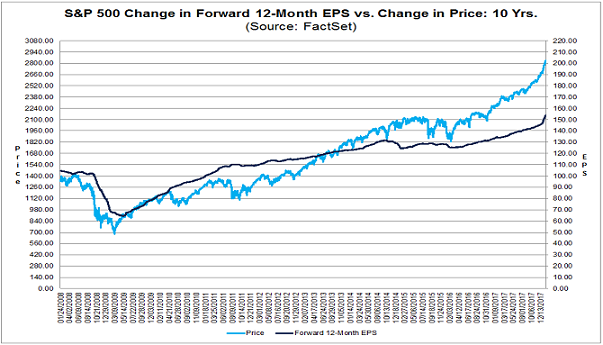

Again, one might choose to focus on the benefits of tax reform alone. Yet, what tax cuts “gaveth,” higher borrowing costs “taketh” away. The result is a trade-off, and not one that is necessarily favorable to stock valuations.

Consider Forward Price-to-Earnings estimates as we headed into 2018. While those elevated P/E ratios had taken into account higher earnings per share based on the tax overhaul, they did not take into account significantly higher borrowing costs that might exist 12 months later. Many bank economists at the start of the year expected to see the 10-year yield in and around 2.85%-2.90% at the end of the year. We’re already there. Meanwhile, analysts have not exactly slashed their earnings picture or adjusted “cost-of-capital” valuation models.

Put another way, if low rates are not nearly as low as they were before, do they still justify stocks trading in the 96th- 99th percentile of historical valuations on a bevy of measures? When does the higher cost of capital make the highest market-cap-to-GDP and highest price-to-sales ratio(s) in history relevant again?

Take a look at forward price-to-revenue in the chart below. That was BEFORE 10-year yields climbed from 2.3% to 2.9%. Maybe, just maybe, higher borrowing costs will make current S&P 500 valuations look quite ludicrous in a rear-view mirror.

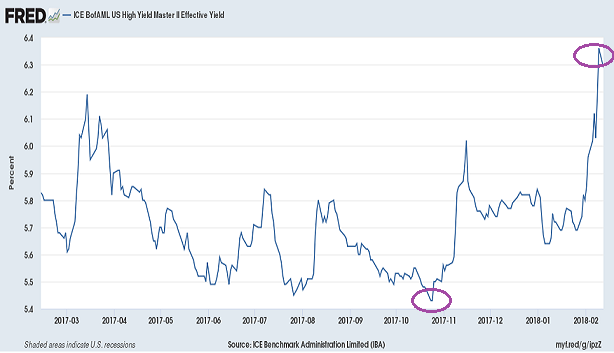

To reiterate, borrowers at all levels (i.e., household, corporate, state government, federal government) will be dealing with higher rates in the near-term. The reasons for those higher rates involve everything from extraordinary fiscal stimulus via trillion dollar deficit spending, significant changes to the tax structure, an increase in Treasury bond supply, central bank quantitative tightening (QT), a decrease in Treasury bond demand from other countries as well as inflationary pressures.

Investors may be unprepared for the ways in which debt, deficits and higher rates can hamper the economy; they’re certainly unprepared for what can happen to the corporate bonds and stocks that they’re invested in. After all, most were caught completely off guard by the speed at which rates were climbing and the ripple effects in the volatility space. (Note: The 10-year has hit 2.90% as I type.)

At present, the S&P 500 is reclaiming roughly half of its correction losses. Relief rallies are common in many 10%-plus pullbacks.

Nevertheless, the headwind of higher borrowing rates may make it very difficult for stocks to solidify longer-term bullish momentum. Phenomenal corporate earnings may not be enough when prices have gotten so far ahead of themselves.

What should investors look for before believing the bull? The day when Federal Reserve members cry, “Uncle.” In particular, Jerome Powell and his Fed colleagues will eventually be forced to backtrack on rate policy.

Perhaps more tantalizing, there will come a time when the Fed will reverse course altogether, implementing actions that push the 30-year fixed rate mortgage down to 2%. That may not happen until the next recession, but it’s an opportunity to start preparing for today.

The following post was republished with permission from ETF Expert.

For more information on new fund products, visit our new ETFs category.