As the capital markets were in the thick of the extended bull run that peaked in the summer prior to the October sell-offs, high-yield assets saw an influx of investor capital, beating out their higher-rated rivals in investment-grade corporate bonds. After investors got washed through the October volatility cycle, that may have tamped down their risk-on sentiment and this is where Goldman Sachs sees a potential buying opportunity after investment-grade debt fell out of favor during the bull run.

As corporate earnings for much of 2018 were largely positive, it made servicing debt, investment-grade in particular, easy. With investors hungry for risk, the yields in investment-grade corporate bonds weren’t enough to satiate that appetite.

“In the investment-grade space, particularly the first half of the year, a lot of LBO (leveraged buyout) and M&A (mergers and acquisitions) activity, a little bit of increase in leverage at a time when debt services are extremely easy to make and earnings are really good,” said Michael Swell, managing director at Goldman Sachs Asset Management. “And so, it’s not a significant risk factor. The investment-grade market is actually the one that’s seen weakness over the course of the entire year and we think that’s an opportunity.”

After the downpour of volatility in October, investors may now be ready to seek refuge under the umbrella of investment-grade corporate bonds again. As a result, high yield has underperformed lately as investors flocked to the safer confines of investment-grade debt issues.

“While in high yield there’s a little bit of an opportunity because they’ve underperformed recently, you’ve had a supply shock in the first half of the year in investment grade and you’ve had the opposite happen in the second half of the year where supply has declined,” added Swell.

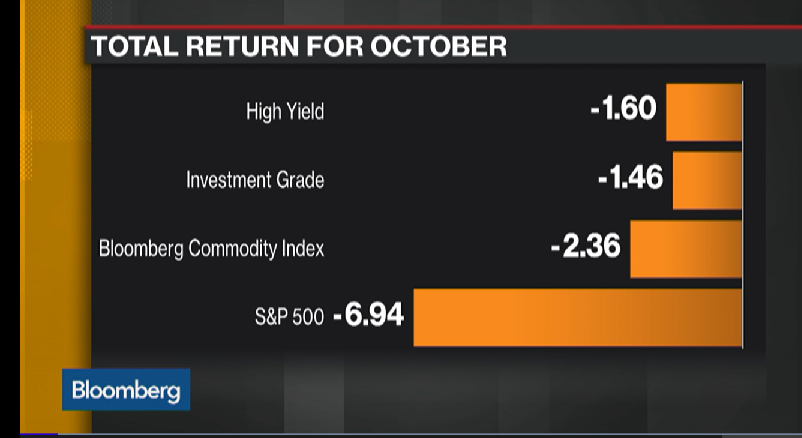

While it’s notable that both high-yield and investment grade took a hit during October, investment-grade was able to nullify the volatility better as evidenced in the chart below:

Investment-Grade Options

Investment-grade corporate bond-focused fixed-income ETF options include the iShares Intermediate Credit Bond ETF (NASDAQ: CIU), iShares iBoxx $ Invmt Grade Corp Bd ETF (NYSEArca: LQD) and Vanguard Interm-Term Corp Bd ETF (NASDAQ: VCIT).