As the phenomenon known as La Niña disrupts the normal weather patterns, farmers across the world could face unpredictable conditions, limiting the supply of crops and strengthening commodity markets and related exchange traded funds.

The natural weather phenomenon, known as the cool sister of the better-known El Niño, occurs every few years, the Wall Street Journal reported. La Niña is characterized by cooler-than-normal waters in the Pacific Ocean, which may trigger dry weather in some parts of the globe and heavy rainfall in others.

Past instances of this phenomenon have contributed to market volatility and higher food prices, and the current round is already lifting prices on crops like corn and cutting supplies of other fruits.

According to government forecasters in the U.S., Japan, and Australia who monitor sea conditions, this La Niña could last until the Northern Hemisphere spring. So far, we have seen dry conditions in Brazil, Argentina, and parts of the U.S., while excessive rain batters Australia and parts of Southeast Asia.

“La Niña 2020 has evolved quicker and with stronger intensity than many leading climate models predicted,” analysts from J.P. Morgan said in November, calling the phenomenon the “primary supply-side wild card” for agricultural markets going into 2021.

The unpredictability of the situation also makes forecasting more complex across a wide range of commodities, Tobin Gorey, agri strategy director at Commonwealth Bank of Australia, warned.

“La Niña is always good for farmers in some places and bad for others elsewhere, but the outcome is always uncertain because total supply is different with each episode,” Gorey told the WSJ.

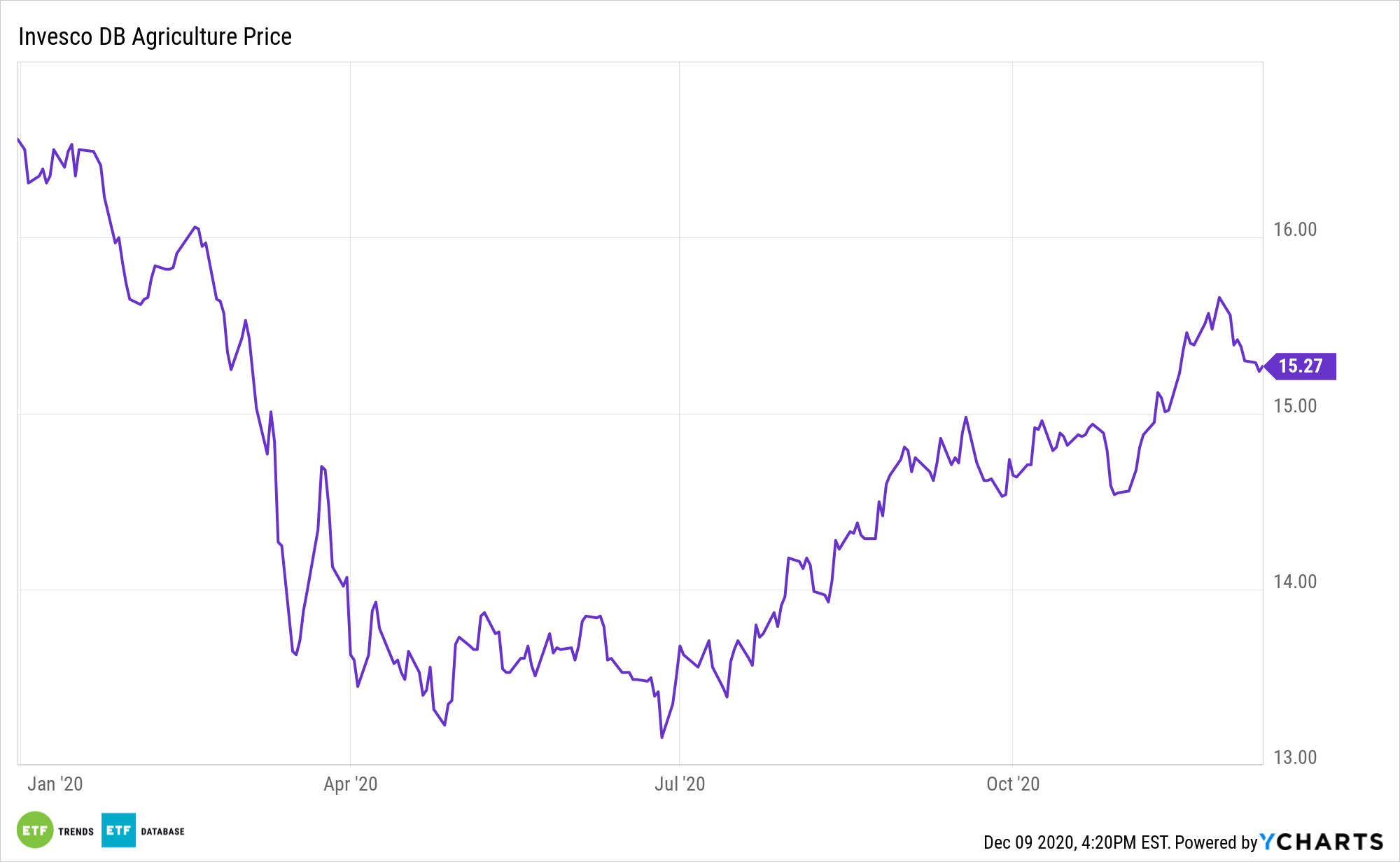

Investors can track the agricultural markets through a variety of ETF strategies. For example, the Invesco DB Agriculture ETF (DBA) is the top fund in the agriculture industry category by assets and provides exposure to a diversified portfolio of various agriculture futures contracts.

Teucrium also offers a suite of ETFs including the Teucrium Corn Fund (CORN), Teucrium Wheat Fund (NYSEArca: WEAT), Teucrium Soybean Fund (NYSEArca: SOYB), Teucrium Sugar Fund (NYSEArca: CANE), and the broader Teucrium Agricultural Fund (NYSEArca: TAGS).

For more news, information, and strategy, visit the Alternatives Channel.