As investors file for tax season, precious metals exchange traded fund investors should keep in mind that profits taken on gold and silver investments come at a different rate than stocks and bonds.

Specifically, the Internal Revenue Service treats physically backed ETFs that track precious metals like gold and silver as collectibles for tax purposes, CNBC reports.

Consequently, these collectibles, which includes art, antiques, and coins, come with a 28% top federal tax rate on long-term capital gains, or profits on investments sold after at least one year of ownership.

In comparison, stocks, bonds, and many other investments have a 20% top tax rate on long-term profits.

While gold and silver ETFs may trade like a stock on a regular brokerage account, investors should still know what they are trading with and the ETFs don’t all come in one shape and size.

“In your mind, you think, ‘I’m just buying a stock,’” Troy Lewis, an associate professor of accounting and tax at Brigham Young University, told CNBC. “But the IRS has taken the position they’re actually collectibles because they’re backed by bullion.”

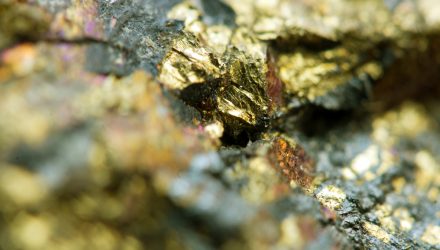

These ETFs are able to reflect the rising or falling prices of precious metals like gold and silver because they are physically backed by gold or silver bars stored in vaults across Europe. Since they are backed by the underlying precious metal bars, each ETF share represents partial ownership of the underlying metal.

The topic of precious metals ETFs may be particularly pertinent given the recent safe-haven purchasing in volatile market actions due to Russia’s sudden invasion of Ukraine, along with the overall rally in the commodities market that has fueled inflationary fears.

Dave Nadig, research director at ETF Trends, noted that not all ETFs associated with precious metals are physically backed by the metal, so these ETFs aren’t subject to the collectibles tax rate. For instance, ETFs that track futures and options contracts aren’t taxed as collectibles.

On the other hand, ETFs structured as trusts that hold the underlying precious metal bars will be taxed like collectibles with a top 28% capital gains tax rate.

For more news, information, and strategy, visit the Alternatives Channel.