Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Nick Peters-Golden discuss the use case for building an international allocation with single-country ETFs.

Elle Caruso, staff writer, VettaFi: Hi Nick! Single-country ETFs are seeing a bit of a low-key revival in 2023 with launches from firms like Matthews Asia, JP Morgan, and Global X. And those ETFs are all actively managed funds. Just last week, Global X rolled out the first active single-country ETFs providing exposure to Brazil and India. I think single-country ETFs can be useful building blocks for creating a customized, dynamic international allocation in portfolios.

Nick Peters-Golden, staff writer, VettaFi: Hi Elle! I respect that point and think they do have some interesting uses. However, for investors looking abroad, it’s clear to me, at least, that multinational ETFs are a better fit for most. Let’s discuss!

Target Desired Exposure with Single-Country ETFs

Caruso: Single-country ETFs allow investors to focus exposure on countries with stronger growth prospects without taking on unrewarded risk. Let’s consider emerging markets. Most broad benchmarks are heavily weighted toward China, which carries some very unique risks: political risk, economic risk, and governmental/ regulatory risk, in addition to a plethora of human rights and ESG concerns – all of which can weigh on equities and returns.

However, investors could avoid many of these risks and position themselves for strong growth by isolating exposure to Taiwan or Vietnam instead. Due to the country’s role in semiconductors, 5G telecommunications, AI, and the Internet of Things, Taiwan is at the center of regional high-technology supply chains. Taiwan has strong economic ties to the U.S. and is currently the U.S.’s 10th-largest trading partner.

Meanwhile, Vietnam, for years, has been considered one of the fastest-growing and relatively stable emerging market economies. Investors would be well rewarded by isolating exposure to either Vietnam or Taiwan.

