![]() By Eric Clark, Accuvest Global Advisors

By Eric Clark, Accuvest Global Advisors

2017 has largely been a terrific year for equity investors. For the last few years, we at Accuvest have been pounding the table for U.S. investors to shift some U.S. exposure towards international and emerging markets. Those who took that advice have been rewarded handsomely. Why did we come to that conclusion? The growth opportunities were more obvious and the valuations more attractive. In the U.S., the best returns in 2017 have largely come from high revenue growers, strong price momentum and companies with high international sales. Different style factors drive markets at different times but for now, this trend will likely continue as global growth stays range-bound.

Complacency bubble?

One theme we have been talking about lately with clients and advisors is that of complacency within the stock market. The equity and bond markets have performed quite well since the financial crisis bottom of March 9, 2009. With just a few exceptions, the markets and the economy have been improving steadily. With this steady improvement, we’ve often heard as of late that all is well and that advisors don’t want to change anything in fear of them allocating away from something that has worked. This bull market has led to a complacent mentality amongst asset allocators.

As we know, Fed policy has probably been a key driver of our willingness to take risk since 2009. As risk-taking gets rewarded, more risk taking often takes place. As it continues to be rewarded, risk taking continues to happen. Every time we get rewarded we take our eye off the ball just a little more until finally, we virtually ignore the risk we are taking and focus solely on the seemingly easy returns we can receive. We continue to do this until we get hit hard with a reminder from a correcting stock or bond market.

Current risks

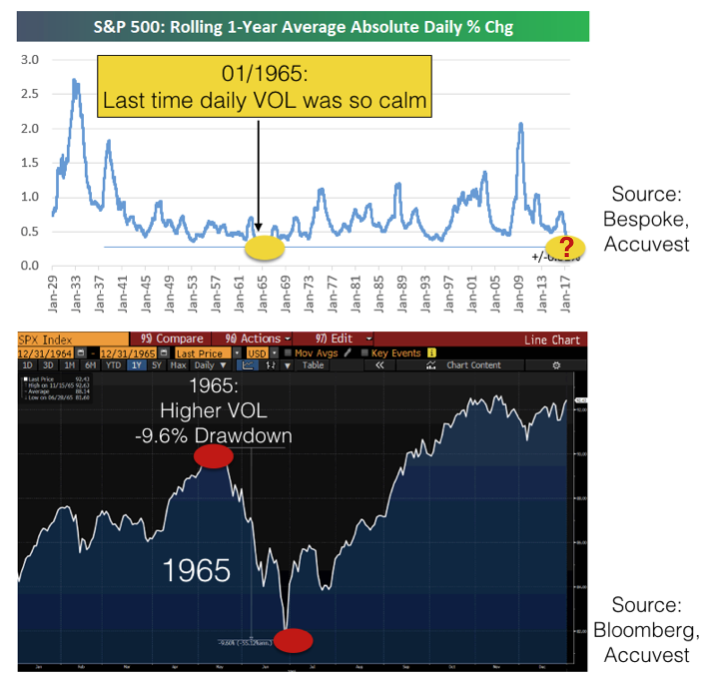

As we head into year end, one particular risk seems most obvious but not well covered in the media. We may be experiencing a historic bubble in complacency with the current historically low volatility environment. When the media highlights historic data, a mean reversion is often not far behind. Currently, equity volatility as measured by the VIX is about as low as it ever gets. In fact, below is a terrific chart from Bespoke highlighting the long term chart of rolling 1-year average absolute daily percent change in volatility.

The last time we saw a calm period like 2017 was 1964. What happened in 1965?

Something to think about as we end 2017.

Conclusion

If you do not have an allocation to equity strategies that have the ability to adapt to changing markets by de-risking and holding cash & other protective assets, perhaps now is a good time to consider them. We believe that having risk managed strategies and not needing them, is much better than needing them and not having them.

This article was written by Eric Clark, Portfolio Manager at Accuvest Global Advisors, a participant in the ETF Strategist Channel.