By Orchid Research

- BAR proved resilient last week despite the official announcement of a Phase 1 trade agreement between the US and China.

- However, we contend that the resulting pro-risk rotation is likely to delay the rally for BAR we had expected.

- Although risk assets are in vogue, the macro backdrop for gold remains positive because the dollar and US real rates are likely to drop on the accommodative Fed’s policy stance.

- We expect BAR to reach $16 per share in January 2020, instead of this month.

Introduction

Welcome to Orchid’s Gold Weekly report. We discuss gold prices through the lenses of the GraniteShares Gold Trust ETF (BAR).

BAR proved resilient last week despite the official announcement of a Phase 1 trade agreement between the US and China.

Although risk assets are preferred among investors, the macro backdrop for gold remains positive because the dollar and US real rates are likely to come under pressure thanks to the Fed’s easy policy stance.

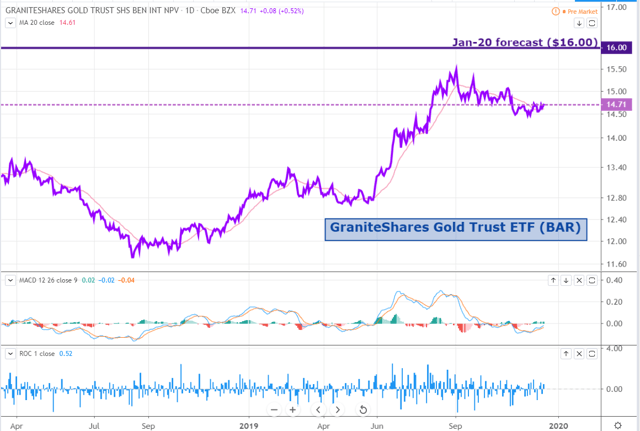

We expect BAR to reach $16 per share in January 2020 (instead of year-end) because the pro-risk rotation underpinned by the US-China partial trade deal is likely to delay the uptrend in gold prices.

Source: Trading View, Orchid Research

Source: Trading View, Orchid Research About BAR ETF

BAR is directly impacted by the vagaries of gold spot prices because the Fund physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.1749%), according to BAR’s prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts. Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars. BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long-term horizon.

Indeed, BAR offers an expense ratio of just 0.1749% while IAU and GLD have an expense ratio of 0.25% and 0.40%, respectively.