With advisors focused on rapidly rising interest rates, they are highly interested in safety, and in protecting the downside of their fixed income exposure. But thanks to the Federal Reserve’s efforts to tame inflation, these lower-risk ETFs offer higher yields than before.

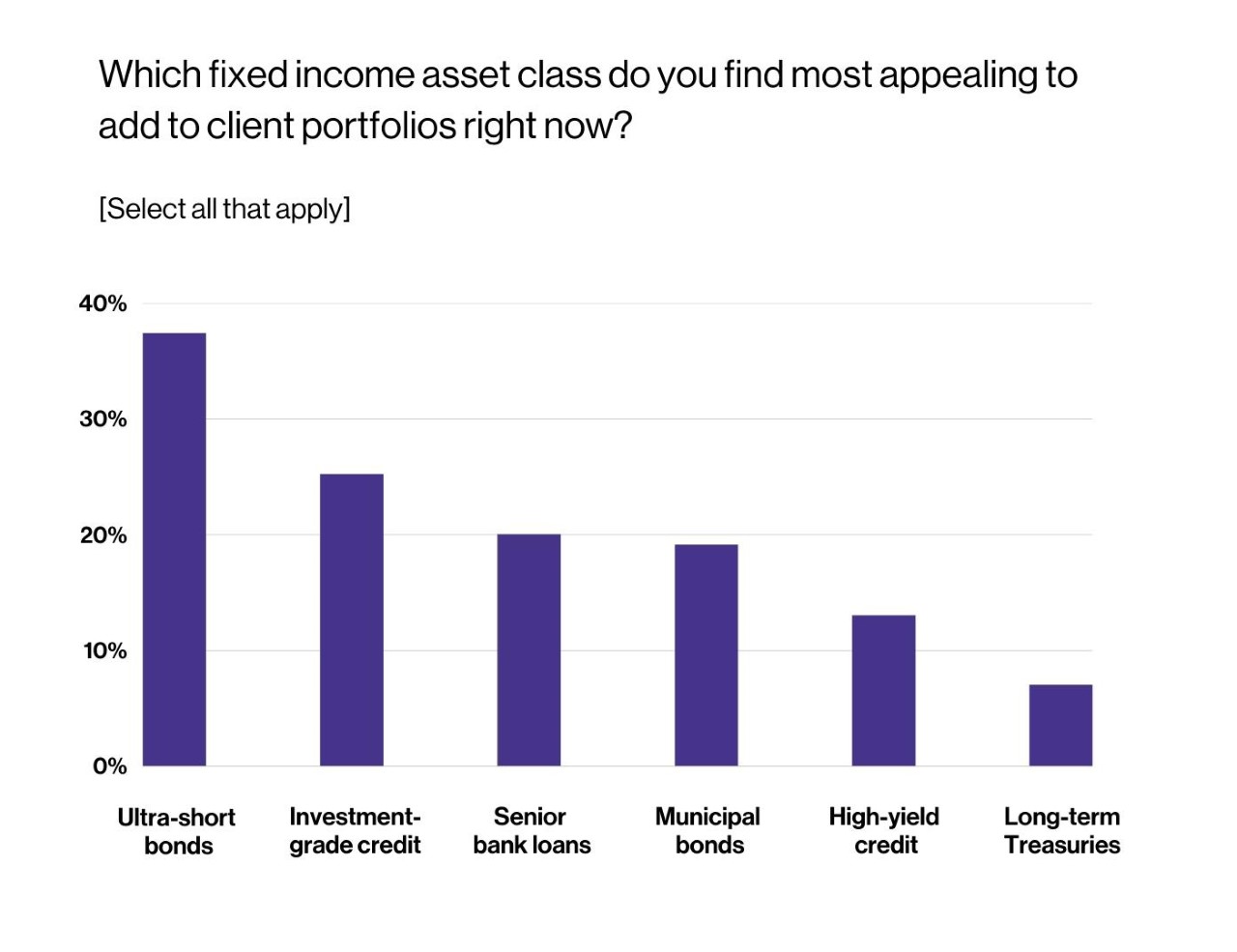

During a webcast with State Street Global Advisors in early October, VettaFi asked advisors, “Which fixed income asset class do you find most appealing to add to client portfolios right now?” allowing respondents to choose all the options listed that apply. Ultra-short bonds (37%) were the most popular, followed by investment-grade credit (25%), senior bank loans (20%), and municipal bonds (19%). High-yield credit (13%) and long-term Treasuries (7%) were also available selections.

Ultra-short bond ETFs invest in bonds with less than one year of maturity, which provides protection from the negative impact of rising interest rates on the bonds. With bond funds, duration is the metric most cited to discuss the interest rate risk. Duration is measured in years, and generally, the higher the duration of a bond or a bond fund — meaning the longer you wait to pay coupons and return of principal — the more its price will drop as interest rates rise.

There are many ultra-short bond ETFs worth consideration and that have the liquidity many advisors are seeking. But first, investors need to decide if they want a lower-cost index-based approach or a slightly more expensive, active ETF.

The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the iShares Short Treasury Bond ETF (SHV) are the two largest ultra-short bond ETFs, and both are index based Treasury ETFs. The $25 billion BIL has an average duration of 0.13 years but a 30-day SEC yield of 2.4%, while the $24 billion SHV has an average duration of 0.29 years and a yield of 3.0%.

Other index-based ultra-short bond ETFs available are the Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) and the iShares 0-3 Month Treasury Bond ETF (SGOV).

Meanwhile, we have seen advisor interest in actively managed fixed income ETFs. The JPMorgan Ultra-Short Income ETF (JPST) and the PIMCO Enhanced Short Maturity Active ETF (MINT) are a few such examples that invest in more than just AAA-rated Treasury bonds. The $22 billion JPST’s average duration is also 0.29 years, identical to SHV, but sports a yield of 3.2%, despite a slightly higher expense ratio of 0.18% (0.15% for SHV).

The $11 billion MINT also recently had a 3.2% yield but a slightly higher average duration of 0.45 years and a slightly higher expense ratio of 0.35%. Both ETFs incorporate short-term investment-grade corporates and mortgages with hefty stakes to A- and BBB-rated securities in exchange for higher income generation than Treasury-based funds.

However, the management of these funds has the flexibility to shift exposure to reflect where they see the best risk-reward opportunities.

Other established active ETFs include the Invesco Ultra Short Duration ETF (GSY), the PGIM Ultra Short Bond ETF (PULS), and the Vanguard Ultra-Short Bond ETF (VUSB). Meanwhile, Alliance Bernstein was one of the latest asset managers to bring some of its best ideas into the ETF market. The AB Ultra Short Income ETF (YEAR) began trading a few weeks ago and has $150 million in assets.

The ultra-short bond ETFs provide a yield less than the 5%-plus sported by the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) and the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) that were part of the investment-grade corporate bond style second most popular with advisors according to VettaFi.

Yet, more conservative ETFs like BIL and JPST have held up much better in this rising rate environment of 2022 as they are far less sensitive to Fed policies. Advisor interest in ultra-short fixed income ETFs stems from the funds’ relative safety and ability to provide a modest income.

For more news, information, and strategy, visit VettaFi.com.