One of the original environmental, social, and governance (ESG) advocates is eagerly anticipating regulations within the ESG industry that would eliminate the false narratives that some fund managers are creating within the $35 trillion industry, reports Bloomberg.

Trillium Asset Management’s CEO Matt Patsky got his start in ESG-style investments back in the 90s before anyone was really even investing in the sector, and believes that today there are very few funds which actually reflect sustainable investing. In 1994, Patsky was the first to introduce a “green-chip” index that contained socially responsible companies.

Patsky welcomes the attention by regulators into the industry, saying, “It brings scrutiny to an area that’s become the wild west, where fund managers have discretion to slap ESG labels on anything.” Patsky firmly believes that unless a firm is interacting with the companies it is investing in and pushing them to increase their ESG practices, the fund in question is not an actual sustainability fund.

Regulation is starting to roll through the industry globally; Europe enacted its Sustainable Finance Disclosure Regulation in March, which cuts back on greenwashing and requires actual data to back claims. In the U.S., the SEC is looking at ESG data reported by companies and is considering requirements and consequences for inaccurate claims.

Patsky considers a fund to be authentically ESG if there is pressure on the corporate executives to change behavior and extend sustainability practices, shareholder resolutions filed on the end of investors, and also voting on those resolutions filed by others.

“Unless that happens, most of ESG will largely be ineffective in quickly addressing systemic issues,” Patsky said.

Putnam Engages With Companies, Digs Into Data

Putnam believes in sustainability and holds ESG practices as a core aspect of its investment approach. Its ESG-focused active sustainability managers are a fundamental part of its work to align shareholder ESG values with investment practices by engaging directly with the companies invested in about their ESG fundamentals and practices.

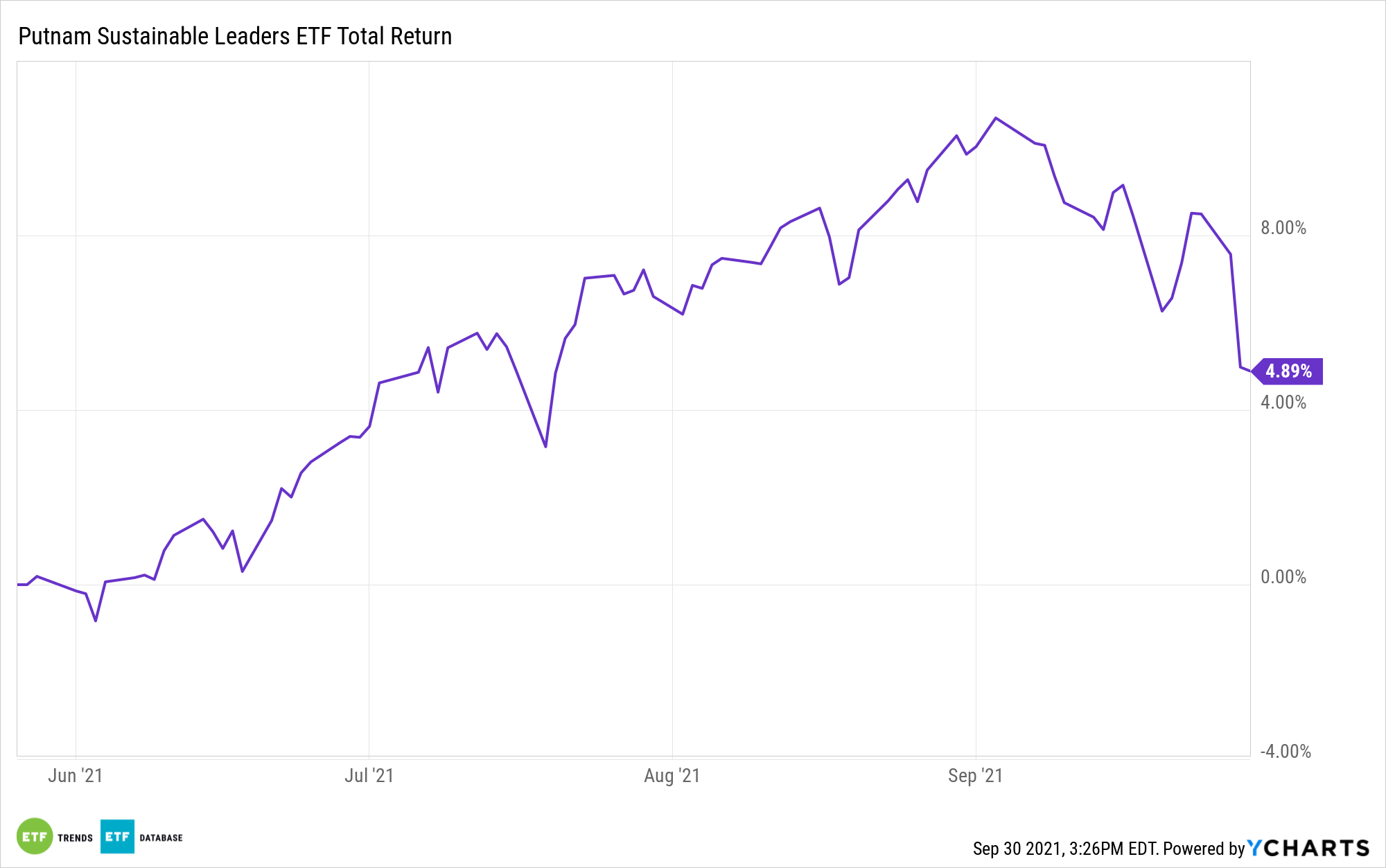

The Putnam Sustainable Leaders ETF (PLDR) invests in companies whose focus on ESG issues goes well beyond just basic compliance and for whom ESG is an integral part of their long-term success. These companies have transparent goals and provide consistent, measurable progress updates.

As a semi-transparent fund using the Fidelity model, PLDR does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

Holdings as of the end of August included Microsoft Corp. at 8.28%, Apple at 7.38%, and Amazon.com at 5.01%. The fund was heavily allocated to information technology stocks (32.41%), followed by healthcare at 15.91% and consumer discretionary at 14.61%.

PLDR has an expense ratio of 0.59% and has 60 holdings as of the end of August.

For more news, information, and strategy, visit the Big Ideas Channel.