Microsoft recently announced a new partnership with Volt Energy, as the tech giant continues on its trek to convert all energy usage to renewable sources by 2025, CNBC reports. As a solar energy development firm, Volt Energy will work with Microsoft, with both companies using profits to bring carbon neutral electricity to underserved communities in the U.S.

While sustainability is one of the easiest and hottest topics discussed in the ESG umbrella, other important topics like racial and social justice rank just as highly. In reality, racial injustice and environmental injustice go hand in hand, with underserved communities often being some of the hardest hit by environmental impacts, and with the least amount of access to sustainable options.

Microsoft has found a way to marry the two in this partnership with Volt Energy, a Black-owned business in the energy sector, and while the actual purchase may be small in scale (250 megawatts of solar power), the impact is mighty. Through the contracted deal between the two companies, an agreement was made that a portion of profits would be allocated to developing renewable energy sources in communities that are traditionally underserved.

“It is critically important that clean energy infrastructure and economic development investments are made in underserved minority and rural communities that have been disproportionally impacted by environmental injustices and lag behind in the health and financial benefits of the thriving clean energy economy,” said Volt Energy’s co-founder and CEO Gilbert Campbell in a statement. “It is equally important to provide access to the business and job creation benefits of the clean energy movement.”

Microsoft continues to be an industry leader in its ESG approach and structuring. In addition to its goal of using 100% renewable energy by 2025, it has also pledged by 2050 to remove all carbon that the company has directly and indirectly emitted since its foundation in 1975.

“This is another example of them continuing to push the boundaries of what environmental leadership and leadership overall looks like for companies,” said Alison Omens, chief strategy officer at JUST Capital, an ESG research specialist. “Microsoft is doing a good job of thinking about the connection point between equity and environmental justice. We cannot think about these things in silos.”

‘PLDR’ Invests in ESG Industry Innovators

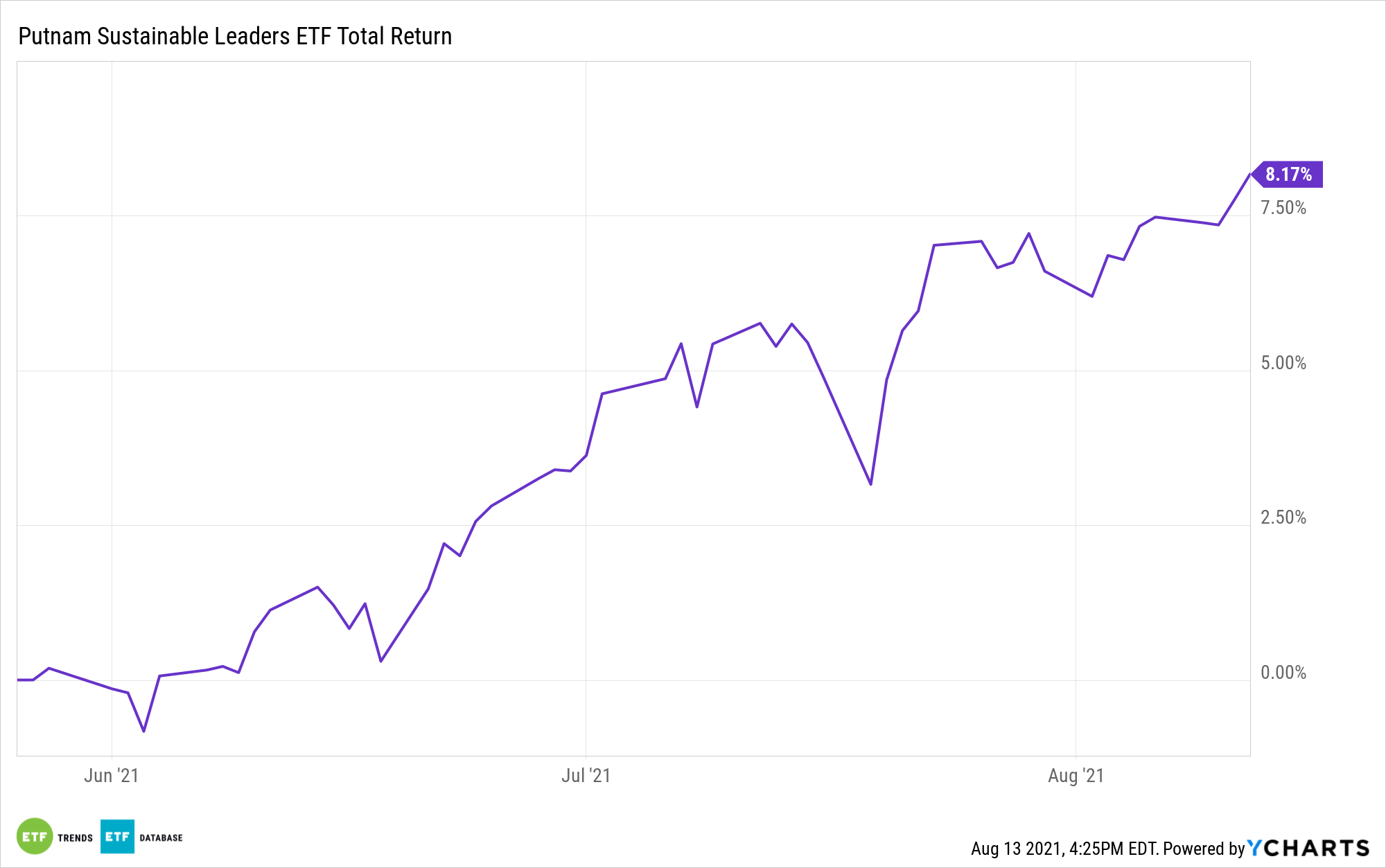

The Putnam Sustainable Leaders ETF (PLDR) invests in companies whose focus on ESG issues goes well beyond just basic compliance. These companies, like Microsoft, have transparent goals and provide consistent, measurable progress updates.

PLDR invests larger percentages of its portfolio in fewer stocks, and the companies invested in by PLDR exhibit creative, proactive leadership in the sustainability issues that create long-term success, both for the company itself and the community as a whole.

As a semi-transparent fund using the Fidelity model, PLDR does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

Holdings as of the end of June included Microsoft Corp. at 8.45%, Apple at 7.08%, and Amazon.com at 5.26%. The fund was heavily allocated to information technology stocks (31.84%), followed by healthcare at 15.27% and consumer discretionary at 14.96%.

PLDR has an expense ratio of 0.59%.

For more news, information, and strategy, visit the Big Ideas Channel.