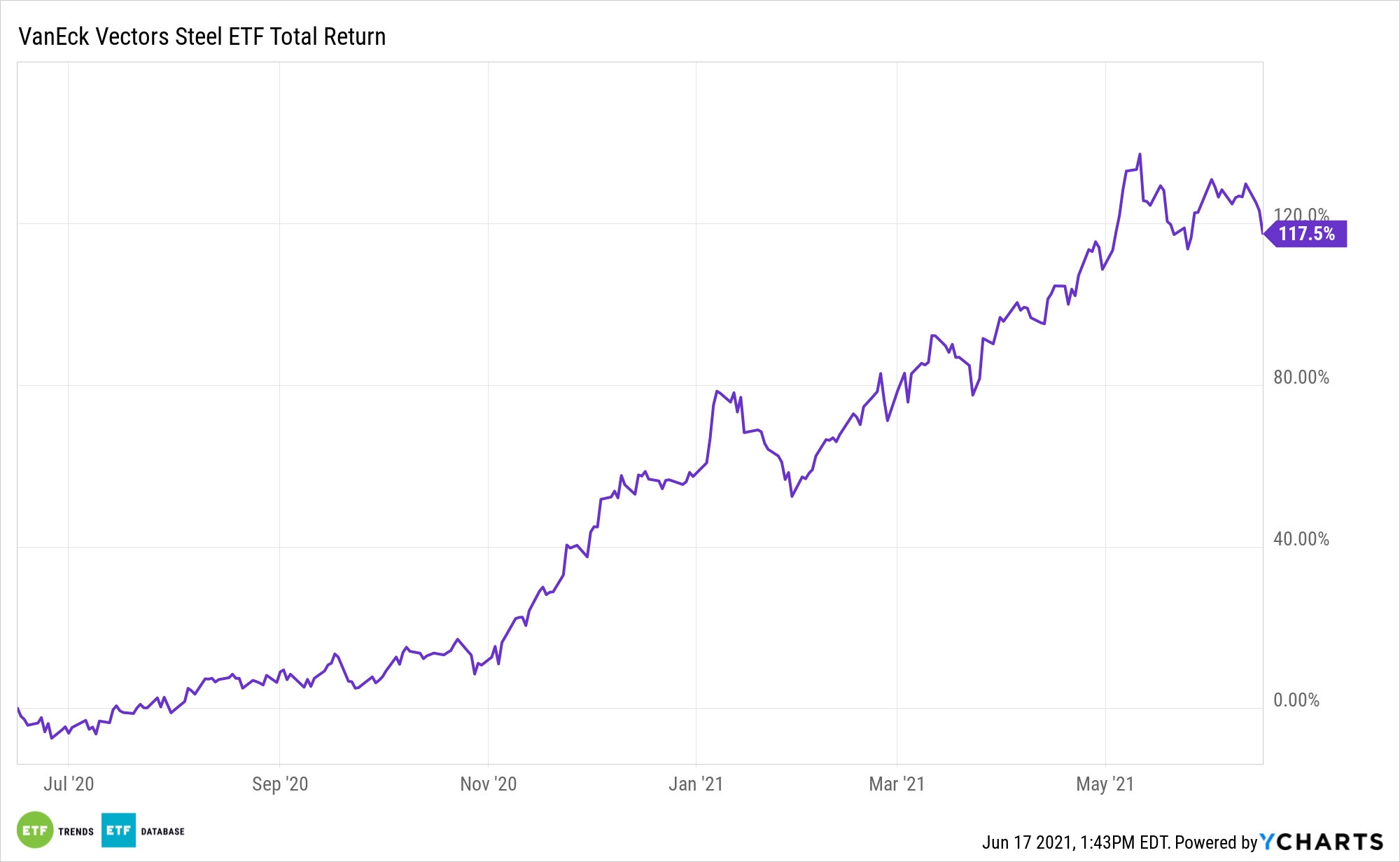

Supported by resurgent cyclical stocks, the VanEck Vectors Steel ETF (SLX) is higher by more than 38% year-to-date.

That’s impressive work in less than six month’s time, but it could prove to be more floor than ceiling for the steel exchange traded fund as some analysts are forecasting more upside for some SLX components.

“Even assuming a pullback in pricing beginning in 2H:21, the cash flow windfall provided by prices provides a generational opportunity for integrated steel to de-lever, fund pensions, reposition the businesses for a low-CO2 world and generate returns through the cycle,” said JPMorgan steel analyst Michael Glick in a recent note.

The analyst’s top two steel picks are Cleveland Cliffs (CLF) and Steel Dynamics (STLD), which combine for 8.61% of the SLX roster, according to issuer data.

“Glick set price targets for Cleveland-Cliffs at $39 per share and Steel Dynamics at $107 per share, both roughly 70% above where the stocks closed on Tuesday. The previous JPMorgan analyst who covered Steel Dynamics had a price target of $33 per share for the stock,” reports Jesse Pound for CNBC.

Sizing Up SLX’s Prospects

With the U.S. economy rebounding from the coronavirus pandemic, cyclical stocks are back in style in a big way. While steel stocks reside in the materials sector, SLX is trouncing the broader materials space this year as the S&P 500 Materials Index is up “just” 16%.

Specific to holdings Cleveland-Cliffs and Steel Dynamics, JPMorgan’s Glick sees multiple favorable factors further. In the case of Steel Dynamics, the company’s new flat-roll mill on the Texas Gulf Coast is coming online amid crimped supplies, which could be a boon for the producer. Likewise, Cleveland-Cliffs has a robust automotive business, which could be a plus amid soaring demand for cars and trucks.

The analyst rates both stocks “overweight” and has the same rating on Reliance Steel (NYSE: RS), which is the tenth-largest holding in SLX at a weight of 3.65%.

Another benefit with SLX is that it’s a global fund. U.S. stocks account for 34.24% of its roster. The 24.65% weight to Brazil is relevant today because the fund’s Brazilian components are primarily iron ore producers. The price of that commodity recently shot higher amid strong demand from China.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.