With so much talk about environmental, social, and governance (ESG) investing, it’s easy to understand how some investors are glossing over other concepts with environmental implications.

The VanEck Vectors Environmental Services ETF (EVX) is an example of an exchange traded fund that’s in that boat, but it shouldn’t be. It’s not for lack of age because EVX turns 15 years old next week, and while the VanEck ETF isn’t grabbing many headlines, it’s more relevant today than many investors realize.

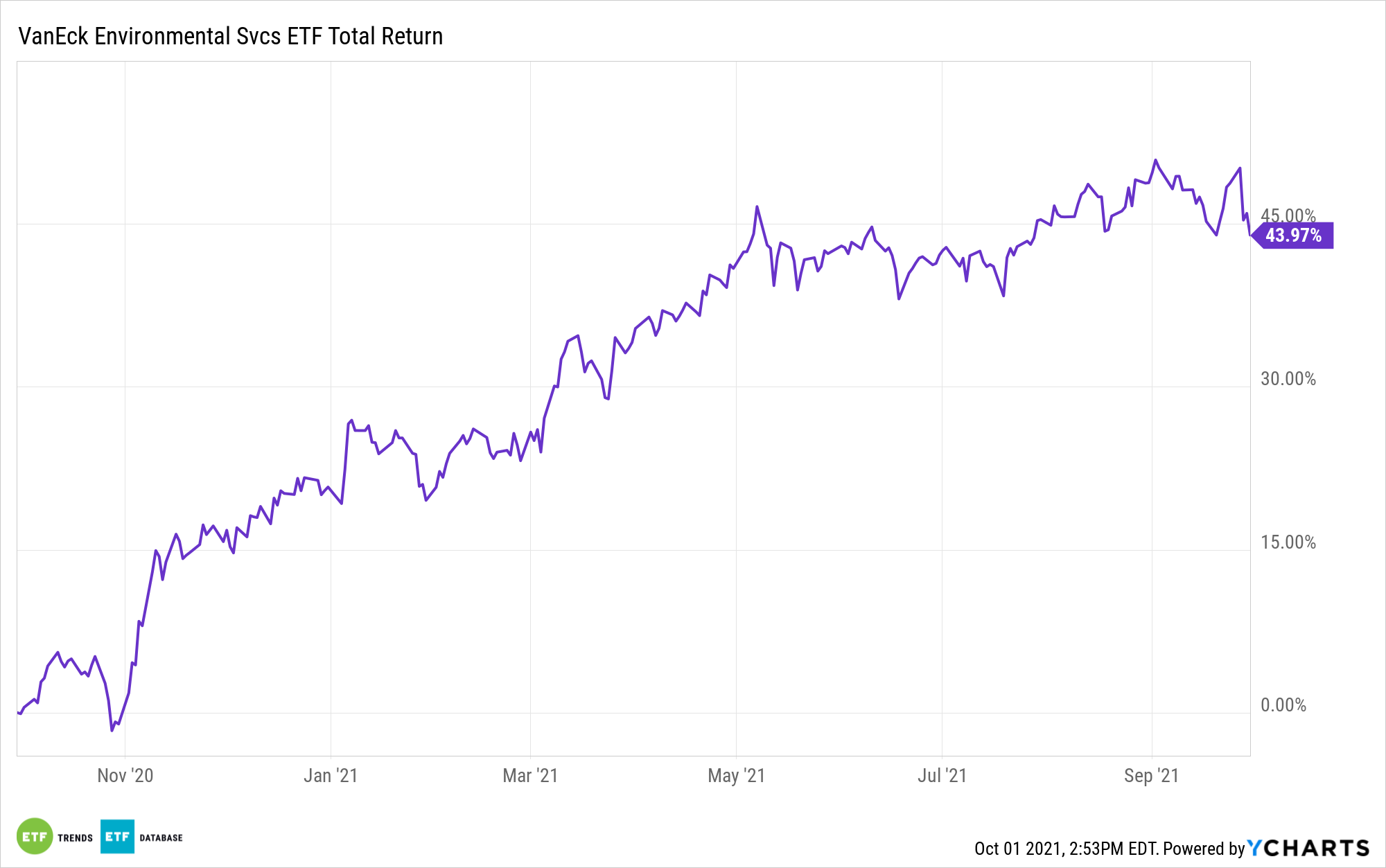

EVX follows the NYSE Arca Environmental Services Index, which features companies engaged in trash hauling, recycling services, wastewater management, and environmental consulting services, among other pursuits. Those aren’t glamorous or sexy industries, but what is captivating about EVX is that it’s up nearly 44% over the past 12 months.

“The environmental services industry represents an integral part of the economy that may be overlooked and under-appreciated by investors,” says VanEck analyst Samir Barjon. “According to VanEck research, the U.S.-listed environmental services opportunity set generated $78.1 billion dollars in 2020, up from $65.8 billion in 2015. Environmental services and waste management companies are those that engage in waste removal, operate landfills and process recycling for a range of customers including individual homes, retail businesses and massive industrial operations.”

EVX allocates over 21% of its combined weight to Republic Services (NYSE:RSG) and Waste Management (NYSE:WSM) — two of the dominant names in trash hauling. Again, that’s not a glamorous business, but it’s one with deep environmental implications. Plus, some EVX components are more forward-thinking and tech-savvy than many investors realize.

“Casella Waste Systems has established the first zero-sort recycling system which helps customers and communities reduce costs and ease participation by placing all recycle materials into a single bin,” says Barjon. “In partnership with AMP Robotics, (Waste Connections) plans to deploy 24 AI-guided robotic systems to recover recyclables reclaimed as raw materials. The technology recovers plastics, cardboard, paper, cans, and many other packaging types reclaimed for raw material processing.”

Waste Connections and Casella combine for 12.1% of EVX’s roster. Additionally, the industry is ripe for consolidation. While some EVX member firms hold dominant market share in their respective segments, some environmental services are fragmented with smaller players making potentially attractive takeover targets.

“Mergers, acquisitions and consolidation activity may give a further boost to revenue and growth to the environmental services industry in the next few years. While a few select names have dominated the majority of market share, there remains many idiosyncratic opportunities in the market, which are seen as growth opportunities for the larger companies,” concludes Barjon.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.