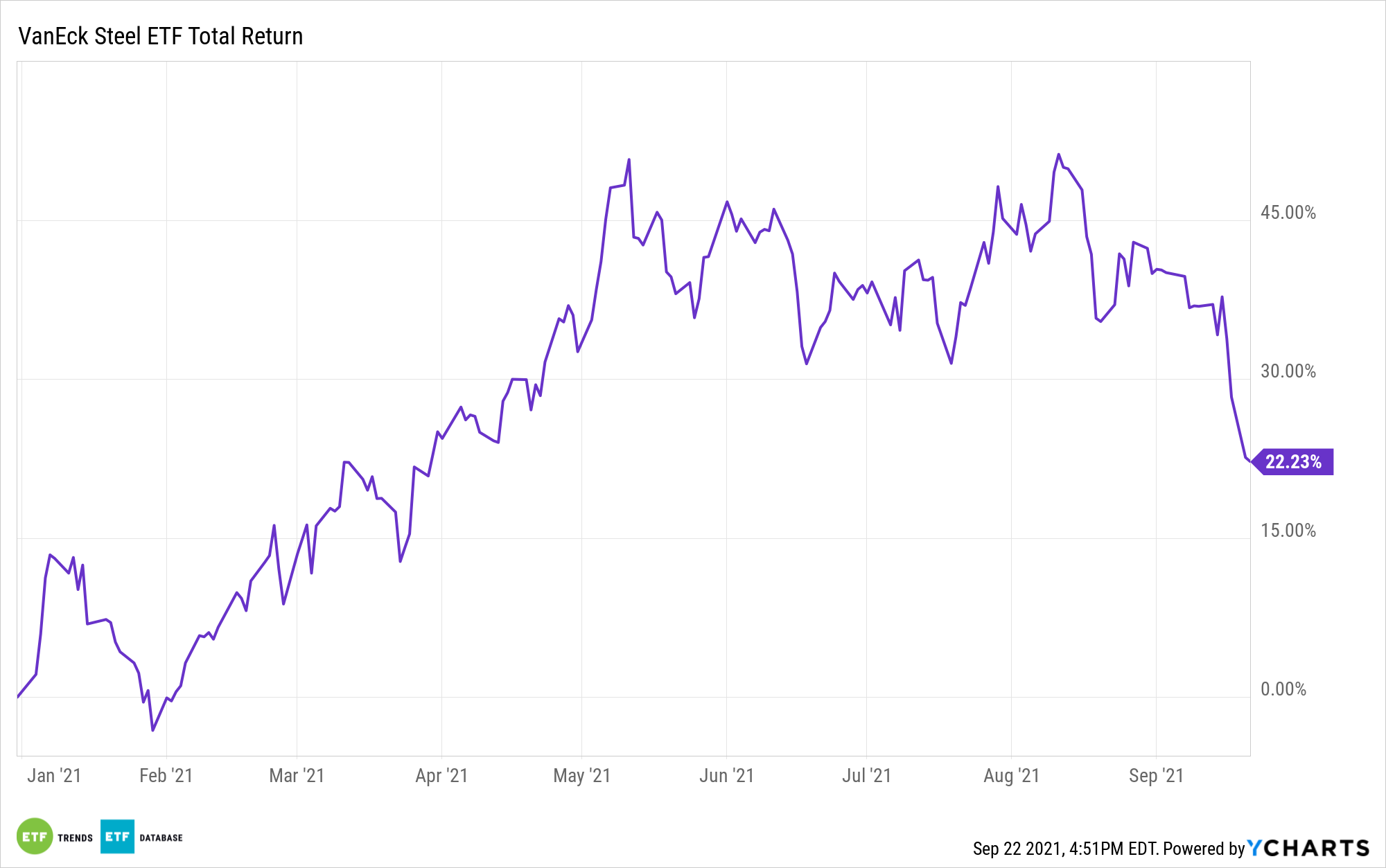

On news that China is curbing steel output for the remainder of the year, iron ore prices tumbled last week, taking the VanEck Vectors Steel ETF (SLX) along for the ride.

Over the past week, SLX is lower by nearly 9%. Obviously, that’s a glum performance, but some market observers believe that the recent slide endured by iron ore prices is disconnected from fundamentals. That could be a sign that SLX offers near-term rebound potential.

“The main factor behind the price slump has been moves by China, which buys about two-thirds of global seaborne iron ore, to cut steel output in the second half of 2021, in order to ensure that full-year production doesn’t exceed the record 1.065 billion tonnes from last year,” reports Clyde Russell for Reuters.

The $156.8 million SLX, which tracks the NYSE Arca Steel Index, turns 15 years old next month and is home to 26 stocks and, yes, that includes some iron ore names such as Rio Tinton (NYSE:RIO) and Vale (NYSE:VALE), among others.

SLX’s iron ore exposure is a give and take proposition for investors considering the fund. Earlier this year, the fund furiously rallied amid crimped iron ore supplies, but that situation is evening out, perhaps contributing to the fund’s recent malaise.

“Iron ore supplies, meantime, have improved in recent months after the earlier weather disruptions in top exporter Australia and coronavirus outbreaks in number two shipper Brazil,” according to Reuters.

While iron ore supplies are being replenished and China is reducing steel output to curb pollution (steel production is notoriously carbon-intensive), those factors don’t mean that SLX should be ignored. In fact, global iron ore imports are slated to rise this month.

“September is likely to see even stronger imports, with Refinitiv vessel-tracking data estimating as much as 111 million tonnes will be landed this month, and commodity consultants Kpler being even more bullish with an estimate of 116.6 million,” notes Reuters.

Two of the largest iron ore-producing countries, Brazil and South Africa, are poised to up output to meet rising demand. That’s impressive given the situation in China and relevant to investors considering SLX because Brazilian stocks account for almost 21% of the VanEck ETF’s roster. Only U.S. stocks have a larger weight at 36%.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.