The VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ: ANGL) is a fixed income exchange traded fund with some momentum.

There’s a steady appetite for high-yield corporate debt and some market observers are speculating a host of energy-sector fallen angels could regain investment-grade status due to improving balance sheets and fundamentals in that sector. Both scenarios are positives for the VanEck ETF.

So are falling 10-year yields and the declining yield curve because many fallen angels are longer-term bonds. The VanEck fund has an effective duration of 6.81 years.

“As a result, the flattening of the curve has provided an advantage to fallen angels, which are now on top of the broad high yield market by 1.13% YTD as of 6/30/2021 and 1.87% in Q2 2021, after outperforming by 67bps in April, 3bps in May and 113bps in June,” writes VanEck analyst Nicolas Fonseca. “For Q2 2021, fallen angels returned 4.64% vs 2.77% for the broad high yield market and have returned 4.83% this year through 6/30/2021.”

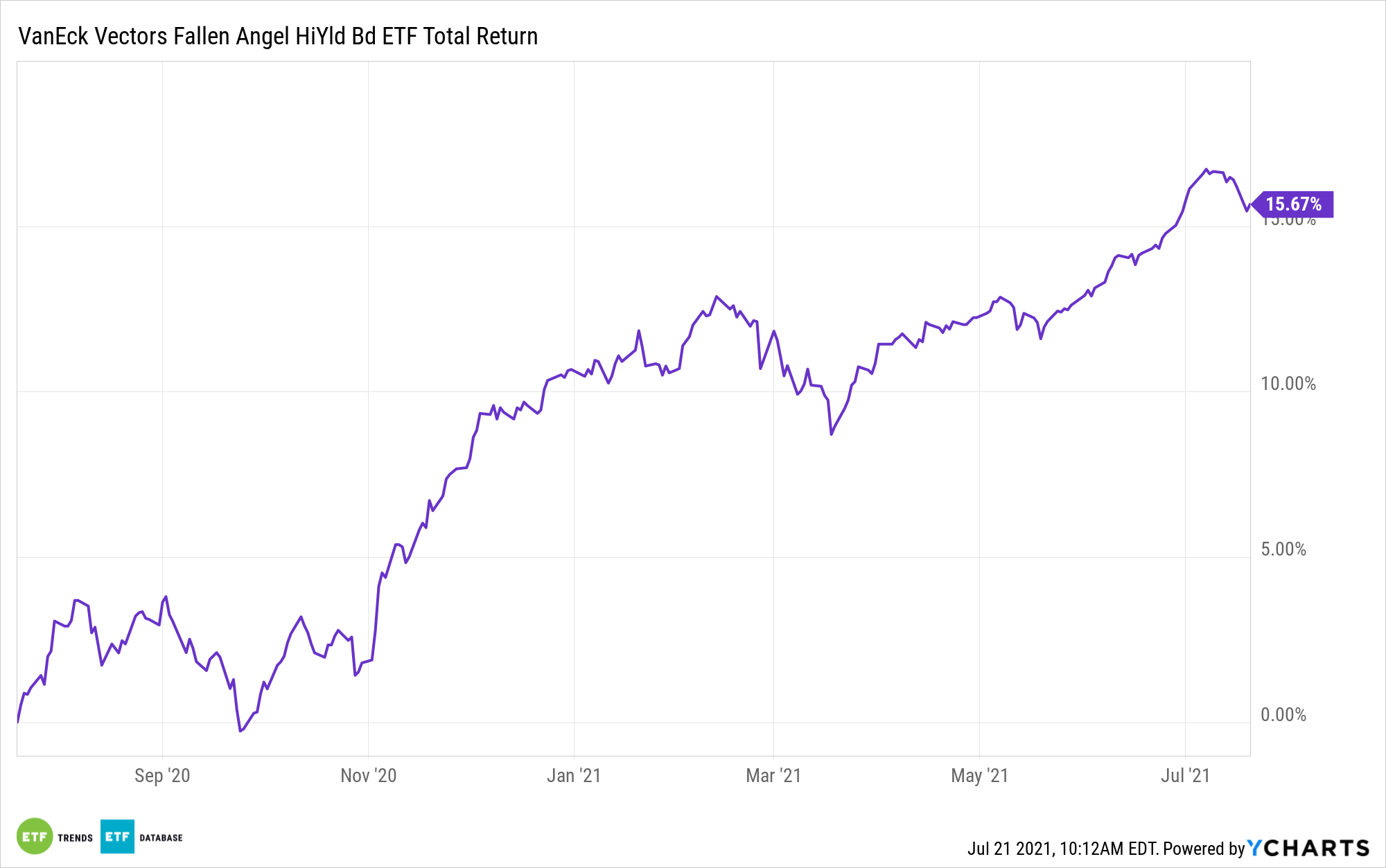

ANGL’s Impressive 2021 Performance

Buoyed by a three-month winning streak over the traditional high-yield corporate bond universe, ANGL is beating that asset class and 10-year yields on a year-to-date basis.

As noted above, ANGL is deriving tailwinds from energy debt that joined the fund last year, confirming the fund’s unconstrained approach is meaningful to investors. While ANGL isn’t an active fund – it tracks the ICE US Fallen Angel High Yield 10% Constrained Index – it doesn’t have to wait extensive periods to add new fallen angels and it levers investors to fallen angels with strong recovery prospects.

“The outperformance by fallen angels over broad high yield in Q2 2021came largely from the newer fallen angels that drove performance last year,” adds Fonseca. “The unconstrained sector approach of the fallen angel index provides differentiated exposure, particularly to the potential recovery of beaten down sectors. The higher allocation to energy (close to 30% since May 2020) is a clear example of this contrarian view.”

Speaking of recoveries and rebounds, the ETF offers the potential for its holdings to regain investment-grade status. Plenty of fallen angels are quite close to doing just that.

“Some sell side shops have recently mentioned that the global economy recovering, higher corporate earnings and robust capital markets may help some of these issuers become rising stars in the coming months. JPMorgan estimates that there are approximately $57B dollars’ worth of BB-rated bonds that are one rating agency action away from regaining investment grade status,” according to Fonseca.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.