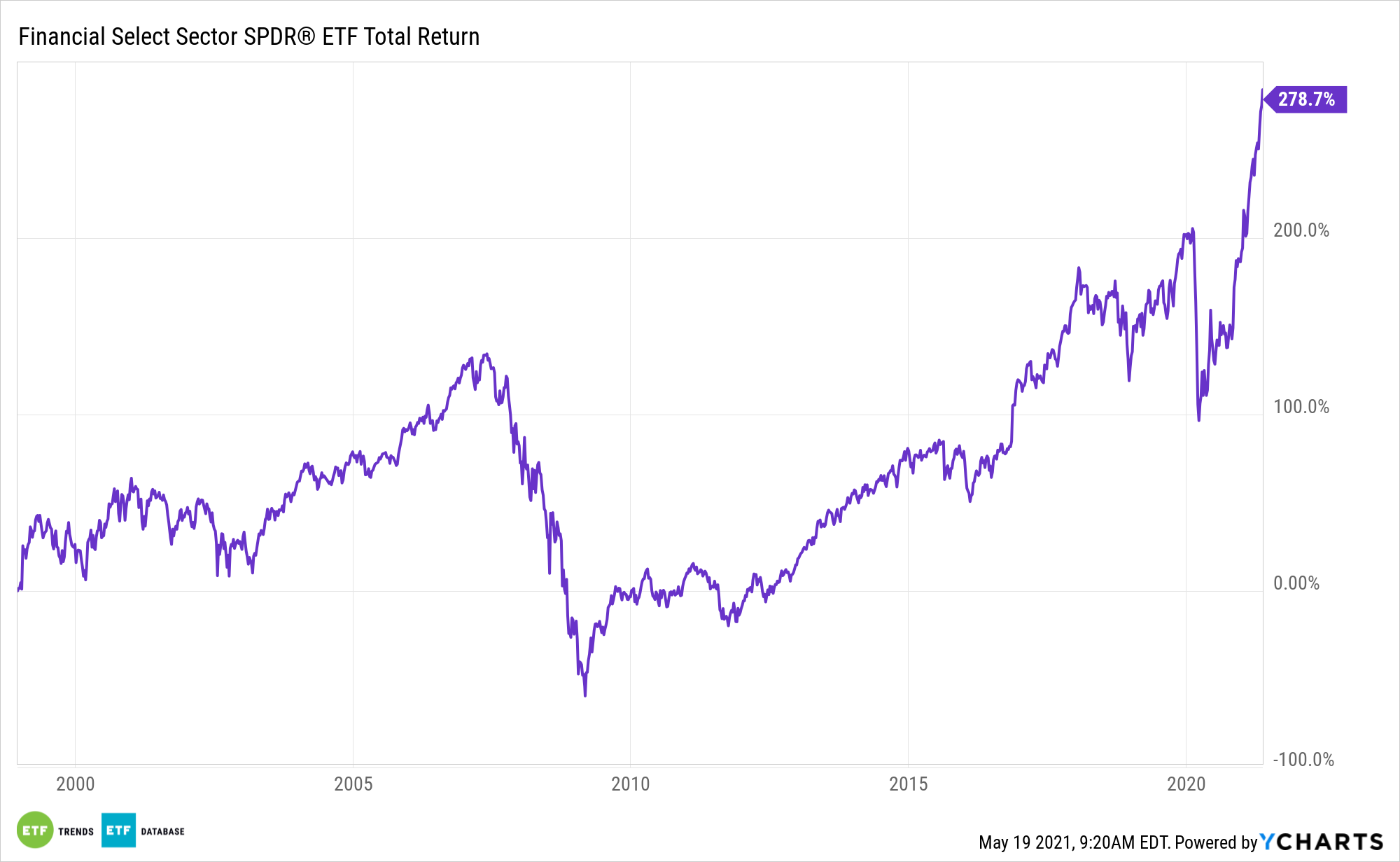

Bank stocks and sector-related exchange traded funds are attracting more attention as investors capitalize on areas that benefit from the broad economic recovery.

Year-to-date, the Invesco KBW Regional Bank Portfolio (NYSEArca: KBWR) has advanced 38.9% while the SPDR S&P Bank ETF (NYSEArca: KBE) increased 33.4%. Meanwhile, the broader Financial Select Sector SPDR (NYSEArca: XLF) rose 29.3%.

Bank stocks are on pace for what could be their best year on record when compared to the S&P 500, the Wall Street Journal reports.

After years of underperformance, the bank sector is finally enjoying a moment of outperformance. Analysts argued that the sector remains cheap, and many shareholders view the industry as a relatively safe play that would benefit from the economic recovery.

The KBW Nasdaq Bank Index is up 37% and the KBW Nasdaq Regional Banking Index up 38% this year while the S&P 500 is 11% higher. In comparison, the big-bank index declined nearly 14% last year, underperforming the S&P 500 by 30 percentage points.

“They are still pretty much as cheap as they have ever been relative to the market,” Eric Hagemann, an analyst at Pzena Investment Management Inc, told the WSJ. “The market is still trying to figure out how it wants to feel about the banks.”

The outperformance has drawn greater attention to the banking and financial sectors. According to Bank of America strategists, about $32 billion has been flowed into broad financial stocks this year, setting a full-year record in less than five months.

However, investors are now waiting on how the Federal Reserve could adjust its monetary policy as the economy recovers and inflation runs higher.

“The biggest factor driving flows into the financials has been a belief that 2020 marks a secular low point so far as interest rates and inflation,” Michael Hartnett, chief investment strategist at Bank of America, told the WSJ. “Financial stocks were out of favor and underweight so why not buy in if you see inflation and interest rate increases.”

For more information on the financials sector, visit our financial category.