By Derek M Horstmeyer

Investors are displaying a tendency to over-react to news which has never historically been seen before.

Financial researchers have known for decades that investors tend to under-react to news. This shows up in everything from earnings announcements, stock recommendations, analyst reports and ultimately leads to momentum in stock prices. Yet, for the first time ever, since we have emerged from the 2008 crisis, investors are displaying a new form of behavior – over-reacting to big moves in the stock market.

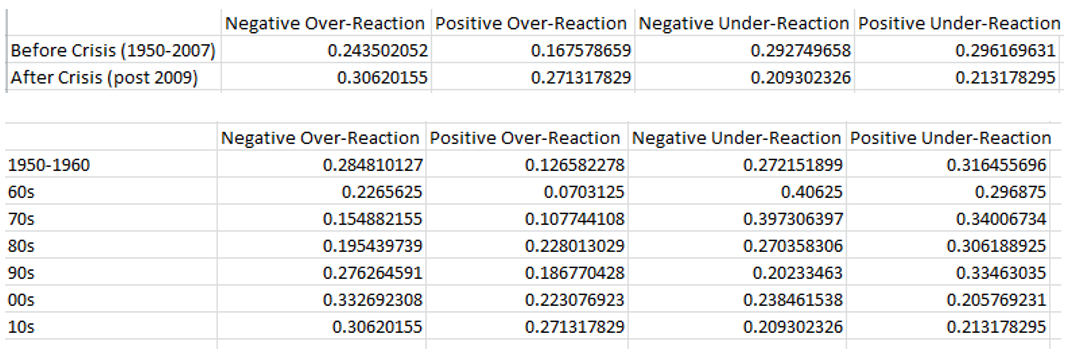

Investigating daily returns for the past 60 years (S&P 500 returns) shows an interesting pattern of investor behavior: Between 1950 and 2007, on 601 occurrences the S&P moved at least one percent in some direction followed by moving the opposite direction in the subsequent day at least half a percent. This denotes a classic over-reaction to news. Contrary to this, between 1950 and 2007, on 851 occurrences the S&P moved at least one percent in some direction followed by moving the same direction in the subsequent day at least half a percent. This is a classic under-reaction to news.

![]()

This signals that investors tend to under-react as opposed to over-react with close to a 60/40 split. Yet, following the 2008 crisis this has completely shifted in the opposite direction with nearly a 40/60 split favoring over-reactions: 149 over-reactions and 109 under-reactions. This result holds no matter how you condition the statement or if you become more/less strict with how you categorize an over-reactions and under-reactions (in terms of percentage thresholds).