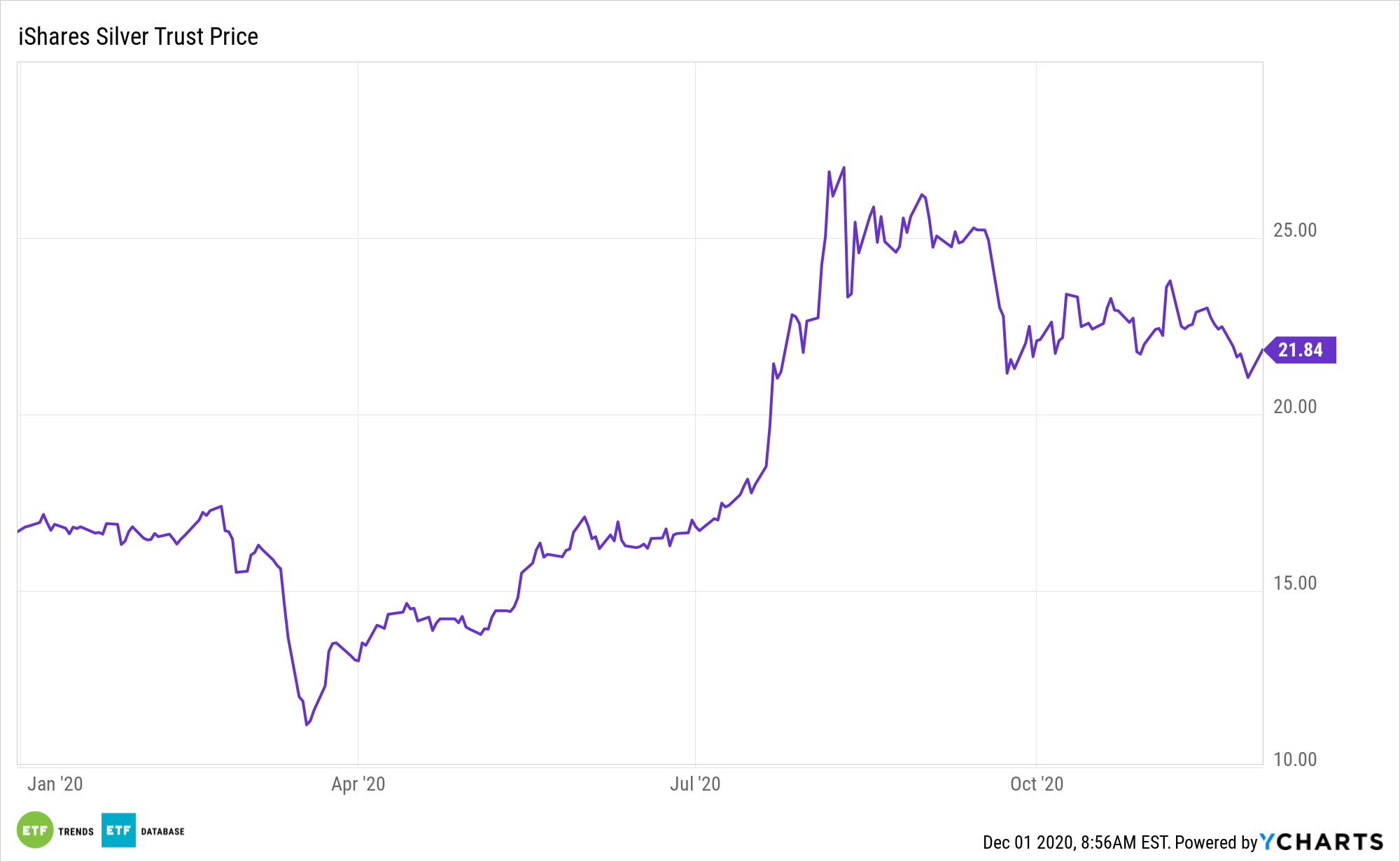

The iShares Silver Trust (SLV) and Aberdeen Standard Physical Silver Shares ETF (SIVR) are among the best-performing commodities exchange traded products this year, with silver benefiting from low interest rates around the world and a weak U.S. dollar.

SIVR seeks to replicate, net of expenses, the price of silver bullion. The shares are backed by physically allocated silver bullion held by the custodian. All physical silver held conforms to the London Bullion Market Association’s rules for good delivery.

Easy monetary policies and the weak greenback are clearly beneficial to commodities prices, particularly precious metals, but there are other reasons to believe SIVR and SLV will continue shining well into 2021.

“Analysts see the white metal rising to $30 an ounce in the next year from the current $23.36, and even higher given the large-scale stimulus needed to revive economies. It would be a continuation of the trend this year, which has led to the surge in gold and silver prices as investors hunt for havens,” reports Liz Moyer for Barron’s.

Silver’s Shiny Potential

On the other hand, SLV seeks to reflect generally the performance of the price of silver. The Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities. It is not actively managed. The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of silver.

Amid increased adoption of renewable energy sources, new, fast-growing end markets are emerging for silver. Translation: The expected influx of cash to the renewable energy industry thanks to Biden’s victory is seen as benefiting silver prices.

“Goldman Sach’s Mikhail Sprogis explained in a note last month that silver is a key component in the solar industry, which is poised for big growth. Solar investments account for 18% of silver industrial demand and about 10% of overall demand for the metal. Sprogis has a $30 price target on it,” reports Barron’s.

Bottom line: there are positive catalysts for silver and analysts are growing bullish on the white metal.

“Citigroup analysts are even more bullish, with a $40 price target on silver over the next 12 months, driven by investor desire for safety as well as industrial demand once the recovery picks up. They see a return of the 2010-11 bull market in silver as demand rises 6% in China, from both industrial buyers and retail investors,” adds Barron’s.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.