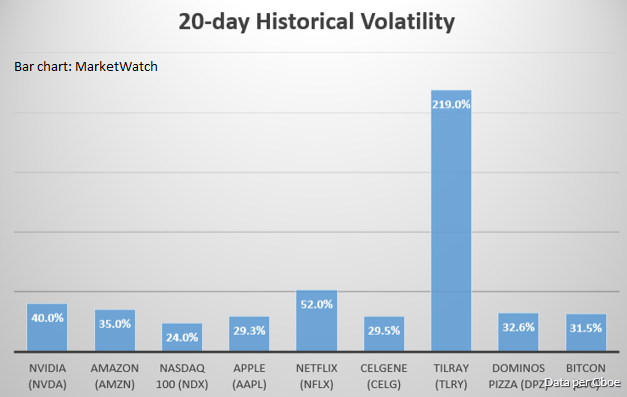

As the Dow Jones Industrial Average gives investors another roller coaster ride of volatility today, Bitcoin in the meantime has been exhibiting stability as of late with its price little changed in the last 24 hours, falling just 0.77%, while the Dow is down 100 points as of 12:00 p.m. ET. Based on the 20-day historical volatility metric, the leading digital currency is right there with some of the top tech names, such as Amazon, Apple and Netflix.

To the general public, Bitcoin as a stable investment is a notion that is far-fetched, particularly after its rise in late 2017 to $20,000 and its subsequent fall in value by as much as 70% in 2018. However, its movement as of late has been on par with the tech stocks that helped to fuel the historical bull market run.

“A one standard deviation move for bitcoin at present is about $475,” wrote Kevin Davitt, a senior instructor at The Options Institute at Cboe. “That works out to +/- 7.3% (475/6500). Compare that to earlier this year (mid-January) when bitcoin was around $11,000. Back then the standard deviation measured $4640 or +/- 42%.”

While the decreased volatility may stave off short-term traders hungry for price action, it could be a welcome thought for legacy investors affixed to a buy and hold strategy. Of course, for long-term Bitcoin investors, this could be viewed as a positive as price stability could attract more investors.

While the decreased volatility may stave off short-term traders hungry for price action, it could be a welcome thought for legacy investors affixed to a buy and hold strategy. Of course, for long-term Bitcoin investors, this could be viewed as a positive as price stability could attract more investors.

“Perhaps we are witnessing the maturation of a market. It’s far too early to declare this the “new normal” but the persistent range over the last few weeks may be hinting at a structural shift. Time will tell,” wrote Davitt.

Fidelity Jumping into the Cryptocurrency Space

Fidelity is getting into the digital currencies game as the 72-year-old investment firm with more than $7.2 trillion in client assets announced today that it’s launching Fidelity Digital Asset Services, LLC, which will offer enterprise-quality custody and trade execution services for cryptocurrencies to sophisticated institutional investors such as hedge funds, family offices and market intermediaries.

Related: The Key to The First Bitcoin ETF

While the new company won’t cater to retail investors, it’s still a big step forward for digital currencies as Bitcoin and other cryptocurrencies are struggling to gain wider public adoption. In a bid for legitimacy via government regulation, the Securities and Exchange Commission has already rejected nine applications for Bitcoin exchange-traded funds, but is open for comments from investors on pending applications until later this month.