Right now, China is the dominant player in rare earth metals. ETF investors can play this strength with the VanEck Vectors Rare Earth/Strategic Metals ETF (REMX).

“They (rare earth metals) are so special because they have chemical and physical properties that are very useful for a very wide range of technologies,” explained Rebecca Abergel, assistant professor of nuclear engineering at the University of California, Berkeley, and a faculty scientist at the Lawrence Berkeley National Lab, in a Marketplace.org article.

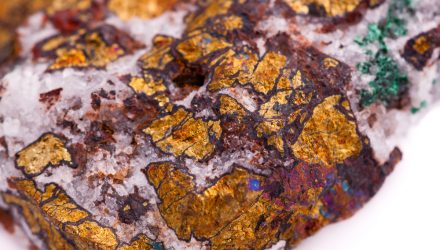

China’s dominance in rare earth metals presented a concern at the height of the trade wars with the U.S., sparking concerns that China could use its strength in the market as leverage. Rare earth metals can be found in smartphones, computers, electric car batteries, and a host of other consumer electronics.

“Chinese mining and processing operations now control about 80% of the world’s global output in processed rare-earth metals,” said Eric Chewning, a partner at consulting firm McKinsey & Co. and former U.S. deputy assistant secretary of defense for industrial policy.

REMX, which is up 21% year-to-date, seeks to replicate the price and yield performance of the MVIS® Global Rare Earth/Strategic Metals Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes companies primarily engaged in a variety of activities that are related to the producing, refining, and recycling of rare earth and strategic metals and minerals. The fund is showing its strength, gaining over 160% the past 12 months.

Can the United States Catch Up?

Earlier this year, U.S. president Joe Biden signed an executive order to review supply chains for critical materials, including rare earth metals.

It certainly won’t be easy.

“For these minerals to go from a hole in the ground to an electric motor, you need vast skills and expertise, which barely exist out of China,” said Constantine Karayannopoulos, chief executive of Neo Performance Materials, one of a few Western companies able to process rare earths and make magnets.

“Many producers will find it difficult to compete head-to-head against China on price without some level of ongoing government assistance,” he added.

For more news and information, visit the Beyond Basic Beta Channel.