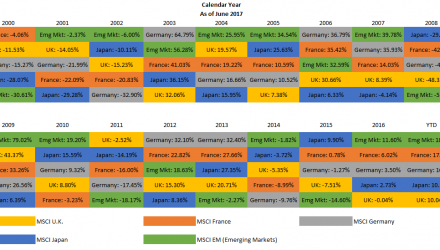

The above table displays only four countries, plus emerging markets, but two key take-aways are readily apparent:

- First of all, there doesn’t appear to be any rhyme or reason as to which countries or regions will be the worst-performing at any given time. With little reason, how do people time the markets effectively?

- Second, during the worst years like 2000–2002 or 2008, we see markets moving down in lock-step. The high correlation among the markets during downturns means there is little to no risk protection.

The DRS and Foreign Developed Markets

This is why Swan Global Investments brought its philosophy of “always invested, always hedged” to both developed and emerging international markets. When in favor, global investing can boost the returns of a U.S.-centric portfolio. When markets sell off, the DRS investments are hedged to protect against major losses.

By adding international equities to Swan’s line-up, investors have access to a larger opportunity set. During those times when foreign developed markets are in favor (or foreign emerging markets or U.S. small cap, for that matter) investors can participate in their rallies. While the past year or so has been good for foreign markets, there is no guarantee that it will continue on indefinitely. Any of the aforementioned events or new, unforeseen crises could potentially turn the bull market in international equities into a bear. However, by applying the Defined Risk Strategy to foreign developed, emerging markets and U.S. small cap stocks we believe we have developed the building blocks to create a better global portfolio.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.

Important Notes and Disclosures

Swan Global Investments, LLC is a SEC registered Investment Advisor that specializes in managing money using the proprietary Defined Risk Strategy (“DRS”). SEC registration does not denote any special training or qualification conferred by the SEC. Swan offers and manages the DRS for investors including individuals, institutions and other investment advisor firms. Any historical numbers, awards and recognitions presented are based on the performance of a (GIPS®) composite, Swan’s DRS Select Composite, which includes non-qualified discretionary accounts invested in since inception, July 1997, and are net of fees and expenses. Swan claims compliance with the Global Investment Performance Standards (GIPS®).

All Swan products utilize the Defined Risk Strategy (“DRS”), but may vary by asset class, regulatory offering type, etc. Accordingly, all Swan DRS product offerings will have different performance results due to offering differences and comparing results among the Swan products and composites may be of limited use. All data used herein; including the statistical information, verification and performance reports are available upon request.

The MSCI (Morgan Stanley Capital International) EAFE index comprises the MSCI country indexes capturing large and mid-cap equities across developed markets, excluding the U.S. and Canada. The MSCI (Morgan Stanley Capital International) Emerging Markets Index is designed to measure equity market performance in global emerging markets. Indexes are unmanaged and have no fees or expenses. An investment cannot be made directly in an index. Swan’s investments may consist of securities which vary significantly from those in the benchmark indexes listed above and performance calculation methods may not be entirely comparable. Accordingly, comparing results shown to those of such indexes may be of limited use. The adviser’s dependence on its DRS process and judgments about the attractiveness, value and potential appreciation of particular ETFs and options in which the adviser invests or writes may prove to be incorrect and may not produce the desired results. There is no guarantee any investment or the DRS will meet its objectives. All investments involve the risk of potential investment losses as well as the potential for investment gains. Prior performance is not a guarantee of future results and there can be no assurance, and investors should not assume, that future performance will be comparable to past performance. All investment strategies have the potential for profit or loss. Further information is available upon request by contacting the company directly at 970–382-8901 or www.swanglobalinvestments.com. 216-SGI-081717