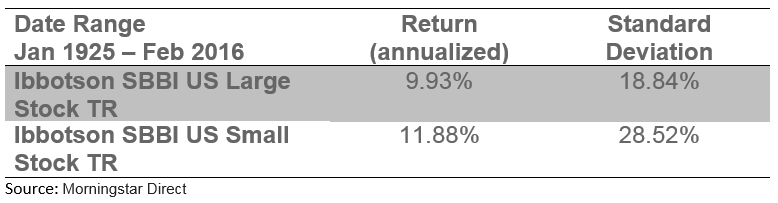

The downside, however, is that higher returns are coupled with higher risk. Many smaller companies will never become large companies, and many will die along the way. During periods of market turbulence, small caps tend to have higher volatilities and drawdowns than their large cap cousins.

With both the upside potential and downside risks in mind, Swan Global Investments has recently applied the Defined Risk Strategy to small cap stocks. Since 1997, Swan has successfully remained invested in large cap companies while mitigating the downside risks via the intelligent and efficient use of options. Conceptually, the Defined Risk Strategy can be applied to any asset class with an investable exchange traded fund (ETF) and liquid enough options on the ETF, whether S&P 500, emerging markets, foreign developed markets or others. Applying the DRS to other asset classes is explored in detail in the recent white paper “Diversifying with the Defined Risk Strategy.”

No one knows what companies or industries might be born, evolve, or dominate our economy over the next ten or twenty years. Twenty years ago most people wouldn’t have been able to conceive of social media, the iPhone or Amazon Prime, yet today many people couldn’t imagine life without them. With small cap stocks, investors have early exposure to the leaders of tomorrow.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.

Important Notes and Disclosures:

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®). All data used herein; including the statistical information, verification and performance reports are available upon request. The S&P 500 Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.swanglobalinvestments.com. 059-SGI-031516