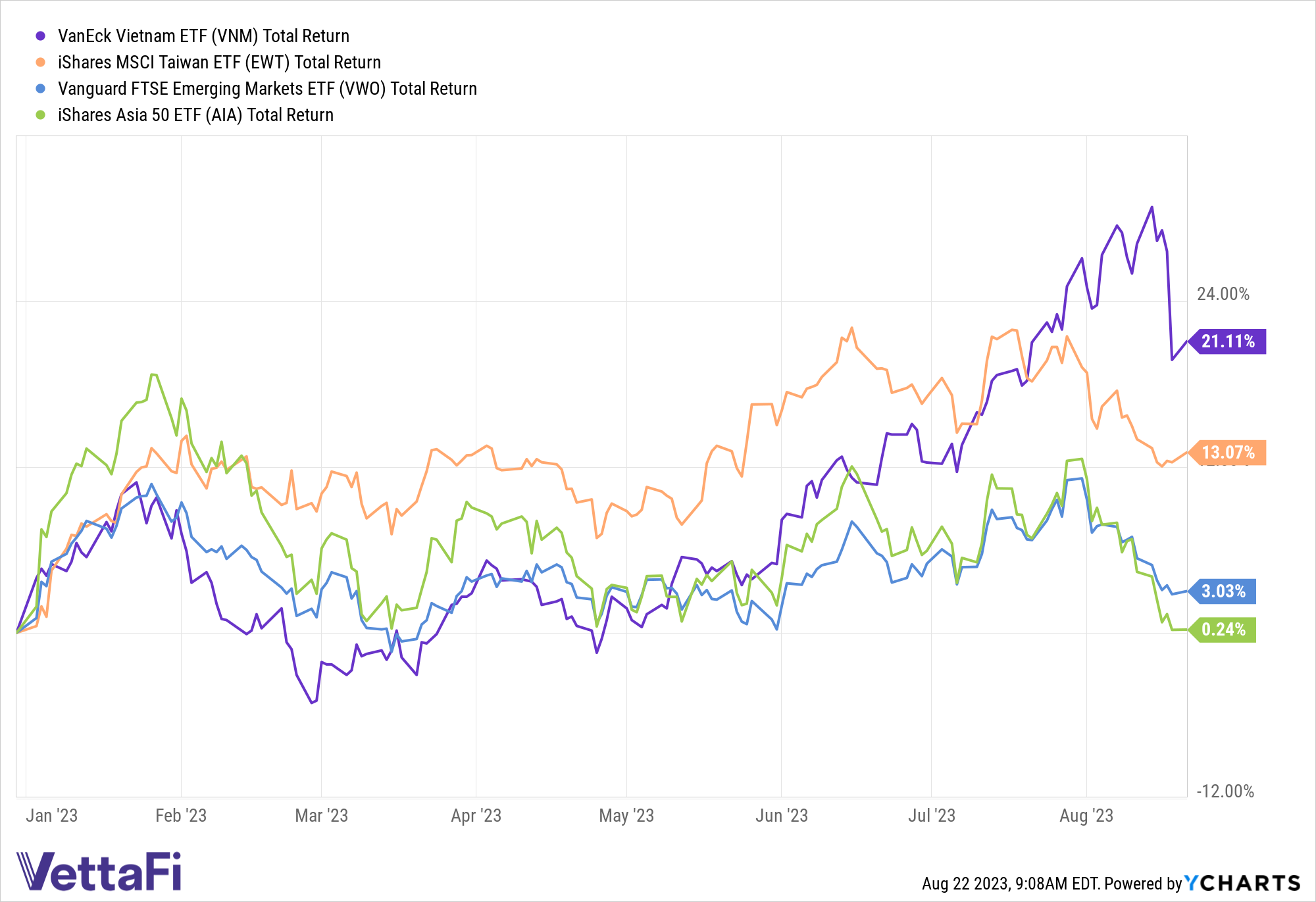

Now, let’s look at returns: the VanEck Vietnam ETF (VNM) is up 21.1% year to date as of August 21, beating the broad Vanguard FTSE Emerging Markets ETF (VWO) by over 1,800 basis points. Meanwhile, the iShares MSCI Taiwan ETF (EWT) is up 13.1% during the same period, beating VWO by over 1,000 basis points.

Importantly, returns for isolating exposure to 50 of the largest Asian stocks with the iShares Asia 50 ETF (AIA) provides the worst returns of the group. AIA is up just 0.2% year to date.

Which ETFs Stand Out in Diversification?

Peters-Golden: You make some fair points there Elle, and I can respect investors’ desire to lock in on a single country. However, there are some factors they need to consider, advantages available in ETFs that track indexes covering multiple countries. I’ll be digging into those in our discussion here, but let’s start with diversification. Yes, you get some diversification within a single nation ETF, but it’s more than risk avoidance. It also provides some interesting routes toward returns.

First off, let’s consider the defensive aspects of diversification. The biggest nations often contain multiple important sectors. However, that isn’t true for every country. Many countries, particularly emerging markets, rely on resource extraction sectors like fossil fuels or metals. Even with cap limits set by an ETF’s index, a Brazil ETF would struggle if commodities demand dropped. That’s nothing to sneeze at.

It’s not just commodities, either. You might avoid certain resource extraction-focused economies and invest in, for example, the United Kingdom. The U.K. relies a lot on its finance sector, with finance the highest-weighted sector in the iShares MSCI United Kingdom ETF (EWU). So even if the U.K. were to (somewhat miraculously) start to do really well overall, a mini bank crisis like we saw in the U.S. this year would derail EWU.

Broader, regional, multinational ETFs can avoid some of those issues, of course, as neighbors’ economies can differ significantly. However, that multinational diversification adds upside as well as more defensive benefits. Certain regions’ outlooks largely depend on one big country – think China in East Asia, or Germany in Europe. An ETF can ride a boom in the Chinese economy, yes, but consider how that boom reverberates throughout the region. That can produce more durable returns, solid diversification, and perhaps even more upside.

But Should Investors Trust a Broad Benchmark Is Diversified?

Caruso: It’s easy to think that international benchmarks will be well diversified, but I’d argue that’s rarely the case. International benchmarks are often overly concentrated in just a few countries and companies, which makes a compelling case for filling your international sleeve with a custom cocktail of single-country ETFs instead.

Let’s go back to VWO, which is the largest ETF in the emerging markets category, with nearly $72 billion in assets. Nearly half of the fund by weight is just two countries: China and India. The fund comprises 5,000 holdings, and yet over 32% of assets are in the top 10 names. This hardly seems diversified!

This isn’t just VWO, either. The iShares MSCI Emerging Markets ETF (EEM), one of the largest and oldest ETFs in the emerging markets category, looks very similar. The fund comprises 1,500 securities, and yet 35% of assets are in the top 10 names. Significantly, 27% of the fund by weight is in China.

