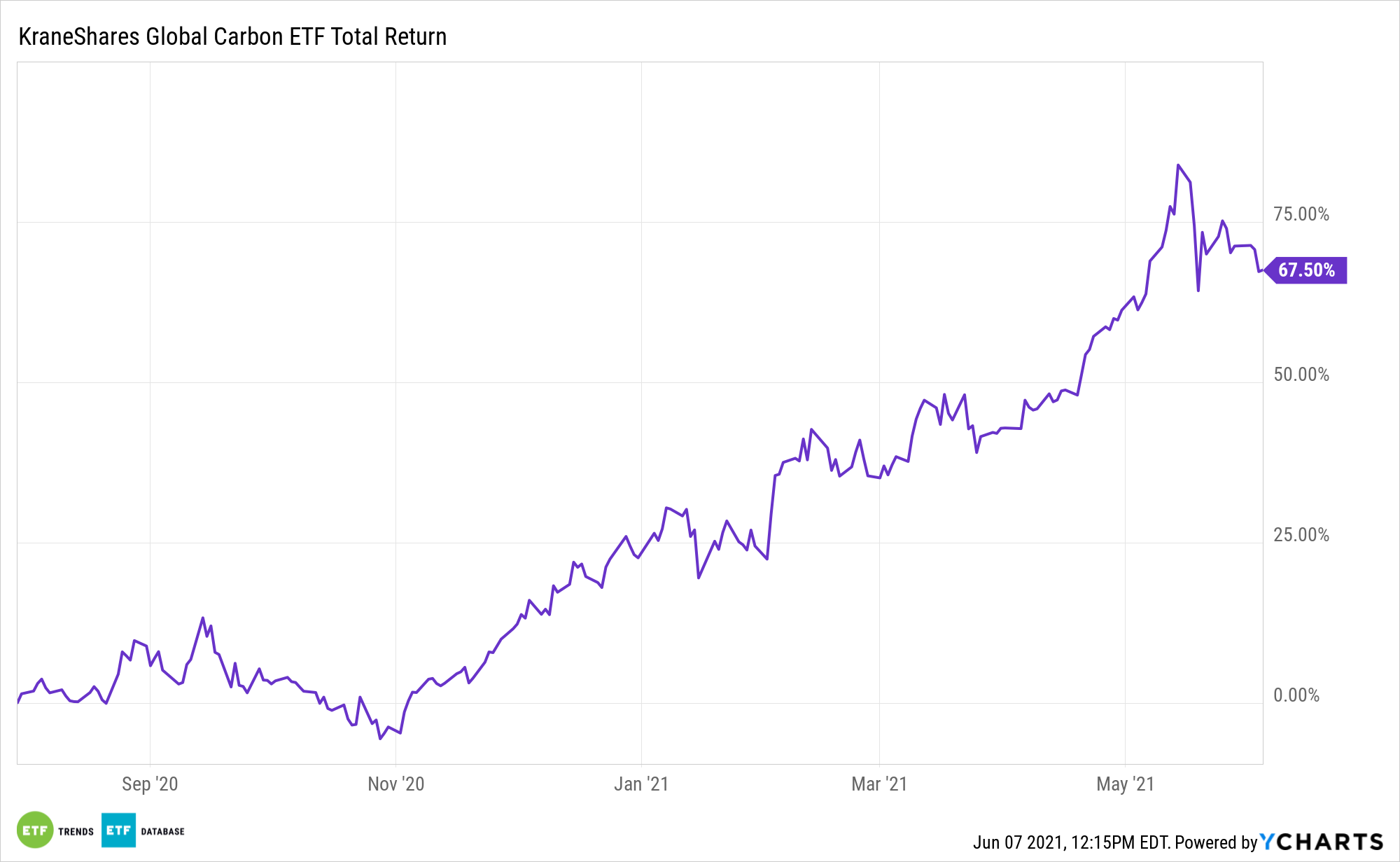

That could be good news for the KraneShares Global Carbon ETF (NYSE: KRBN), which tracks the newly flourishing carbon credits market.

Carbon Credit Growth Is Exponential

Investors are moving to the newly created emissions-trading market as global pressure and an increasing focus on ESG within companies gains traction.

In Europe, the carbon credit trading funds market was one of the top-performing commodities-related markets of the past year, surpassed only by lumber.

European carbon credit prices have increased 135% in the past 12 months and have been hitting record highs, as lockdowns begin to ease from the pandemic.

Low inventories of liquid gas, a harsh winter in Europe, and tighter governmental controls all contributed to the increasing prices.

The Intercontinental Exchange, a host to U.S. and European emissions trading, said the number of investors has increased by 85% between 2017 and 2020. Open interest on European emissions contracts specifically hit a record of $105 billion in May 2021.

Carbon credit prices rise as demand increases from companies that use them to offset their carbon emissions. But they also rise when investors bid and increase the price. This in turn makes it more expensive for carbon-producing companies to buy the credits, thereby providing financial pressure for them to reduce their emission output directly.

KraneShares chief operating officer Jonathan Shelon told the WSJ that “demand has grown steadily from both retail investors and professionals who see the investment as a way to profit from tighter regulation and investor pressure on companies to reduce carbon emissions.”

KRBN: A Way to Invest in the Future

The KraneShares Global Carbon ETF (NYSE: KRBN) tracks the global carbon credits market.

Using the IHS Markit’s Global Carbon Index as a pricing benchmark, the fund tracks the most traded carbon credit futures contracts and “offers for broad coverage of cap-and-trade carbon allowances” per the KraneShares website.

KRBN covers the primary European and North American cap-and-trade programs. Contracts from the European Union Allowances comprise 69% of the fund, while contracts from the California Carbon Allowances comprise 14%. The rest of the exposure is made up of 3 other smaller carbon allowance futures contracts.

The total annual expense ratio for KRBN is 0.79%.

For more news, information, and strategy, visit the China Insights Channel.