As fears of an overheating economy linger, many ETF investors are seeking steady options that hedge against inflationary risk. Two VanEck assets to consider are the VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) and the VanEck Vectors EM High Yield Bond ETF (HYEM).

As the federal government continues to pump dollars into the economy to stem the economic tide of the pandemic, ANGL and HYEM offer substantial upside.

“Rates have obviously been on people’s minds. That’s subsided over the past few weeks, but there was a period of time where that was a real headwind,” said Ed Lopez, VanEck’s Head of ETF Product.

“Investors are looking for asset classes within fixed income that are going to do well in a reflationary environment” added Lopez. “That’s high yield and EM. Rates are going up for a reason, and it’s not a taper tantrum but higher growth.”

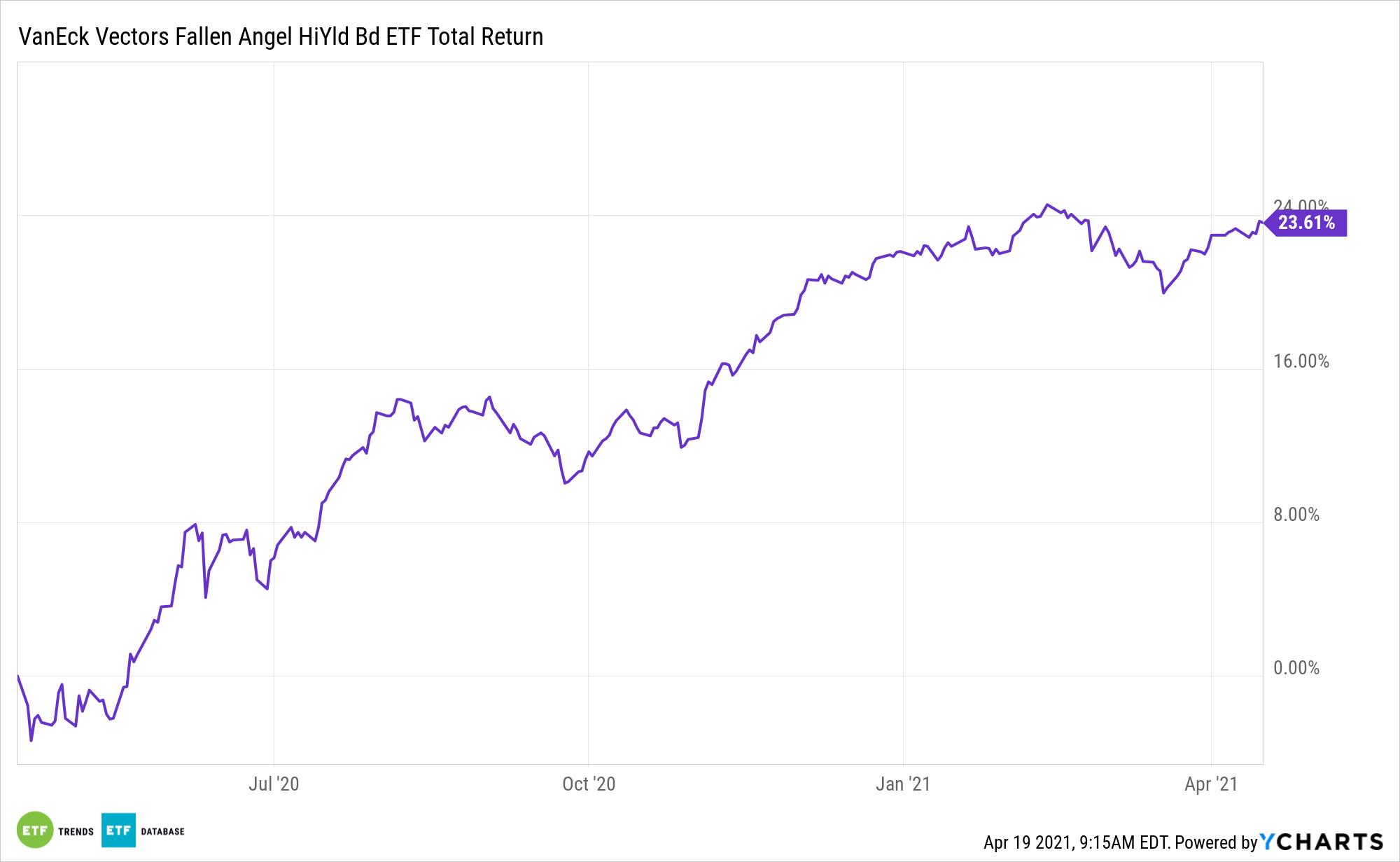

ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

The fund focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status.

ANGL gives investors exposure to:

- Higher-Quality High Yield: Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe.

- Outperformance in the Broad High Yield Bond Market: Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years.

- Higher Risk-Adjusted Returns: Fallen angels have historically offered a better risk/reward trade off than found with the broad high yield bond market.

- Low Cost: ANGL’s 0.35% expense ratio, falls below its categorical average.

An Emerging Markets Bond Play

HYEM seeks to replicate the ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index, which is comprised of U.S. dollar-denominated bonds issued by non-sovereign emerging market issuers that have a below investment grade rating and that are issued in the major domestic and Eurobond markets.

HYEM:

- Focuses solely on the non-sovereign segment of the high yield emerging markets bond market.

- Currently has lower average duration compared to high yield U.S. corporate bonds.

- Boasts lower historical default rates than high yield U.S. corporate bonds.

For more news and information, visit the Beyond Basic Beta Channel.