Meanwhile, EWT and VNM have 93 and 44 holdings, respectively, making them much more concentrated offerings, but they’re not trying to pass as well diversified products. Thus, investors could allocate some of their international allocations to one or two of these funds and then add focused exposure to European equities, Mexico, or Latin America, among many other options, to create real diversification.

Don’t Limit Your ETF to One Nation’s Stock Universe

Peters-Golden: So far, we’ve been talking about ETFs that mostly track an index of firms either in one nation or multiple. However, there are more ETF investing styles than just simple index-tracking funds. There are active strategies that consider bottom-up fundamentals, equal weight strategies that try to get the best out of a stock universe while limiting downside, and dividend-growth approaches that eye firms based on their dividend health, to name a few.

Single nation ETFs can employ these for their one country, of course, but to some extent, that defeats the purpose of those strategies. Broader, multinational foreign equities ETFs have access to a bigger and more diverse pool of firms that these strategies can screen. Why limit a dividend growth ETF, for example, to just one nation’s stocks?

Let’s take a look, for example, at the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG). IHDG tracks the WisdomTree International Hedged Quality Dividend Growth Index, which screens for quality and growth factors. The ETF considers things like earnings growth, return on equity and return on assets. It also sets max weights of 5% for each individual stock and 20% for each country or sector.

Per VettaFi, IHDG invests in stocks from North America to Australia, South America to Europe, and South Asia to East. That breadth means IHDG can find the most intriguing opportunities – at least based on the dividend growth approach – around the world. For investors that really like that strategy, they get more bang for their investing buck, so to speak, by looking at multiple nations rather than just one. For me, that’s reason enough to lean towards a multinational equities ETF vs. a single nation ETF.

How Are Single-Country ETFs Impacted by Liquidity Concerns?

Caruso: Understandably, investors may be worried about liquidity in single-country ETFs. Fortunately, however, this shouldn’t be a concern for most investors. Part of the appeal of ETFs is the liquidity of the wrapper. Additionally, ETF liquidity providers/ market makers can minimize transaction costs, particularly relevant for institutional investors.

Let’s look back to EWT and VNM. These are both fairly large funds with $3.2 billion and $613 million in assets under management, respectively. Both funds have impressive trading volumes, too. EWT and VNM exchanged hands an average of 2,269,350 and 805,295 times, respectively, in the past month.

You cited IHDG, so we’ll use that as a comparison. IHDG is also a sizable fund with $1.7 billion in assets but has a significantly lower trading volume than EWT and VNM. IHDG’s one-month average volume is 173,509.

For this reason, investors should not shy away from single-country ETFs due to concerns regarding liquidity.

The Return Upside of Multinational ETFs

Peters-Golden: I think we’ve done well to touch on some key ideas for investors to consider about these two ETF slices so far, but let’s dig into the strategies themselves. ETFs come in all shapes and sizes, but let’s not forget that they have their costs. Yes, single nation ETFs may offer more discrete investing capabilities, that’s true. However, the cheapest ways to invest outside of the U.S. and internationally are multinational ETFs.

For example, investors can consider strategies like the BNY Mellon International Equity ETF (BKIE). BKIE invests in ex-U.S. developed markets and has returned a respectable 7.6% YTD. It has done so, however, for just four basis points (bps). That’s one of the cheapest available ETFs for the international space. Compare it, for example, to the iShares MSCI Japan ETF (EWJ). By far the most popular route into Japan equities, it charges 50 bps.

But beyond that, let’s take a more regional approach. The Vanguard FTSE Pacific ETF (VPL) gives regional exposure to East Asian equities for just eight bps. That again benefits from country-by-country diversification while also charging much less.

These strategies aren’t just hanging around though, they’re offering robust returns of their own. The Franklin FTSE Latin America ETF (FLLA) charges slightly more at 19 bps than some of the truly broad strategies. However, it also returned 14.4% over three years and 15.5% YTD. That outdoes some nation-specific strategies without giving up on true diversification.

Caruso: Nick, you’ve made some excellent points, but I still think single-country ETFs work exceptionally well as building blocks in an international sleeve. I look forward to revisiting this topic with you in the future to see how things unfold.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.